September 06, 2021

As it comes to full form, IFF meaning is Invoice Furnishing Facility is a facility given to quarterly taxpayers who are in QRMP scheme, to file their details of outward supplies in the first two months of the quarter (M1 and M2), to pass on the credit to their recipients.

IFF utility in GST could be used by the small taxpayers who have chos en the QRMP scheme to file their GSTR 1 return every quarter.

en the QRMP scheme to file their GSTR 1 return every quarter.

A QRMP taxpayer who files quarterly GSTR1 and GSTR 3B returns could use the Invoice Furnishing Facility (IFF). Unless a taxpayer opts for it, he is required to upload invoices directly in the GSTR 1.

As it comes to full form, IFF meaning is Invoice Furnishing Facility is a facility given to quarterly taxpayers who are in QRMP scheme, to file their details of outward supplies in the first two months of the quarter (M1 and M2), to pass on the credit to their recipients.

IFF utility in GST could be used by the small taxpayers who have chosen the QRMP scheme to file their GSTR 1 return every quarter.

As the Invoice Furnishing Facility in GST is for the quarterly taxpayers, the following are the steps in detail for uploading invoices by using the IFF in GST payment.

Step 1: After logging in to the GST portal, click Services-Returns-Dashboard

Step 2: Then the file returns page be viewed. From there, choose the ‘Financial Year’, ‘Quarter’ and ‘Period’ from the dropdown list and click on ‘Search’. Then click the ‘prepare Online’ button under ‘Details of outward supplies of goods or services’

Taxpayers have to note it for the month 3 of a quarter, GSTR 1 should be filed.

Within the invoice furnishing facility, the following tiles would be displayed.

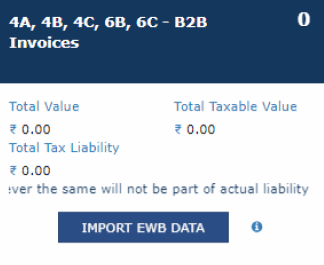

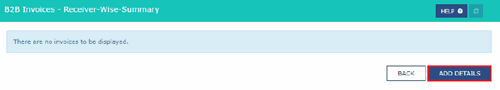

Step 3: Choose the tile for Table 4.1-4A,4B,4C,6B,6C- B2B invoices and add all B2B invoices of the period. On another way around, invoice details could be imported from the e-way bill data by clicking on ‘Import EWB Data’.

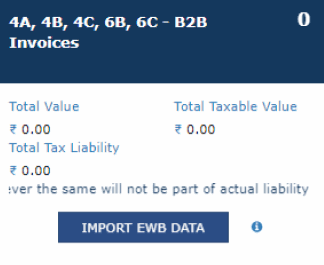

Step 4: After selecting ‘Add Details’ (as shown in the above), furnish the ‘Receivers GSTIN/UIN,’ Invoice No’, Invoice Date’, ‘POS’, Total invoice value and GST rate. After giving the details of the invoice click on ‘Save’.

It is to be noted that if the ‘Type of supply is intrastate ‘, Central tax and state, UT tax columns would be appearing in place of integrated tax.

Step 5: After all the invoices are added, select ‘ Back ‘, then you would be directed to the landing page that was shown in Step 2.

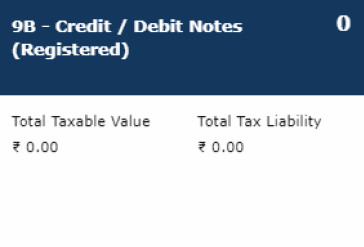

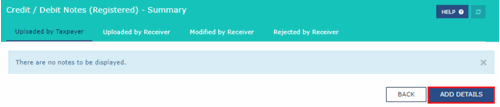

Step 6: In case the taxpayer has issued any credit or debit notes, he could choose the ‘9B - Credit / Debit Notes (Registered) option.

Step 7: Choose the option for Table 4.2 - 9B- Credit /Debit Notes (Registered) and add Credit/Debit Notes for the period and click on ‘Add details’

Step 8: Tick the checkbox is given ‘Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax as notified by the government’. In case the supply is eligible to be taxed at a differential percentage of the existing rate of tax. Then, update the details like ‘Receivers GSTIN/UIN’,’ Debit / Credit Note No’, ‘Debit /Credit Note Date’,’ Note Type(Credit /Debit), ‘Note Value ‘ and ‘POS’ in addition to taxable value and tax amount against the GST applicable rate. After furnishing the Debit/Credit Note details, click on ‘Save’.

It is to be noted that if the ‘Type of supply is intrastate ‘, Central tax and state, UT tax columns would be appearing in place of integrated tax.

Step 9: After the credit/debit notes are added, click ‘Back’, and the taxpayer would be redirected to the Landing page.

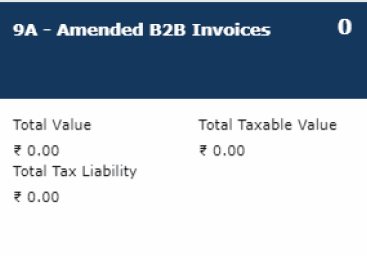

Step 10: If any invoices filed earlier needs to be modified, click the option for Table 4.3 - 9A - modified B2B invoice.

Step 11: Choose the ‘Financial Year’ and provide the invoice number to be modified and click on ‘Amend invoice’

Step 12: Then click on ‘Amend invoice’, furnish the ‘ Receivers GSTIN/UIN’, ‘Revised invoice No’, ‘Revised Date’,’ Point of Sale (POS)’, AND ‘Total Invoice Value’, as needed, in addition to the tax value and tax amount against the GST applicable rate. Then provide the amended invoice details, and click on ‘Save’

Step 13: After applicable invoices are modified, click ‘Back’, and the taxpayer would be redirected to the Landing Page.

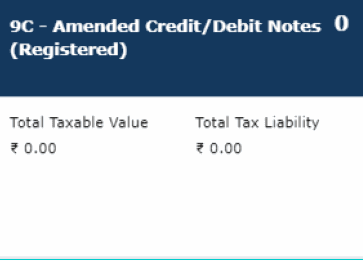

Step 14: If any credit /debit notes filed earlier needed to be modified, choose Table 4.4 - 9c- amended credit/debit notes (Registered).

Step 15: Choose the ‘Financial year “and provide the Credit/Debit Note number to be modified and click on ‘Amend Note’.

Step 16: In the Revised Credit/Debit Note Number field, furnish the revised credit or debit note no. Give the Revised Credit/Debit Note Date and modify details such as ‘POS’, Note type ‘, ‘Note Value’, ‘Taxable value’, as the case may be. After that, click on ‘Save’.

Step 17: After applicable notes are modified, click ‘Back’ and the taxpayer would be redirected to the Landing Page.

Step 18: After all the updating, choose ‘Generate IFF summary’.

Step 19: It may take a while to generate. Then a success message would appear on the top of the page, and all the details would be updating.

It is to be noted that the IFF summary could be generated once every 10 minutes and the GST portal would automatically assess the summary of Invoice Furnishing Facility in GST every 30 minutes. In case the taxpayer tries to generate an IFF summary within 10 minutes of the previous report, an error message would be displayed.

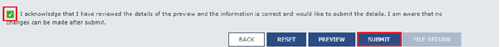

Step 20: After the last IFF summary is generated, choose ‘Preview’ and download the draft report in PDF and review it.

Step 21: After the details are added properly, the taxpayer could tick the acknowledgment box, and click on ‘submit’ to file details.

It is noted that the IFF would be used only if the tax value is less than INR 50 lakhs in a calendar month. If the tax value exceeds the limit, then an error message would appear.

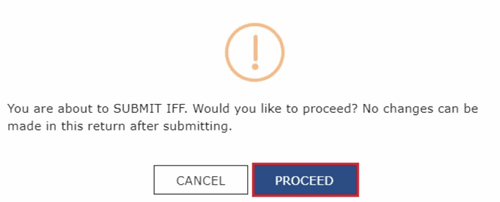

Step 22: Unless there are errors, the taxpayer could click on ‘Proceed’.

The status would be changed to ‘submitted’

Step 23: After the IFF is submitted, the taxpayer may file it and verify it by means of Digital Signature Certificate (DSC) / Electronic Verification Code (EVC).

Step 24: Tick the declaration checkbox and the option for filing.

Step 25: The status of the IFF would be shown as ‘Filed’ in case the filing is successful.

IFF in GST payment is really helpful for small taxpayers and buyers. This facility could indirectly help small taxpayers to increase their business by providing faster ITC claims to their buyers. IFF in GST B2C supplies are not required to be declared there itself and it could be filed in FORM GSTR 1 for the quarter.