March 03, 2022

Business entities use many capital goods on which ITC is at their disposal. Let us examine in detail the credit of GST on purchasing capital goods.

Capital goods include all assets such as buildings, machines, equipment, transport vehicles that an organization relies on to produce goods and services.

For instance, you make chapattis in the machine. You add other ingredients including wheat powder. These ingredients are inputs. The chapatti is the final product. The chapatti machine is the capital good that helps to make chapattis. Inputs are used while making the final product and it is treated as business expenses and cost of production.

Capital goods are not consumed as the final product is ready. It may remain there for a couple of years. Since it would be depreciated over a period of time, it cannot be taken as business expenses in the year of purchase. So this part of costs is identified through accounting methods like depreciation, amortization, and depletion.

If you make any purchase, you are ought to pay GST. Later you can claim ITC on the purchases you made. Likewise, as you purchase any machines (capital goods) for your factory, you need to pay the GST. These could be claimed as credit-like inputs. But, ITC cannot be claimed in case you claim depreciation on the paid GST.

Business entities often use the same assets & infrastructure and inputs for both business purposes and personal use. For instance, Mr Ramesh is a freelance content writer. He uses a personal laptop for his freelance work. He could claim ITC of GST paid on the purchase of a laptop only to the extent it is related to his freelance work. If he buys plagiarism software that is solely for his work, he can claim full ITC on it.

ITC could be claimed for business purposes only. Many businessmen use the same inputs for business purposes and personal use. It is not possible to make any tax benefit of personal expenses. It is to be noted that the list of goods having exemption under the GST already enjoys 0% GST.

Inputs used in such exempted goods cannot make any claim for ITC as it would result in negative taxation. So, Input Tax Credit on inputs for exempted goods would also be removed.

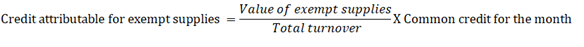

The below-mentioned calculations could help you to calculate the common credit that attributes to personal supplies and exempted supplies that leave behind only the portion related to the taxable sale. ITC could be claimed only for that amount. Otherwise, the credit has to be reversed as you file GSTR 3B.

Capital goods used only for Personal Use or for Exempted Sales

ITC is not available for personal purchases or for capital goods utilized in exempted sales. It would be shown in GSTR 3B and would not be credited to the electronic credit ledger.

Mr. Ramesh bought a refrigerator. As it is only for his personal use, he cannot claim ITC for that.

Mr Rajendran has bought a small flour mill in his shop to produce flour. Since unbranded flour is exempted from GST, he cannot make a claim based on ITC rules for capital goods under GST paid for the mill.

ABC Company has bought machines to manufacture slippers. As slippers are normal taxable supplies, the GST included paid meanwhile purchasing machines would be fully available as ITC. It would be shown in GSTR 3B and would be credited to the electronic credit ledger.

Common credit for partly personal/ exempted and partly normal sales

5 years of useful life would be taken. In case you make a GST payment on a monthly basis then you could apply this formula:

The ITC amount attributable to exempt supplies out of common capital credit - Remaining amount after deducting credit for exempt supplies would be allowed as ITC. Calculations have to be done individually for:

In case a capital asset was previously utilized particularly for :

And at present, it would be utilized commonly for:

Input tax to be credited to electronic credit ledger = Input Tax – 5% of Input tax for every quarter or part thereof from the date of invoice.

For example, Mr. Ramesh purchased a capital asset for use in exempt supplies only. He paid Rs 2,00,000/- along with GST of Rs 36,000 as input tax on 3rd October 2018. On 17th November 2019, he would like to use the capital asset commonly for both taxable and exempt supplies.

At present, the eligible common input tax credit would be assessed as follows = Input Tax – 5% of Input tax for every quarter or part thereof The no. of quarters from 3rd October 2018 to 17th November 2019 = 5 = 36,000 – (5% of 18000) * 5 quarters = 36,000 – 9000 = 25000 Now, this is the common credit at Mr. Ramesh disposal.

He would credit Rs 25000 to the Electronic Credit ledger. Now he would assess the ITC attributable to exempt supplies according to the formula for exempt supplies.

Common credit for one month= 25000÷60=416 assuming his total turnover is Rs.200 lakhs and exempted sales is Rs.60 lakh-

Credit attributable for exempt supplies = (60/200) * 416 = Rs.124.8

This amount of Rs.124.8 would be reversed in GSTR-3B under the ITC Reversal column.

In the following situation the proportionate ITC would be reversed i.e. added to output tax liability in GSTR-3B:

ITC involved in the remaining useful life in months would be computed on a pro-rata basis, taking the useful life as five years.

The calculation has to be done separately for integrated tax and central tax. This amount has to be reversed in (i.e. becomes part of output tax liability) and furnished in:

This has to be attached by a certificate from a practicing chartered accountant or cost accountant. In the case of the sale of capital goods, if the amount assessed above is greater than the tax on the transaction value of such sale, then the amount assessed as above will be added to output tax liability. The details have to be given in FORM GSTR 1.

Capital goods send on job work

ITC would be allowed to the principal manufacturer in case a capital asset has been sent to a job worker for job work.

Condition

Such goods have to be received back within a period of 3 years of being sent out.

Implications

Unless the goods are sent back within 3 years, they shall be considered as a deemed supply from the date of sending the goods and tax would be payable with interest for late payment of taxes.