June 17, 2021

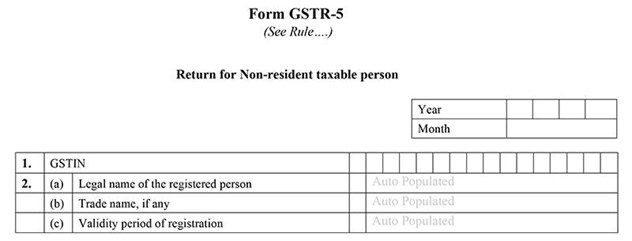

GSTR 5 is a GST document that has to be filed by a non-resident taxable person who carries out a business in India for a particular period. GSTR 5 filings could be done either online or via a tax facilitation center. From the earlier writings, you might have got a clear-cut idea of what is GSTR5, GSTR5 due date, etc. Through this write-up, we are going to discuss the GSTR5 form/ GSTR5 format.

The non-resident taxpayer who does not own a business in India but he makes supplies here for a short duration is ought to pay tax under GST. They are required to pay tax, interests, fees, and penalty within 20 days after the end of their tax period or post seven days validation period, whichever comes first of the two dates.

Government prescribed GSTR5 format consists of 14 sections. Let us go through each section in detail.

GSTIN is a 15 digit Goods and Service Tax Identification Number. This is auto-populated as we file returns.

Since the GSTR5 form is for Non-residents - return filing, the name of the taxpayer here means the legal and the trade name of a non-resident taxpayer, who does own a business out of India and supplies goods and services. It would be auto-populated.

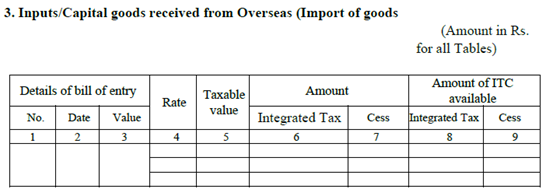

The non-resident taxpayer is required to provide the details in this section regarding all the imported goods to India as per the GSTR5 format. Details of Bill of entry in addition to the tax rate, cess, integrated tax, and amount of ITC available. It is to be borne in mind that non-resident taxpayers shall have only inward supplies (purchases).

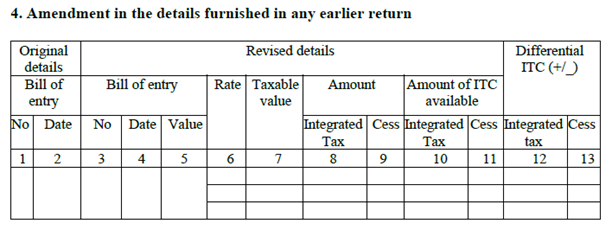

Modification made regarding imported goods provided in the earlier return is to be updated here. Changes could be made in the following heads according to the GSTR5 format in the GSTR 5 form:

This section contains the invoice-wise details of business-to-business transaction supplies in India that also includes supplies to UIN holders (Unique Identification Number). Details include IGST/CGST, SGST, and Cess charges.

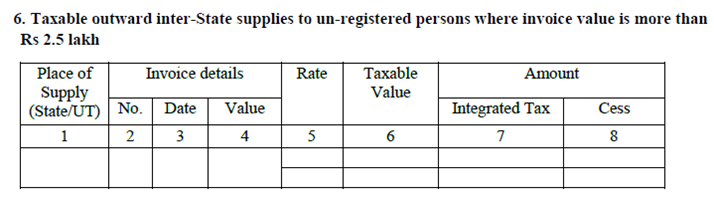

This heading contains the details of Business to Consumer (B2C) large sales or interstate supplies by a registered person to an unregistered person in which supplies value more than 2.5 lakh.

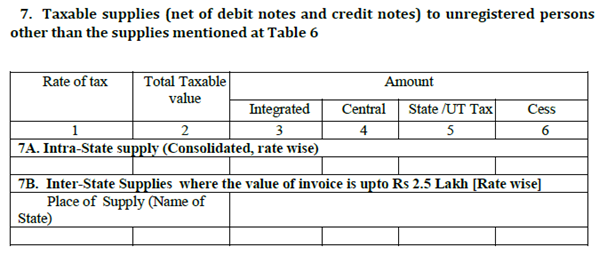

As the above-mentioned Table 6 covers the supplies exceeding 2.5 lakh, here cover the supplies less than 2.5 lakh from a registered person to an unregistered person. When interstate supplies have to be mentioned state-wise, intrastate supplies could be provided in a summarized manner.

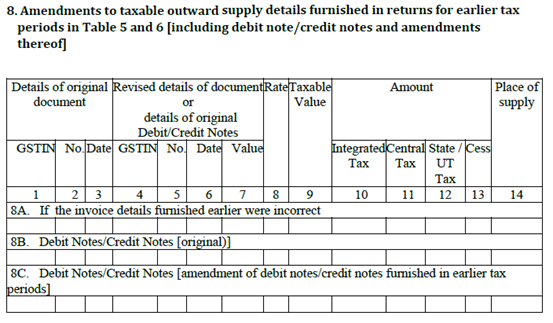

Modifications in B2B and B2C from the previous tax periods are updated here. The real debit notes and credit notes issued during the month would also be provided here. Modifications to invoices and debit credit notes issued would also be seen here. If there are revisions, original details have to be noted.

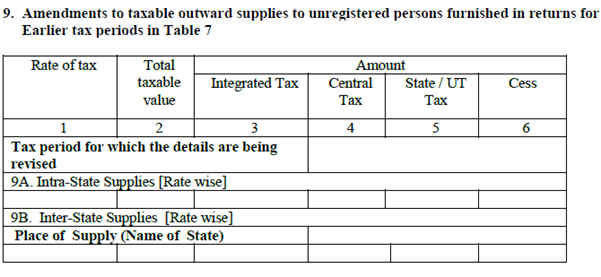

Modifications made to Table 7 (B2C) sales where supplies are made by a registered person ( if the supplies are recorded less than 2.5 lakh in such case) during the previous tax period are made under this head. As interstate sales should be provided statewise, intrastate sales could be summarized in a consolidated way.

This section shows the total tax liability and the information would be auto-populated from the above heads. Under this head, taxpayers get separate liability against IGST, CGST, and SGST.

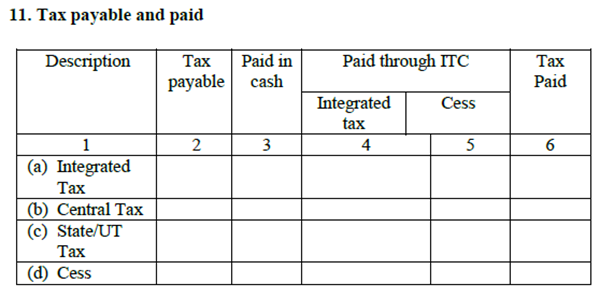

This section shows the details of the total tax to be paid under IGST, CGST, and SGST during the month. The information would be auto-populated from the above headings. The taxpayer could make payment either through cash or use ITC.

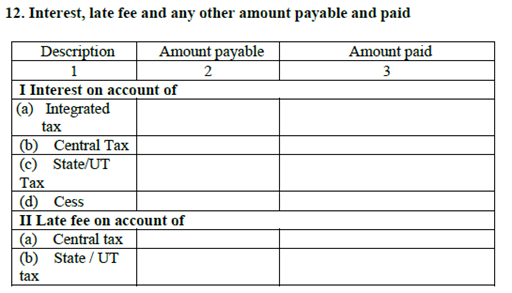

This heading is regarded with the interest, late fee, and any other amount paid under CGST, IGST, and SGST due to late return filing.

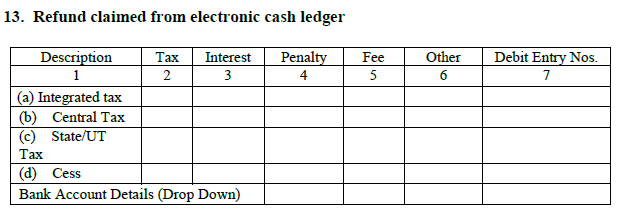

Under this head, details of all refund amounts received into the electronic ledger would be shown. There is a drop-down column to choose as to which bank account the NR would like to have the refund amount to be received. (It is auto-populated).

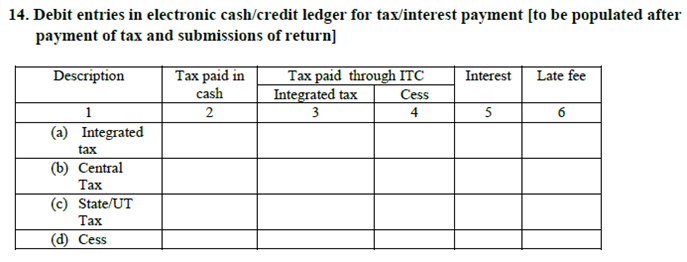

It shows the debit entries on the electronic cash ledger which literally means the cash outflow for payment such as tax, interest /late fee. When the tax is paid and returns are submitted, it would be auto-populated.

Finally, you have to authenticate and sign off with a declaration that all the information provided herein in this GSTR5 form is correct.

Read More: