November 09, 2021

A registered taxpayer whose turnover exceeds 2 crore rupees should get his account audited as specified under subsection (5) of the CGST Act. They have to submit a copy of the audited annual accounts and a reconciliation statement duly certified in the GSTR 9C form.

A registered taxpayer whose aggregate turnover exceeds 2 crores in a financial year should get his accounts audited by a Chartered Accountant or a Cost Accountant. GSTR 9C is a statement of reconciliation between :

It amounts to that of a tax audit report submitted under the income tax act. That includes gross and taxable turnover in accordance with the books reconciled with the respective figures according to the consolidation of the GST return for a Financial Year.

So any irregularities from this reconciliation exercise would be reported here in addition to the reasons for the same. the certified statement would be issued for every GSTIN; Thus, several GSTR 9C forms may have to be filled for a PAN.

GSTR 9C has to be prepared and certified by a Chartered Accountant or Cost Accountant. It has to be filed on the GST portal or via a facilitation center by the taxpayer, in addition to other documents such as audited accounts and annual return copies in GSTR 9 Form. The statement is applicable to all who should get their annual income audited as per GST laws.

Audit under GST is applicable to the registered taxpayers whose annual turnover exceeds two crores in the Financial year. Besides, according to CBIC’s CGST notification 09/2020 16th MARCH 2020, all foreign companies in the airline business, compliant with the provisions and rules of the companies act, 2013 are exempted from GSTR 9C.

Besides, persons who are Non-resident and are providing OIDAR service in India to unregistered persons have been exempted from furnishing GSTR9 and GSTR9C.

GSTR 9C due date is similar to the deadline for submitting annual returns in GSTR 9. So GSTR 9C has to be filed on or before 31st December of the year also same as GSTR 9B return filing subsequent to the relevant Financial Year under audit. The government could extend the GSTR 9C due date if it deems necessary.

A Chartered Accountant or Cost Accountant has to prepare a GST reconciliation statement. Any mismatch between the details reported in the GST returns and the audited accounts has to be reported by the Chartered Accountant by mentioning reasons for the differences.

This reconciliation statement is the base for the tax regime to confirm the authenticity of the GST returns filed by the taxpayers. Due to this, Chartered Accountant should certify any additional liability in the reconciliation exercise and GST audit in GSTR 9C.

The GSTR-9C has two parts:

The figures in the audited financial statements are at the PAN level. So, the turnover, paid Tax and ITC earned on a particular GSTIN (or State/UT) have to be pulled out from the audited accounts of the organization as a whole.

According to Notification No: 56/2019 issued on 14th November 2019 For FY 2017-18 & 2018-19, the following modifications were made:

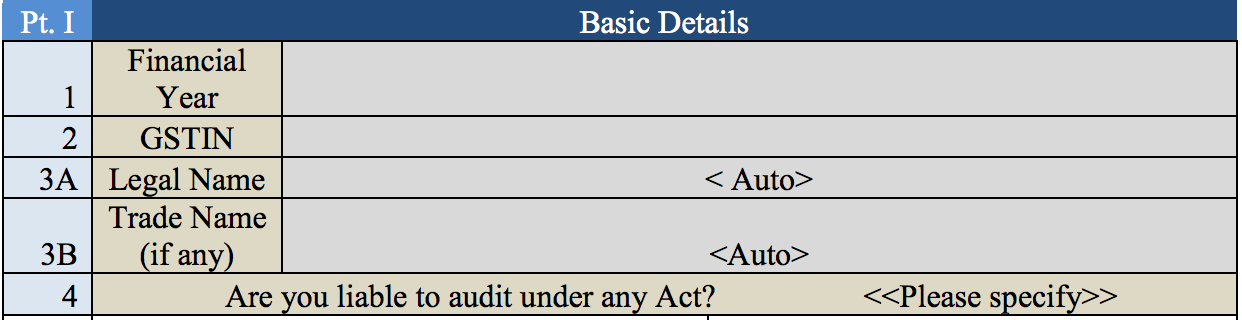

Part-I: Basic details: It Consists of FY, GSTIN, Legal Name, and Trade Name. The taxpayer has to mention if he is subject to audit under any other statute.

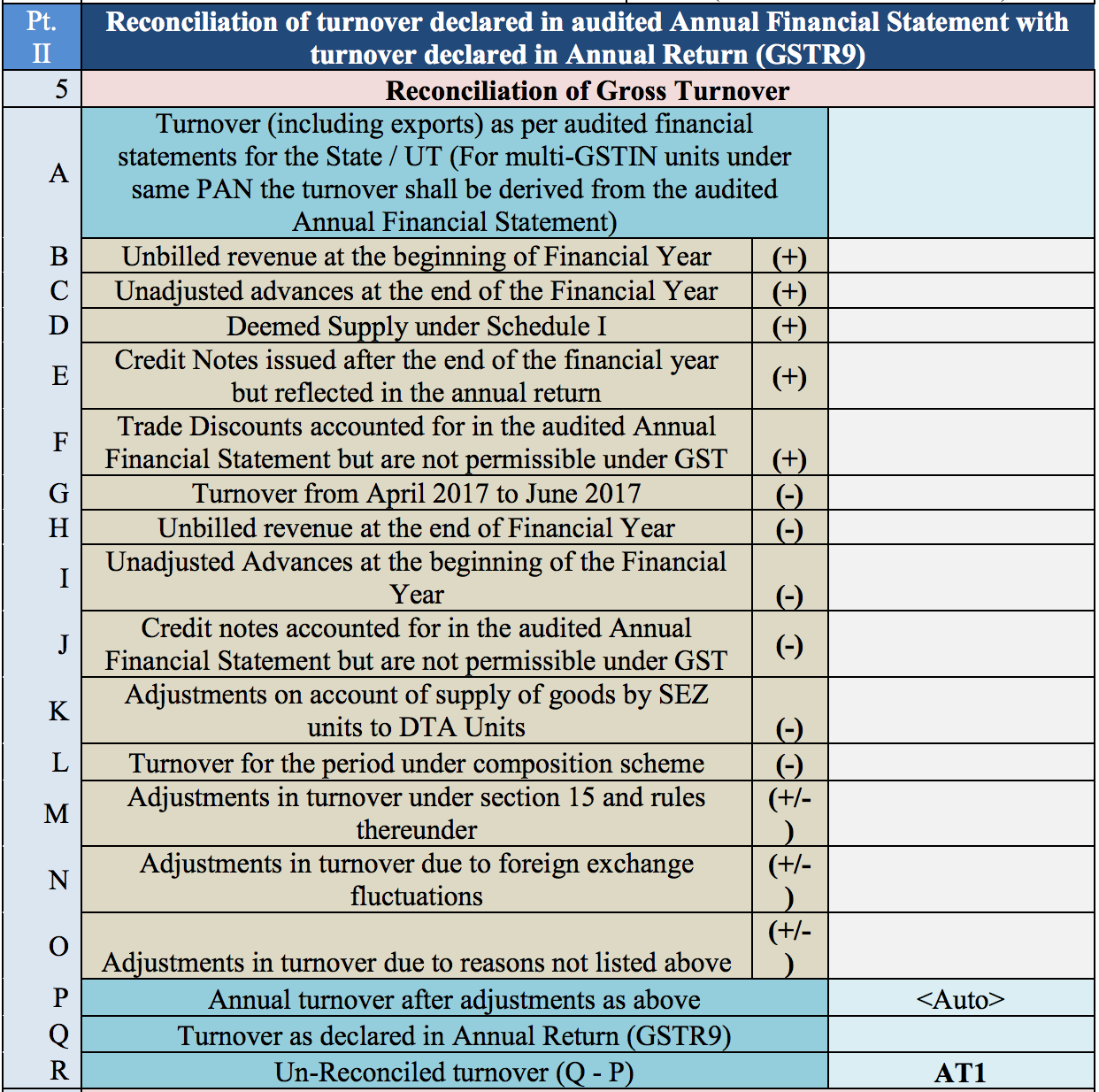

Part-II: Reconciliation of turnover furnished in the Audited Annual Financial Statement with turnover declared in Annual Return (GSTR-9): It involves mentioning the gross and taxable turnover declared in the Annual return with the Audited Financial Statements. One has to note that most often, the Audited Financial statements are at a PAN level. This requires the break up of the audited financial statements at the GSTIN level for reporting in GSTR-9C.

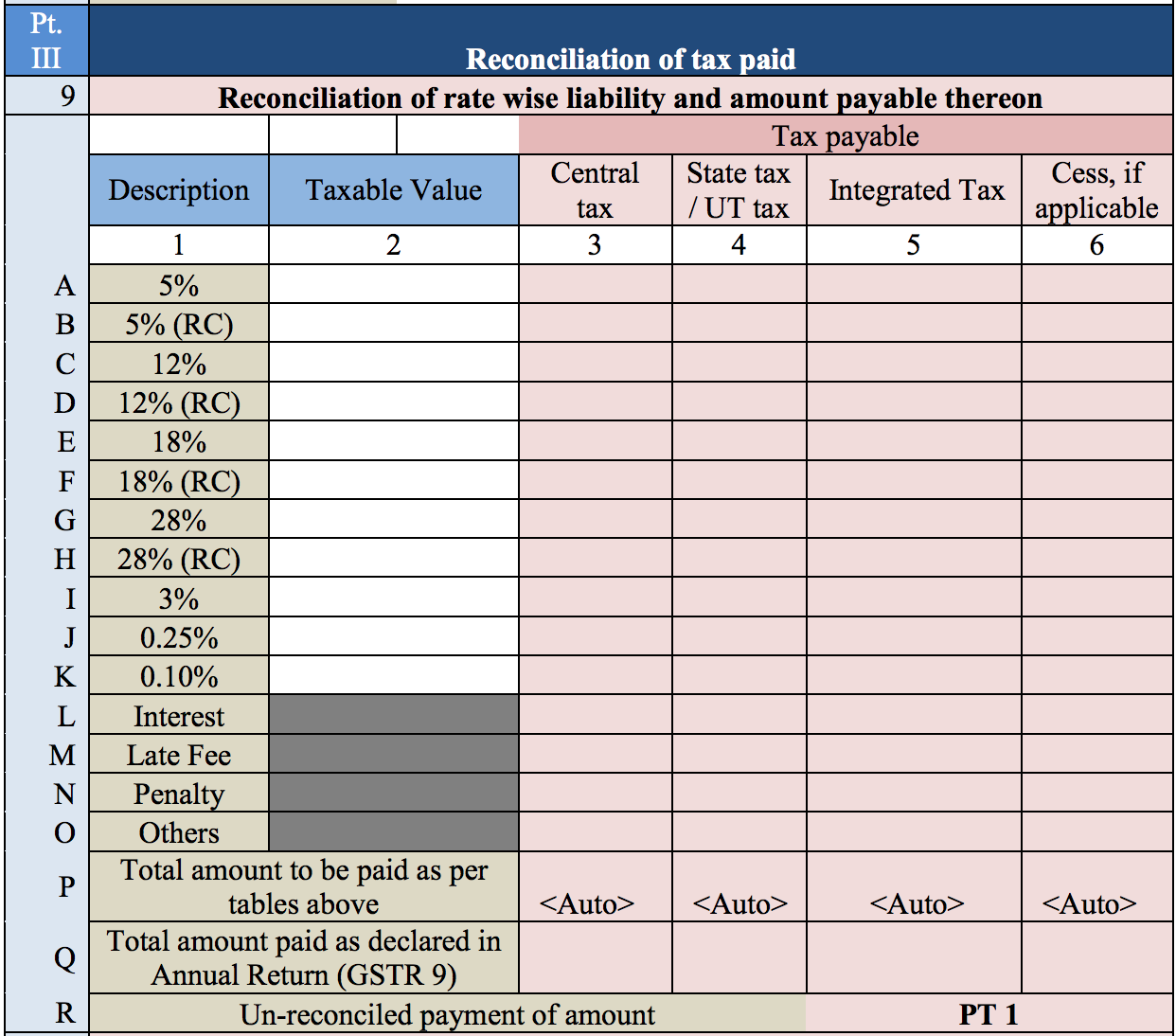

Part-III: Reconciliation of tax paid: This head requires GST rate-wise reporting of the tax liability that is as per the accounts and paid as mentioned in the GSTR-9 respectively with the differences thereof. Besides, it requires the taxpayers to show the additional liability owing to unreconciled mismatch notices upon reconciliation.

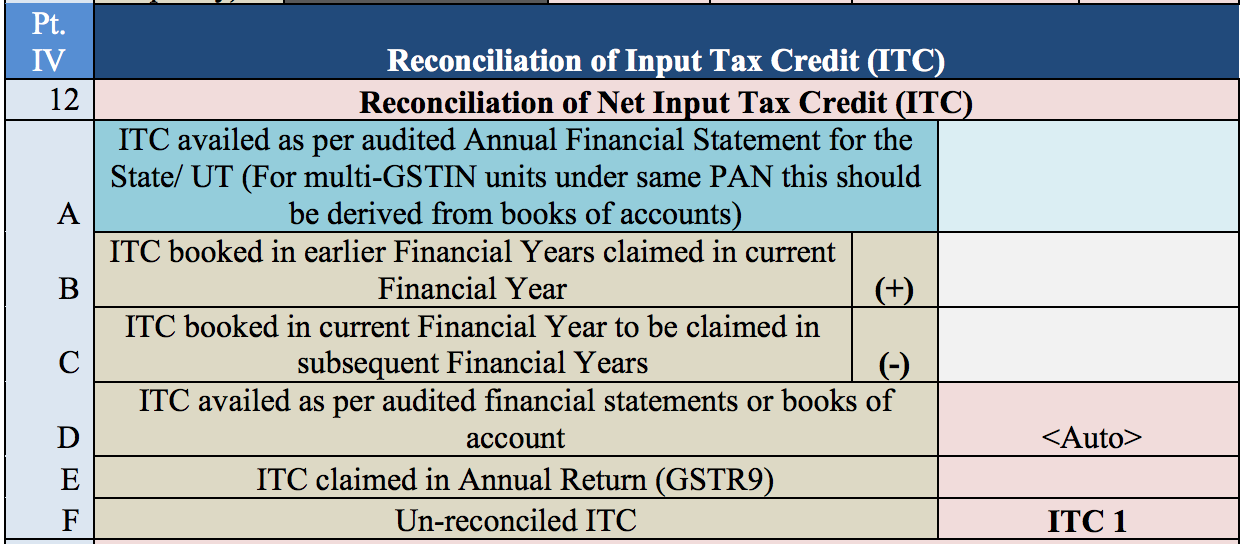

Part-IV: Reconciliation of Input Tax Credit (ITC): This section includes a reconciliation of input tax credit availed and utilized by taxpayers as mentioned in GSTR-9 and as reported in the Audited Financial Statement.

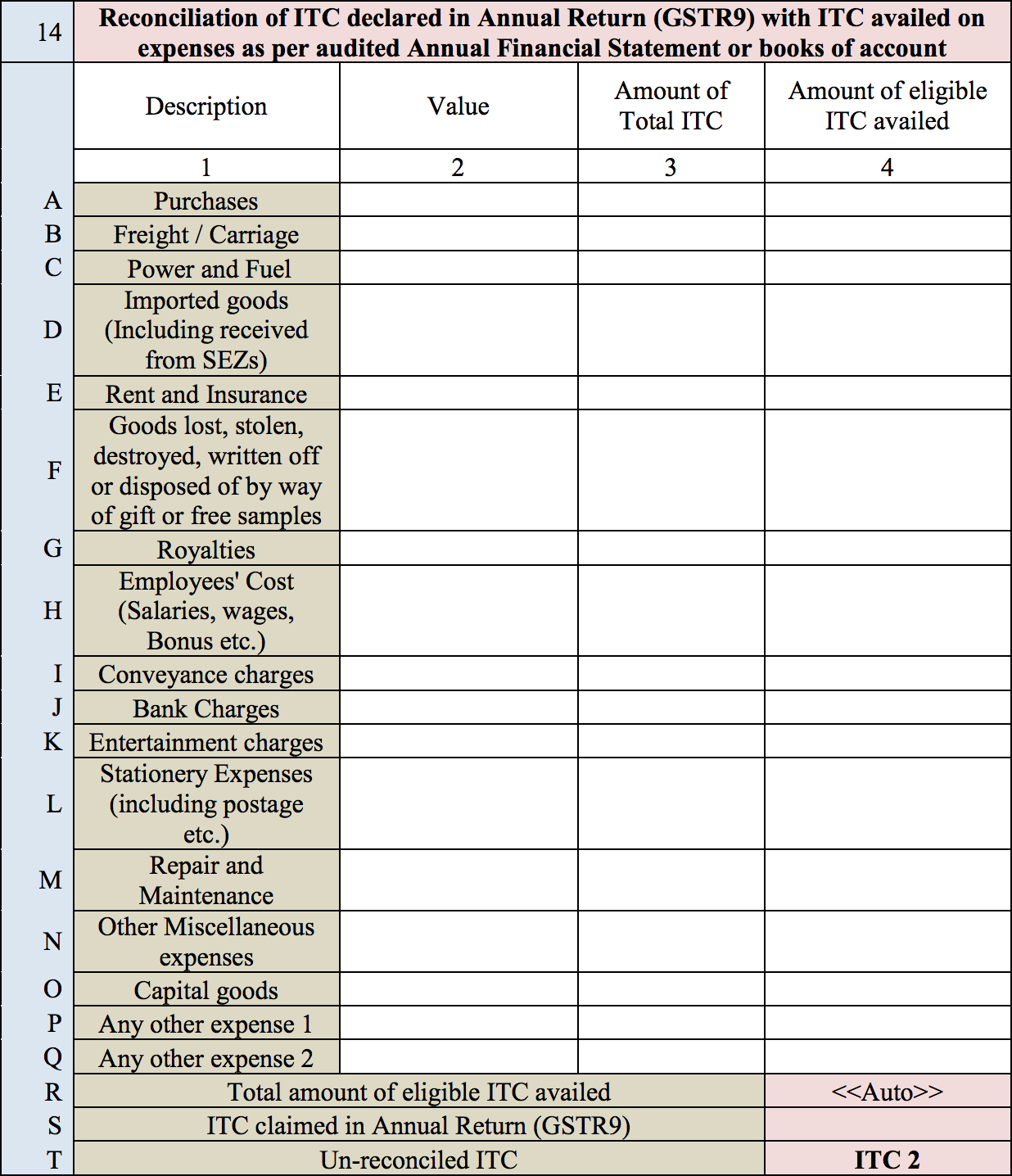

Moreover, it is required to report Expenses booked according to the Audited Accounts, with a breakup of eligible and ineligible ITC and reconciliation of the eligible ITC along with the amount claimed in accordance with GSTR-9. This declaration would be after considering the reversals of ITC claimed, if any.

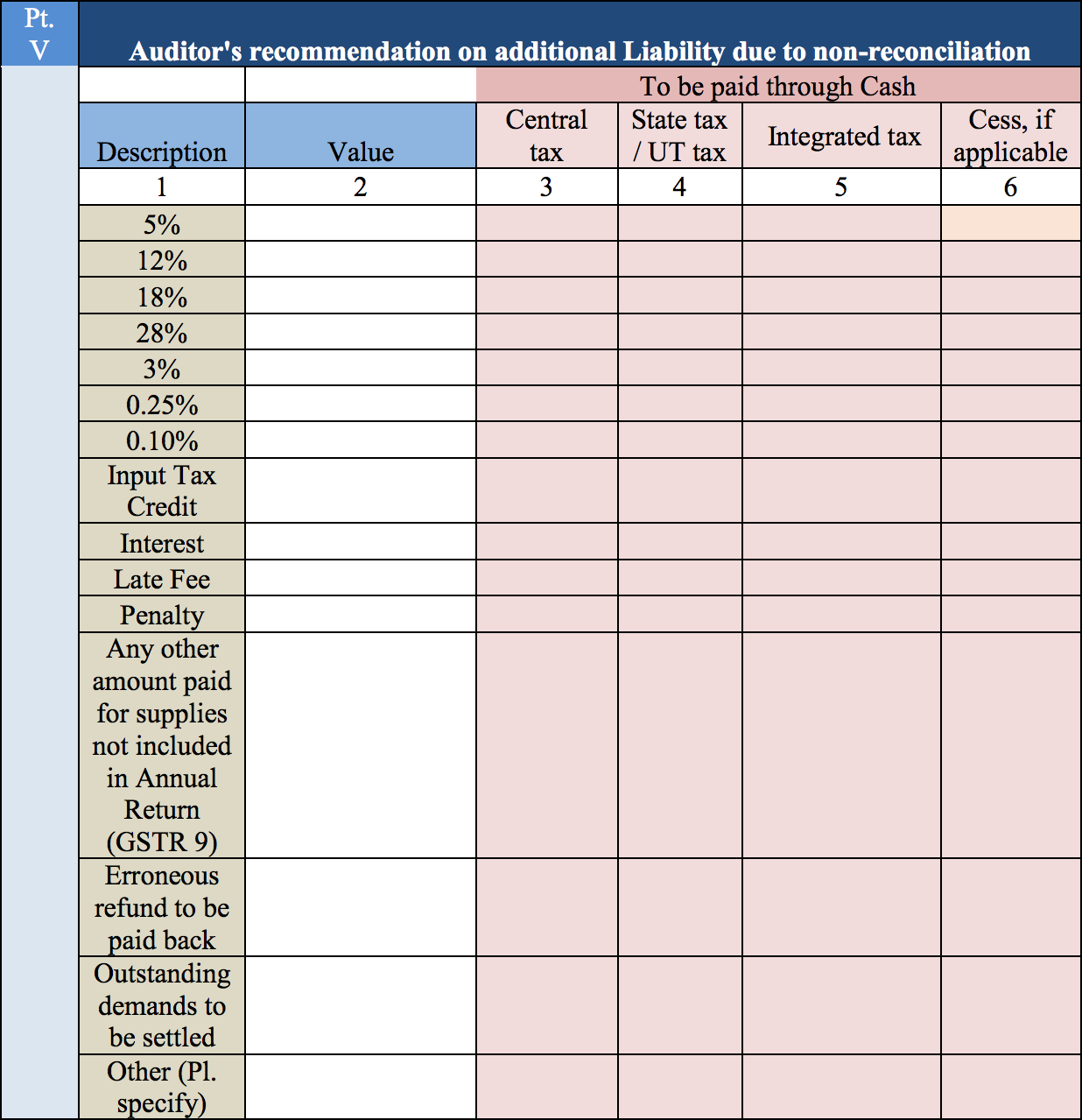

Part-V: Auditor’s recommendation on additional Liability due to non-reconciliation: Here, the Auditor should report any tax liability identified via the reconciliation exercise and GST audit, pending payment by the taxpayer. There could be non-reconciliation of turnover or ITC on account of :

Finally, the format of GSTR-9C specifies that an option would be given to taxpayers to settle taxes as recommended by the auditor at the end of the reconciliation statement.

According to Notification No: 56/2019 issued on 14th November 2019 For FY 2017-18 & 2018-19, the following modifications were made:

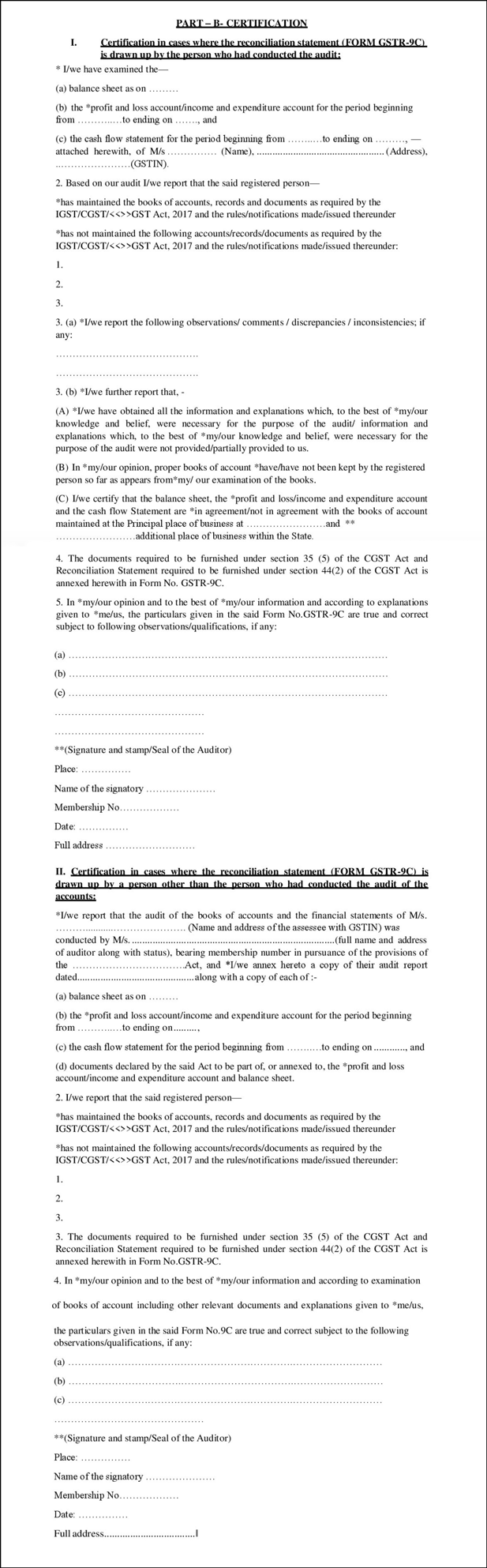

The GSTR-9C could be certified by the same Chartered Accountant who did the GST audit or it could be also certified by any other Chartered Accountant who did not conduct the GST Audit for that particular GSTIN.

The mismatch between the both is that in case the Chartered Accountant certifying the GSTR-9C did not conduct the GST audit, it must have been based on the opinion on the Books of Accounts audited by another Chartered Accountant in the reconciliation statement. The format of Part-B for certification reports varies depending on the certifier.

Part A: Reconciliation statement, contains sections for basic details, reconciliation of Annual Financial Statement turnover with GSTR-9 turnover, reconciliation of tax paid, reconciliation of Input Tax Credit (ITC), an auditor’s recommendation on additional liability due to non-reconciliation.

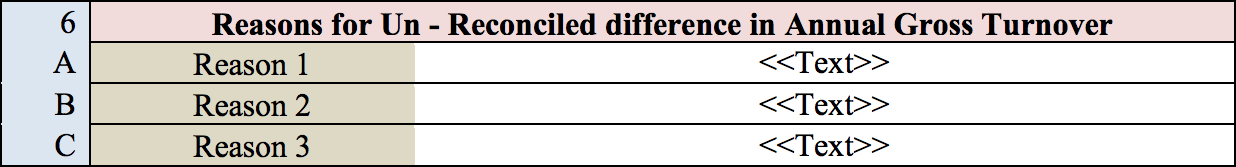

Under Section 6, you could list any possible reasons for unreconciled differences in the annual gross turnover that may have occurred.

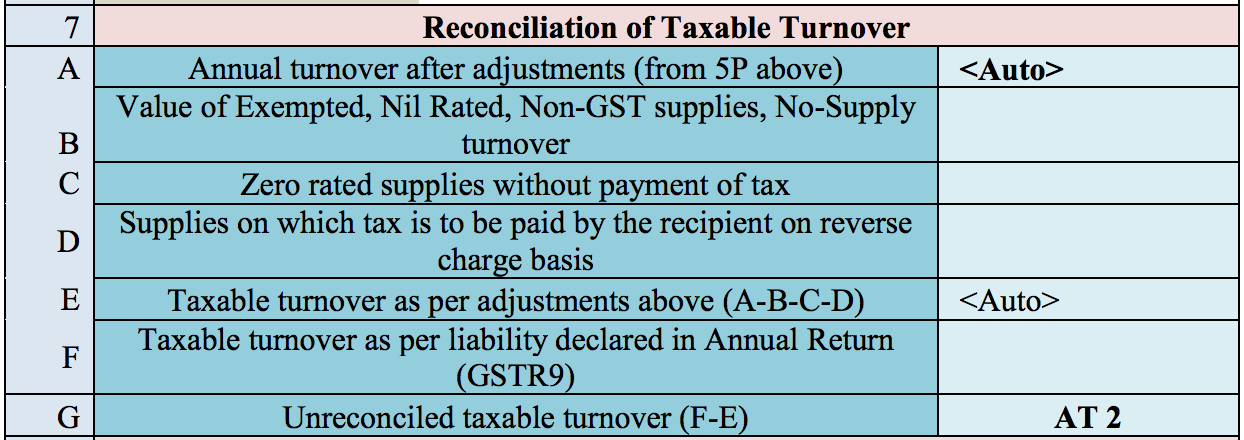

Under this section, you need to fill in the following values regarding the reconciliation of taxable turnover

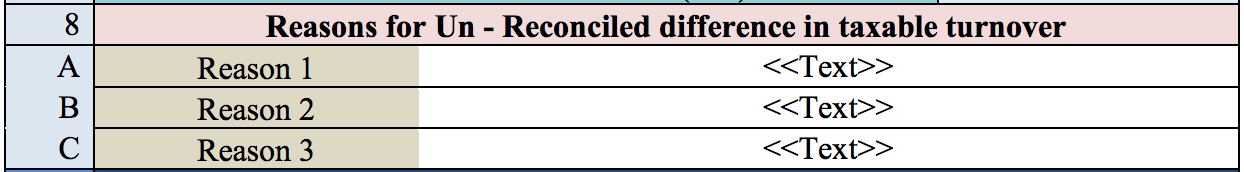

Like Section 6, Section 8 lets you list reasons for the difference between the taxable turnover declared in the annual return and the taxable turnover derived from line E of Section 7.

Under Section 9, you are required to fill in the taxable value, central and state tax, integrated tax, and cess value for each tax rate: 5%, 12%, 18%, 28%, 3%, 0.25%, and 0.10%. For each rate, tax paid by reverse charge is listed in a separate line from tax collected normally.

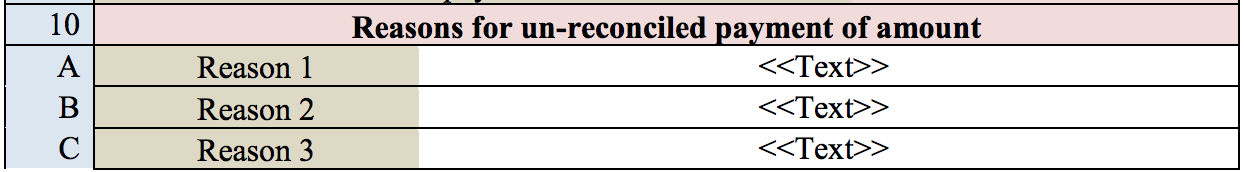

In Section 10, you can furnish the reasons for the difference between the total amount of tax paid according to the reconciliation statement, and the total tax amount paid as given in the annual return (GSTR-9).

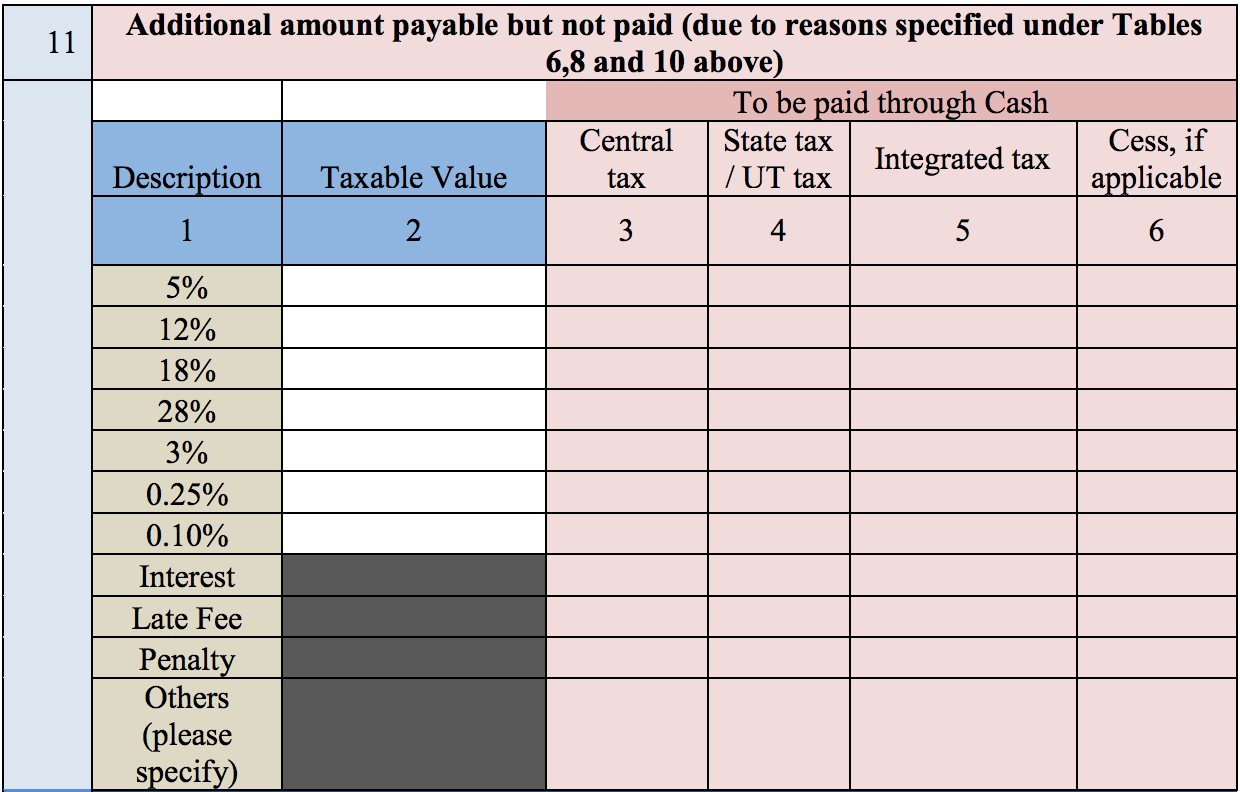

Under Section 11, you can furnish the details of any tax payable, but not yet paid, because of the reasons specified in Sections 6, 8, and 10.

Part 4 contains information for reconciling your ITC. Under Section 12, furnish the value of the ITC availed in the following categories in the table

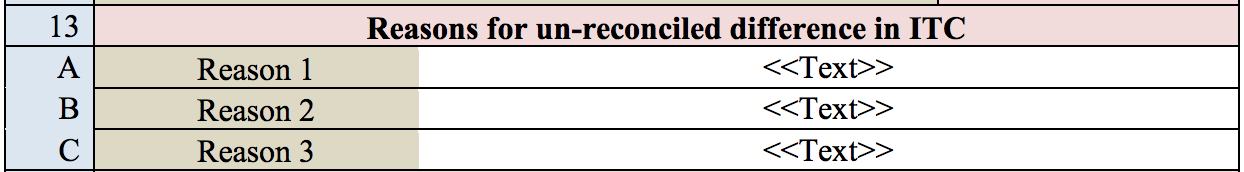

Under Section 13, you could list any reasons for a difference between the ITC claimed as per the annual return filed (GSTR-9) and the ITC claimed in accordance with the audited financial statement.

As per Section 14, specify the value, amount of total ITC, and amount of eligible ITC availed regarding each category of expenses.

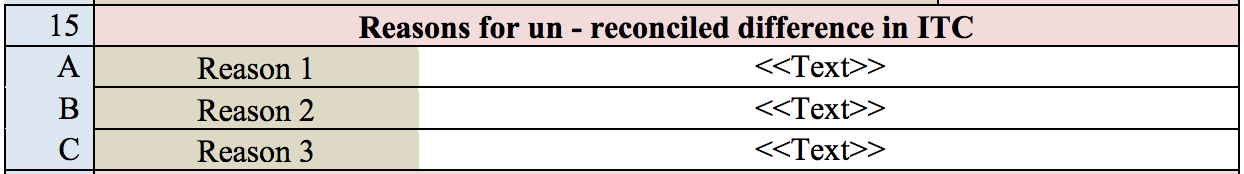

Under Section 15, fill in the reasons for any difference between the amount of ITC availed for the different expenses (provided in line R of Section 14) and the availed ITC in accordance with the annual return (mentioned in line S).

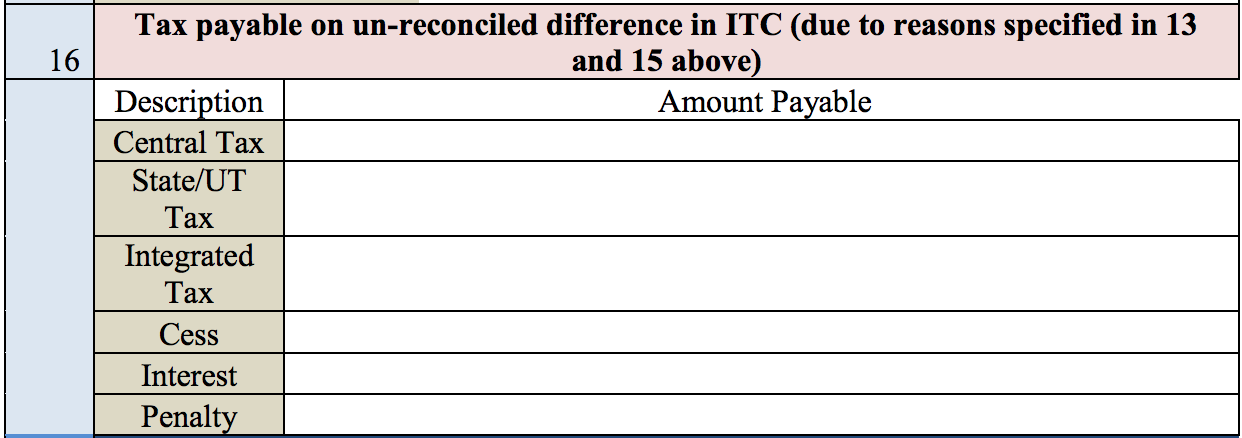

Under Section 16, You are required to fill in the central and state tax, integrated tax, cess value, interest, and penalty payable regarding the un-reconciled mismatch described in Sections 13 and 15.

Part 5 contains your auditor’s recommendations on your additional tax liability due to non-reconciliation. Here, the auditor is to provide the taxable value, central and state tax, integrated tax, and cess value (if applicable) for several categories: the individual tax rates of 5%, 12%, 18%, 28%, 3%, 0.25%, and 0.10%; the applicable ITC, interest, late fees, penalties, any other amounts paid but not included in GSTR-9; erroneous refunds to be paid back; and outstanding demands to be settled.

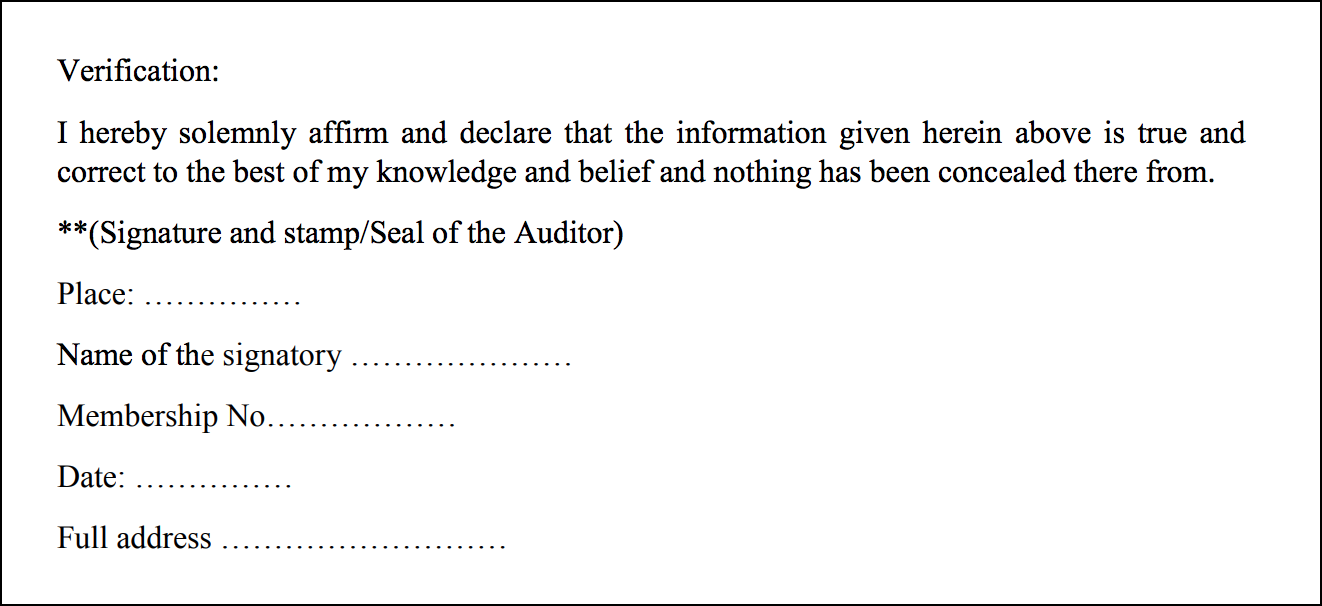

After all the details are provided correctly in the GSTR 9C in accordance with the GST Act and GST rules, the taxpayer is needed to sign a declaration regarding the authenticity of the information given under different heads by means of the digital signature certificate (DSA) or Aadhar based signature verification.

Before filing the GSTR-9C form, you must sign and authenticate the return either through a digital signature certificate (DSC) or by using an Aadhar-based signature verification mechanism.

The following modifications have been made to the format and filing procedures on 31st December 2018 :