GSTR 7 Format - Details to Know

GSTR 7 is a monthly statement that is to be provided by all taxpayers in GSTR 7 format who are needed to deduct TDS (Tax deducted at Source ) under GST. GSTR 7 form could furnish the details of TDS returns, TDS deducted, amount of TDS paid and payable and any refund claimed for TDS. The taxpayer whose TDS has been deducted could claim the ITC of the TDS deducted and use it for paying the output tax liability.

GSTR 7 applicability is valid for the following entities:

- Central or state government departments or establishments.

- Local authority.

- Category or persons notified on the recommendation on the GST council.

- A board, authority, or any other body that has been set up by Parliament or state legislature or by a government, with 51% equity owned by the government.

- Societies by central or state governments or local authorities registered under the Societies Registration Act.

- Public Sector Undertakings

- Governmental agencies.

Details to be Given in GSTR 7?

As per the GSTR 7 format, it consists of 8sections. Unless you get a clear-cut understanding of the details to be provided in the GSTR7 return form, it will be difficult to proceed as to how to file TDS return in GST.

- Step 1: GSTIN: The registered taxpayer would be allotted GSTIN ( Goods and services tax identification number). GSTIN would be auto-populated as the return files.

- Step 2: The legal name of the Deductor: The name of the registered taxpayer would be auto-populated as he logs into the GST Portal. Besides, the trade name of the registered taxpayer would also get auto-populated.

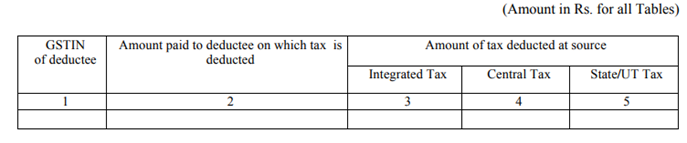

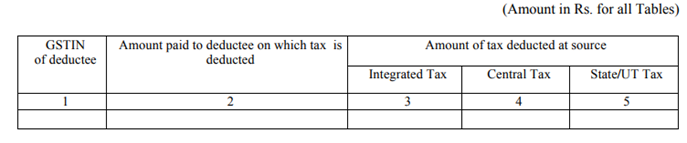

- Step 3: Details of the Tax Deducted at Source (TDS): The taxpayer needs to provide the details with respect to TDS deducted like GSTIN of the deductee, total amount, and TDS amount (center/state-integrated)

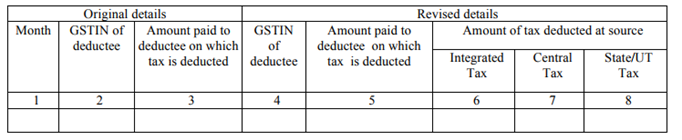

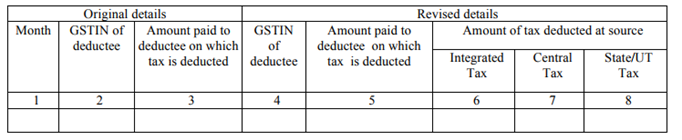

- Step 4: Amendments to details of TDS in respect of any earlier tax period: Any rectification to the data submitted in the return of earlier months could be done under this section by filing the original and revised details. Based on the modifications, the TDS certificate (GSTR7A) would get revised.

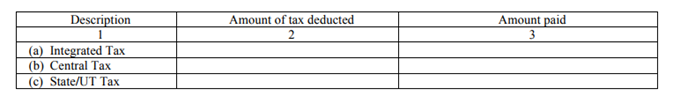

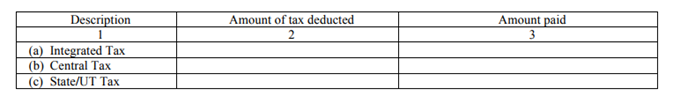

- Step 5: TDS & Paid: Here under this section you are required to provide the details of the tax (integrated, central, state) amount deducted from the deductee and the tax amount (integrated/entre /state) paid with the government.

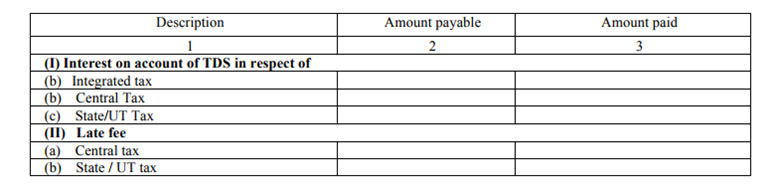

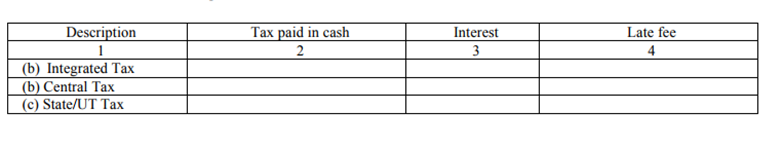

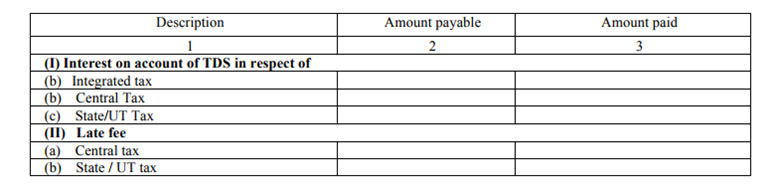

- Step 6: Interest, late fee payable and paid: In case there is any interest fee or late fee applicable on the TDS amount, you have to provide the details regarding that with the amount paid to date

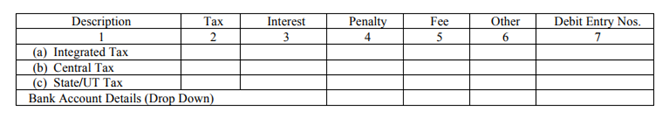

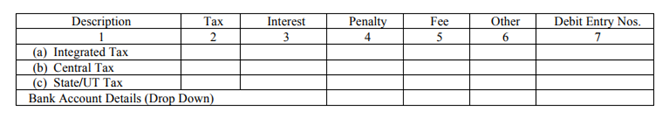

- Step 7: Refund claimed from electronic cash ledger: If the taxpayer wishes to make a claim for the refund of TDS from the electronic cash ledger, he should provide such details under the head. He should also furnish the bank details where the refund for TDS has to be credited.

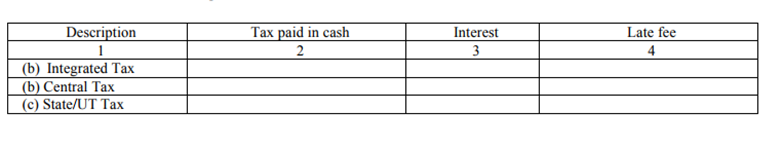

- Step 8: Debit entries in electronic cash ledger for TDS / interest payment (to be populated after payment of tax and submission of return): The entries here are auto-populated, soon you complete filing the return and the TDS payment in addition to the interest if any.

After all the details are provided correctly in the GSTR 7 in accordance with the GSTR 7 format, the taxpayer is needed to sign a declaration regarding the authenticity of the information given under different heads by means of the digital signature certificate (DSA) or Aadhar based signature verification.

It is to be noted that GSTR7 nil return filing is not mandatory when the TDS is not deducted in the tax period.

Read More

What is GSTR 7?

GST Return Forms