November 24, 2021

GSTR 10 is a document that has to be filed by a registered taxpayer when they wish to cancel/ surrender their GST registration at the time of shutting down a business (either voluntarily or due to a government order).

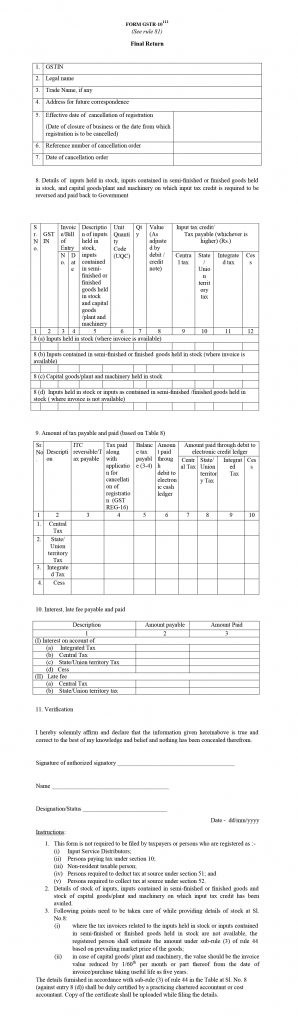

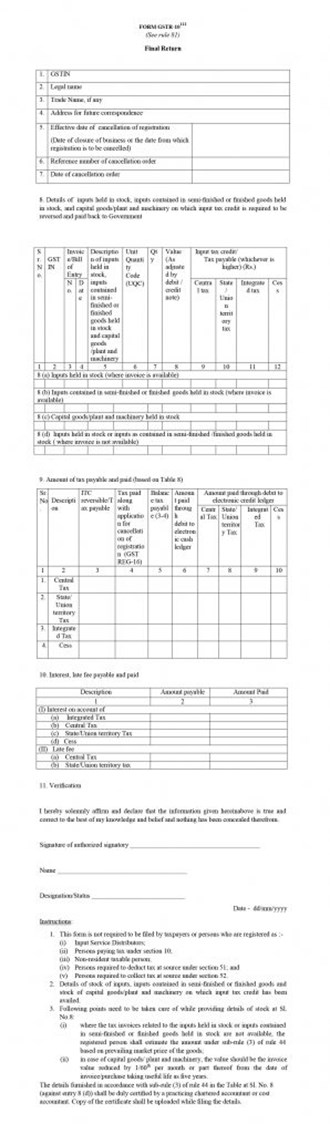

The GSTR 10 format obtains information from taxpayers who choose the cancellation of GST registration. Let’s take a look at each section in detail.

GSTR 10 consists of 11 sections. The following sections would be auto-populated at the time of login :

1. GSTIN: It contains your unique PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN).

2. Legal name: It contains the name of the taxpayer.

3. Business/ Trade name: It contains the name of your entity.

4. Address: It contains the address of your company.

5. Effective Date of Surrender/Cancellation: Here you are required to mention the date of cancellation of GST registration as per the order.

6. Reference number of Cancellation order: Unique ID would be given by the Tax authorities at the time of passing the cancellation order.

7. Date of Cancellation Order: This would be the date on which the GST registration cancellation order is passed by the Tax regime.

8. Particulars of Closing Stock: The taxpayer is required to furnish details of closing stock held at the time business ceases to function. Any amount of input tax credit (ITC) lying in such stock needs to be paid in addition to this return.

8(a). Inputs in stock (invoice present)

8(b). Inputs in the stock of semi-finished or finished goods (invoice present)

8(c). Capital goods or machinery in stock

8(d). Inputs in stock or in stock of semi-finished or finished goods (invoice not present).

9. Tax payable amount and tax paid: Give ITC reversal or tax payable as well as paid, and transfer from electronic cash and credit ledgers in accordance with the sections- CGST, SGST, IGST, and Cess details.

10. Interest, late fee payable, and paid: Provide head-wise break up of the interest and late fee payable and paid.

11. Verification: After all the details are provided correctly in the GSTR10 in accordance with the GSTR 10 format, the taxpayer is needed to sign a declaration regarding the authenticity of the information given under different heads by means of the digital signature certificate (DSA) or Aadhar based signature verification.