October 28, 2021

GSTR 9 A is an annual return filed by taxpayers under a composition scheme once in a year under GST up to the financial year 2018-19. It includes all information given in the quarterly return filed by the composition taxpayers in the financial year.

Take a look at fields in the GSTR 9 A and the information to be provided in detail.

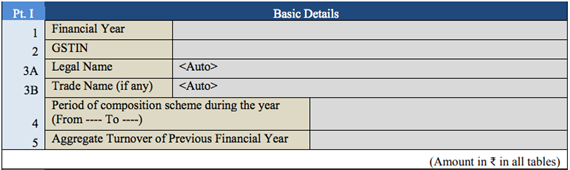

Part I contains basic information such as GSTIN No, legal name, and trade name.

1. Financial Year

Enter the financial year for which you are filing the GSTR9A.

2. GSTIN

Enter your GST registration number.

3 A. Legal Name

It would be auto-populated.

3 B. Trade Name

Trade name would be auto-populated.

4. Period of composition scheme during the year

The beginning and end date of your enrollment under the composition scheme.

5. Aggregate Turnover of Previous Financial Year

Furnish your aggregate turnover of the previous financial year. In case, there are multiple taxpayers' turnover has to be given here.

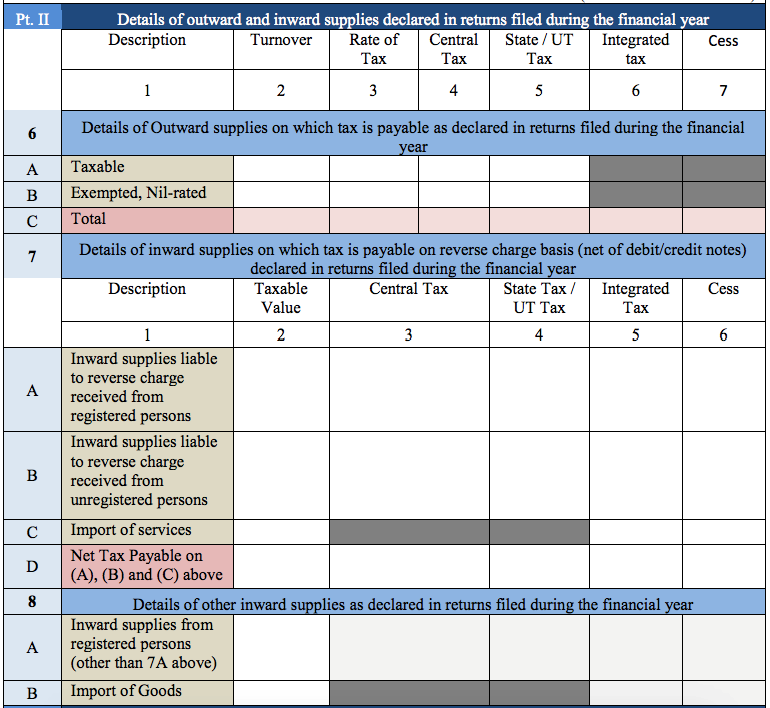

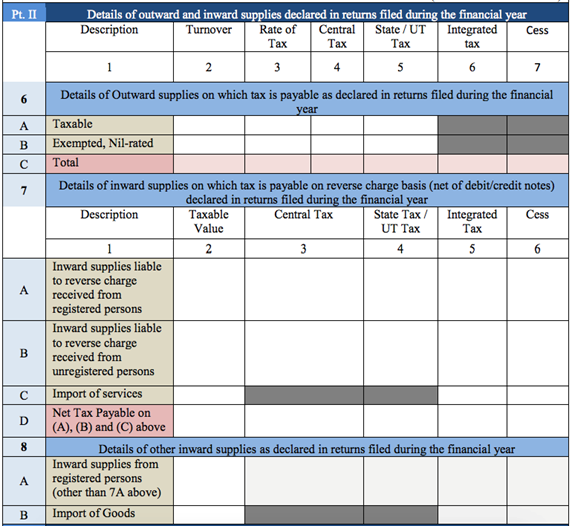

Part 2 contains a summary of all sales and purchases declared in the GSTR 4 during the financial year.

Furnish the aggregate value of all taxable sales.it includes the net value of debit notes and credit notes, advances, and goods returned for the financial year. The value given in table 6 and table 7 of the GSTR 4 could be used for filing in these details.

Furnish the aggregate value of all purchases, purchased from a registered and taxed in reverse charge manner. Table 4B, Table 5, and Table 8A of the GSTR 4 could be used to fill this value.

Furnish the aggregate value of all purchases, purchased from an unregistered and taxed on reverse charge manner. Table 4C, Table 5, and Table 8A of the GSTR 4 could be used to fill this value.

Furnish the aggregate value of all imported services in the financial year. Table 4D, table 5 of the GSTR 4 could be referred to fill the details.

Furnish the total value of 7A, 7B, and 7C under the section.

Furnish the aggregate value of all taxable purchases received from registered persons, besides what is said in section 7A. Table 4A and Table 5 of GSTR3 could be used to fill in the details.

Furnish the goods imported during the financial year. Table 5 of GSTR 4 could be used to fill in the details.

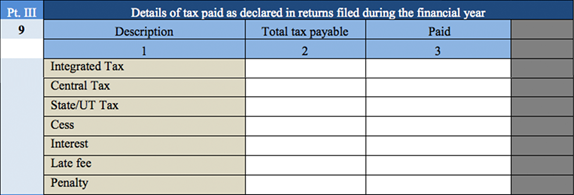

Part 3 collects the details about the tax paid by the business.

Furnish due tax amount details and the amount paid, as declared in returns filed during the financial year. You are required to divide the tax amount as per the type of tax type paid: integrated tax, central tax, state / UT tax, cess, and interest. You are also required to enter values for any late fees or penalties paid in this section.

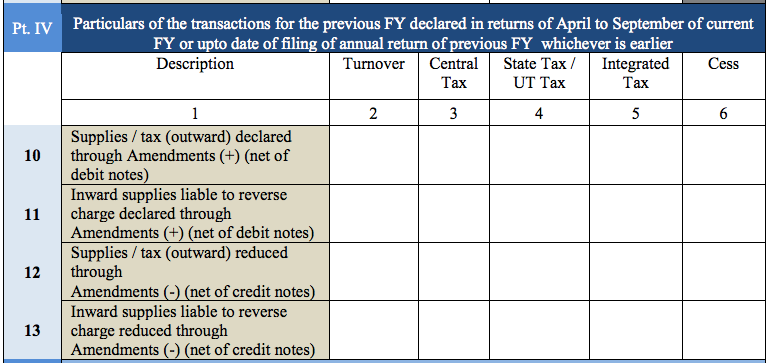

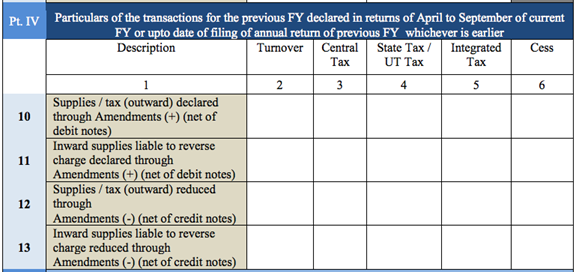

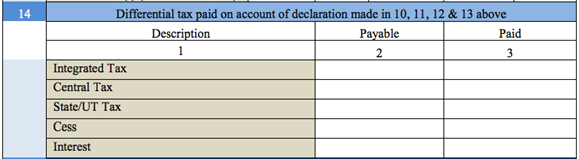

Part 4 consists of details of changes (additions/subtractions made to the transaction details in your previous financial year’s return. It includes transactions declared in returns between April and September of the present financial year or before you filed the previous year’s annual return, whichever is earlier.

Declare all of the various values of supply provided below and split each into turnover, central tax /Union territory tax, integrated tax, and cess.

Furnish the value of sales/tax declared through amendments made in Table 5 or Table 7 of the GSTR-4 here. It consists of the net value of debit notes.

Furnish the value of purchases made that are taxed in a reverse charge manner and declared via amendments made in Table 5 or Table 7 of the GSTR-4. This value consists of the net value of debit notes.

Furnish the value of sales/tax that is reduced through amendments made in Table 5 or Table 7 of the GSTR-4. This value excludes the net value of credit notes.

Furnish the value of purchases that were taxed on a reverse charge basis and reduced due to amendments made in Table 5 or Table 7 of the GSTR-4. This value has to exclude the net value of credit notes.

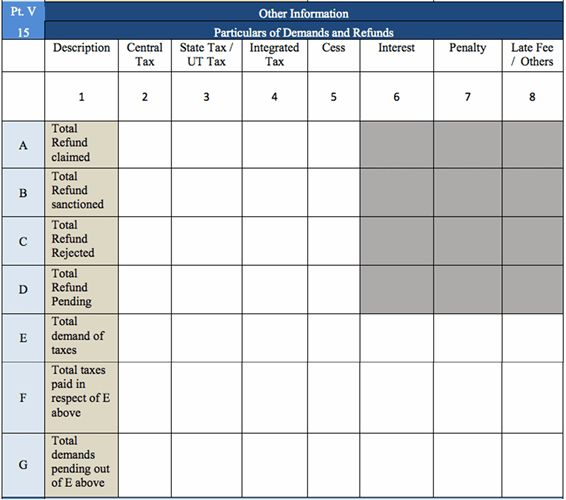

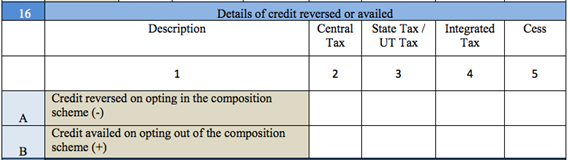

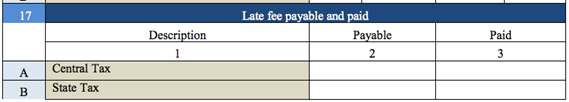

In part 5, provide details regarding all funds claimed, issued, pending, sanctioned, and rejected, credits availed or reversed, and late fees to be paid during the financial year.

Split into each value as per the type of tax levied on the transaction: central tax, state tax / Union territory tax, integrated tax, cess, interest, penalty, and late fees.

Furnish the total value of all the refund claims filed during the financial year, including refunds that were sanctioned or rejected or are still pending.

Furnish the total value of all the refunds that were sanctioned.

Furnish the total value of all the refunds that were rejected during the financial year.

Furnish the total value of all refund applications for which acknowledgment has been received and which are under processing, excluding provisional refunds received.

Furnish the total value of tax demands for which order confirmation has been received from the authority.

Furnish the total value of taxes paid out of the total value entered in field 15E.

Furnish the total value of demands that haven’t been recovered, out of the total value provided in field 15E.

Furnish the total value of all credits reversed when paying tax under the composition scheme. The details in Form ITC-03 could be used to fill in this information.

Furnish the total value of all credits availed as you opt-out of the composition scheme. details filled in FORM ITC-01 could be used to fill in this information

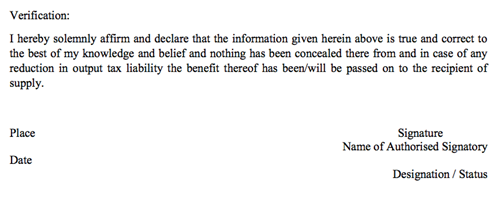

After all the details are provided correctly in the GSTR9A in accordance with the GSTR 9A format, the taxpayer is needed to sign a declaration regarding the authenticity of the information given under different heads by means of the digital signature certificate (DSA) or Aadhar based signature verification.