April 27, 2021

Goods and Services Tax regime tends to implement a uniform taxation structure in the country. The GST payment process and the GST-related transactions have made this tax regime less complex and accessible. As of now, both online and offline payments are at a taxpayer’s disposal for the GST. A taxpayer has to assess the tax which is required to be paid in cash related to the input tax credit availed. It is mandatory to generate a GST challan before or after logging into the GST portal as you file the returns.

GST payment process is common for all taxpayers. Unless there is an adequate cash balance in the electronic cash ledger, a GST challan payment should be used for depositing the cash into the cash ledger by using a prescribed mode of payment. Otherwise, i.e. if a sufficient balance is there in the cash ledger, it could proceed accordingly.

Let us have a glance at the various categories of taxpayers.

A regular taxpayer should use PMT 06 challan for paying in the electronic cash ledger at the time of filing GSTR 3B.

Quarterly taxpayers are those who belong to the Quarterly Returns Monthly Payment ( QRMP) scheme under GST. They deposit the tax by using PMT 6 in the course of the first two months of a quarter.

Taxpayers have no sales or purchases or tax payable for the relevant tax period, either for the month or quarter, need not use the challan or make any payment.

Composition taxpayers have to take their sales/turnover details for the quarter in challan CM-08 and pay tax.

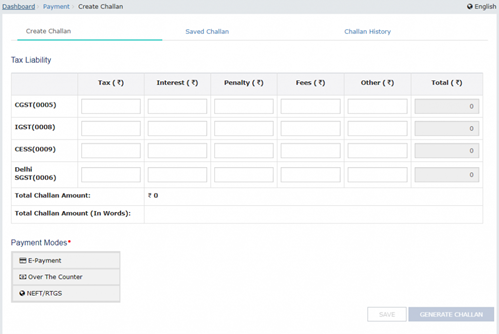

Business entities have the option to choose the mode of payment in the form PMT -06 at the time of generating the GST challan. The choice is in accordance with the convenience of the time to file the GST before the due date, convenience, the banker, etc.

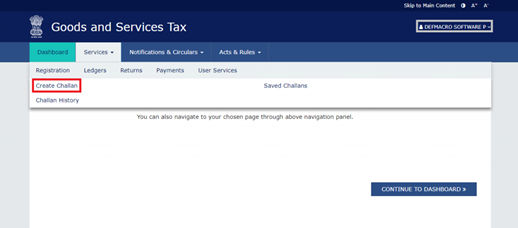

Let’s see how to pay GST online

Online mode of payment means that the payment could be made either via internet banking or debit/credit cards. It is at the discretion of taxpayers to pay these modes with or without logging into the GST portal. Taxpayers can make online payments through the selected banks. Soon after making the payment electronic ledgers get updated. Don’t forget to ensure that the payment has been finished if the taxpayer generates challan without logging in.

Offline payments such as cheque, DD, cash, NEFT, or RTGS can be chosen voluntarily. One of these modes is chosen if the taxpayer bank is not included in the Net banking / Card payment list. Payment could be made through these modes upon generating GST challan, before or after logging into the GST portal. for the completion of the payment process, take the printout and complete the payment. In the case of over-the-counter payments, banks will process the instrument within a couple of days. The electronic ledger gets updated soon after that. It is to be borne in mind that 10000 is the limit for OTC and if it exceeds, it is suggested to go for other modes. If the taxpayer proceeds via RTGS/NEFT while generating challan, the steps are different in the case. A printout of the challan should be taken, fill and submit along with that to the bank. After that, the bank provides the Unique Transaction Reference Number (UTR) normally within a few hours. Then taxpayers are supposed to log into the portal to link the UTR no regarding the challan and the electronic cash ledger would be updated.

There are mainly two ways for generating GST challan either by logging into the GSTIN account or before logging in.

Steps for Challan generation before logging in:

Time Limit to pay GST challan payment starts from the challan generation date. If it is an online mode, particularly in the prel-ogin challan creation for net banking mode payment has to be made immediately. Whereas Fifteen days would be available for offline mode

These details should be borne in mind while entering the details.

Within a couple of days, the electronic cash ledger would get updated.

It is quite natural to have errors while filing returns or making GST payments. If the GST payment you made is excess, it would be shown in the electronic cash ledger balance. The balance in the electronic ledger is refundable by submitting a refund application form, RFD-01.

This refund application could be processed online and could be claimed within two years from the date of the payment.

Then choose ‘Refund of Excess Balance in Electronic Cash Ledger ‘ and click ‘create’. Soon after you click on the ‘create ‘ option, the balance amount in the electronic cash ledger would be automatically uploaded in the form.

There is a space for the taxpayer to enter a refund in the editable ‘Refund Claimed Table’ Then the amount can either be the same or less than the available amount in the electronic cash ledger. By clicking on ‘Click to view Electronic Liability Ledger to get all the details.

After seeing the outstanding demand, you could click on ‘GO BACK TO REFUND FORM’. You could also select the bank account to which you want to get credited the refunds.

Follow some steps to upload the documents.

In the case of Digital Signature Certificate (DSC), you could click on the sign button. If it is in the case of electronic verification code (EVC), OTP would be received on the mail id or mobile number and verify it.

For claiming refund, form GST RFD 01 should be submitted online within two years from the date. After filling the return a registered taxpayer could make a claim of balance at disposal in the electronic ledger.

Scenario to claim ITC Refund

Exceptions where No Refund of ITC is valid

Documents to prove that a refund is due to the applicant should be processed along with the application and it should be substantiated that the tax burden was not passed on to another person. If the refund amount is less than 2 lakh, it is required to submit the application along with documentary evidence and it should be certified that the burden of the tax is limited.