GSTR 3B Form- An Overview

GSTR 3B is a simple, consolidated, self-declared GST summary of inward and outward supplies during a month which has been introduced for businesses to file returns without much difficulty. There are 6 sections in GSTR3B. This article is about the detailed explanation regarding each section.

1. GSTIN

Goods and Services Taxpayer Identification Number (GSTIN) is a 15 digit unique number that you may use for filing GSTR 3B form or a provisional id could also be used.

2. Legal Name of the Registered Taxpayer

The legal name of the Registered Taxpayer is Auto-populated after providing GSTIN.

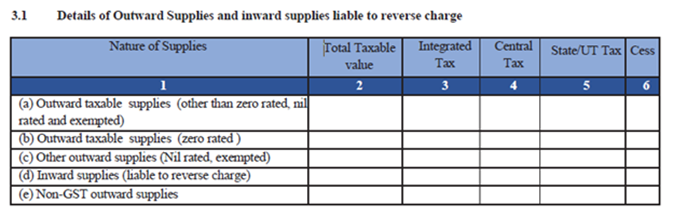

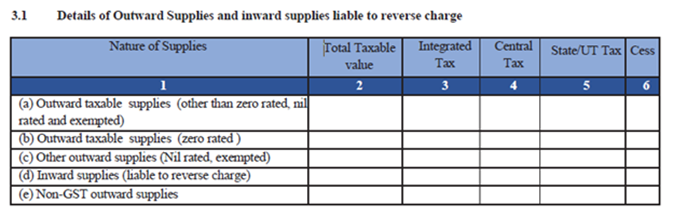

3.1 Outward Supplies and Inward Supplies on Reverse Charge ( Details of your payable tax)

Under GSTR 3B format, these details are further divided into total taxable value, IGST, CGST, SGST/UTGST, and cess. You are required to furnish only consolidated values for the month. Neither invoice level details nor GST rate should be provided. Only tax details are to be provided.

- Outward Taxable Supplies: Zero-rated / GST exempt supplies should not be included. It is to be given separately and to be included in the supplies on which GST has been charged by you. Taxable supplies= invoices+debt notes-credit notes + advances for the invoices which have not been issued in the month- the value of advances arranged against details of invoice advances as well as advances adjustment against invoices are not needed to be furnished separately the value of advances adjusted against invoices Details of advances as well as adjustment of advances against invoices are not required to be shown separately

- Outward taxable supplies( Zero-rated): It includes only the zero-rated GST supplies. Zero-rated supplies are either exports or supplies which are made to SEZ.

- Other outward supplies (Nil Rated Exempt): it includes nil/rated GST exempt supplies for which GST rate is nil or exempt from GST. Curd, lassi, and fresh milk are examples of goods.

- Inward supplies (liable to reverse charge): It provides the detailed purchases of an unregistered dealer on which reverse charge is applicable i.e. In such scenarios, an invoice should be prepared yourself and pay the applicable GST tax rate.

- Non-GST Outward Supplies: Details of your supplies out of the ambit of GST.For eg, Alcohol and petroleum products.

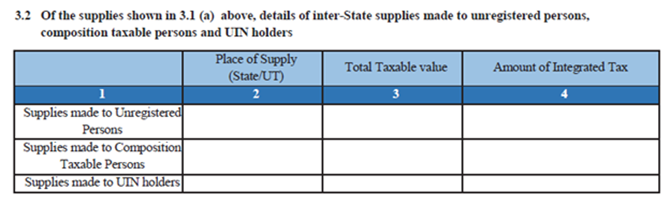

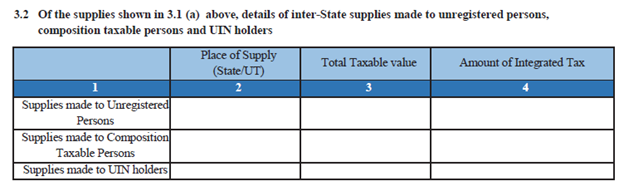

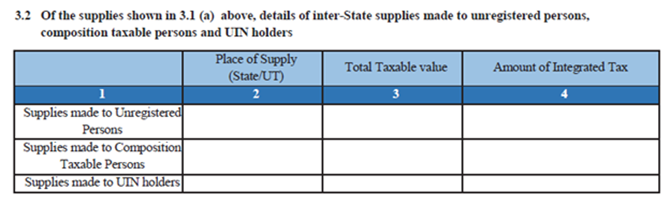

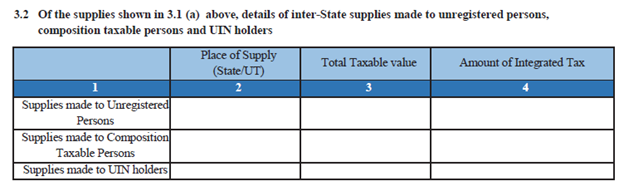

3.2 The Supplies shown in the above image (3.1), Interstate supplies of unregistered persons, composition taxable persons, and UIN holders.

Under this section of form 3B GSTR format, division of ‘outward, taxable supplies in the above-mentioned table must be furnished. You are required to provide here the interstate supplies of

- Unregistered persons

- Composition dealers

- UIN holders

UIN holders are those who have a Unique Identification Number in place of a GSTIN. These are special agencies under UNO or an embassy or some financial organization under the UN (Privileges and immunities) Act, 1947. Commissioners have the privilege to notify other persons.

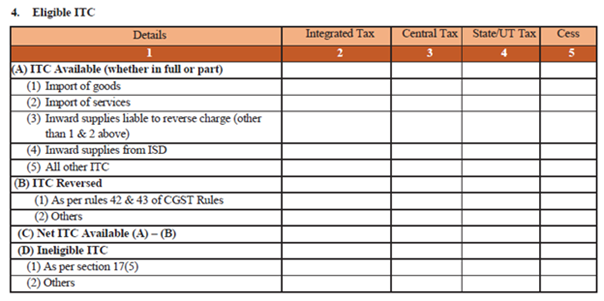

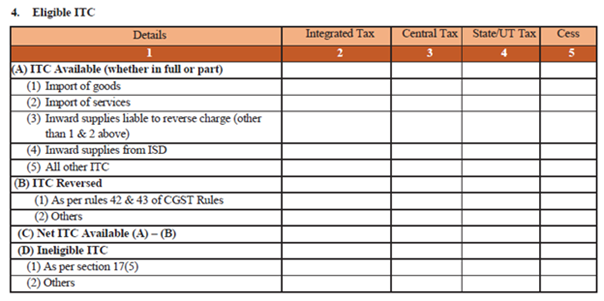

This table shows the details required for the ITC. Details of IGST, CGST, SGST, UTGST, and Cess must be furnished separately. Invoice level information is not needed and only total values have to be reported.

A) ITC available ( whether in full or part)

This information is divided into ITC.

- Import of goods,

- Import of services,

- Inward supplies on reverse charge (other than on import of goods and services reported above)

- Inward supplies from your Input Service Distributor (ISD) basically your head office registered as an ISD under GST

- All other ITC

Closing stock ITC is not to be reported here, as this ITC is to be reported first by filling up TRAN-1 and TRAN-2 forms.

B) ITC Reversed

- As per CGST 42,43 Rules: These rules say that input credit is to be reversed for goods and services where it has been utilized partly for business purposes and other purposes likewise, sometimes even not for business. Like that also Input credit reversal is also not needed for the supplies which include taxable, exempt, and nil-rated supplies. In the same way Input credit regarding capital goods for business or business-related, for taxable, exempt nil rated supplies are to be reversed to the extent not used for business. Detailed formulae have been prescribed on how to proceed.

- Others: Other reversed ITC in your books.

C) Net ITC available (A) - (B)

It would be auto-populated by the respective partner.

D) Ineligible ITC

- According to section 17 (5) - Report credit is not completely at your disposal.

- Others

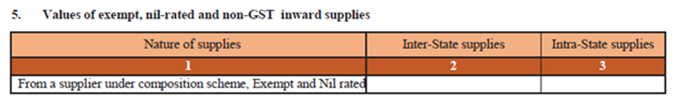

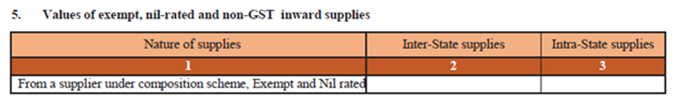

5. Provide values of Exempt, Nil rated, and non-GST Inward Supplies

This is for reporting your purchase of goods and services which is exempt, nitrated, or uncovered GST from a composition leader. This information is further divided into interstate and intra state.

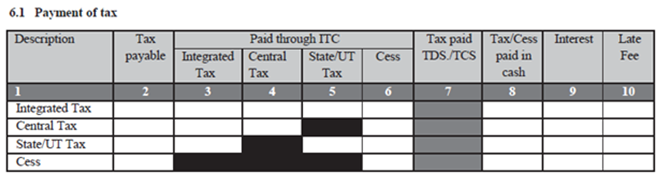

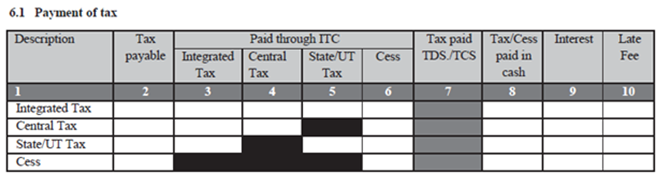

6. Payment of Tax

Under this head, you must report your final payable tax on supplies, which is taxable, made by you that would match with 3.1 (a) above. As the amount is separately reported under IGST, CGST, SGST, and UTGST and it also reports the credit availed against these. That amount is under 4(c). you must deposit the balance tax which appears under column 8. In case any interest or late fee has been deposited, it also needed to be reported.

6.2 Do note that for now no TDS or TCS have to be reported or collected. This section is not applicable for now.

Read More:

What is GSTR 3B?

What is GSTR 3?

GST Return Forms