June 29, 2021

E-way Bill is an electronically generated / electronic bill which is a permit required for inter and intrastate supply of goods worth more than Rs 50000. E Waybill system provides all the details regarding the goods, consignor, transporter, and recipient.

There is also an option available to generate or cancel e-way bills via SMS. You can also modify e-way bill no and we will discuss how to modify e-way bill or how to edit e-way bill in this blog. Let us see all of them in detail.

As you generate part A of the e-way bill, it is not mandatory to provide the vehicle number in the slot. But the e-way bill is not valid for the movement of goods without a vehicle number. The e-way bill portal gives you an option for updating the vehicle number on the document. The option could be valid in the following cases:

This option at your disposal for the e-way bill could be used many times before the expiry of the validity. It is to be noted that no other details on the e-way bill could be edited like that. And also the place of change in the e-way bill should be scrutinized carefully. Besides, the bulk update vehicle number option is available where an excel template could be filled up and uploaded on the portal for updating vehicle details for many e-way bills in a single shot.

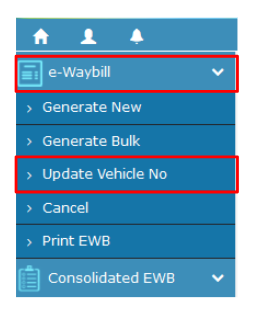

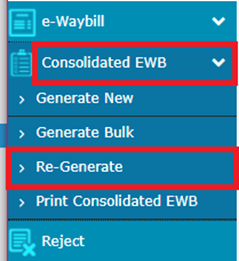

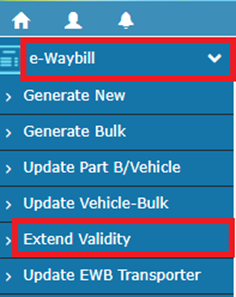

Step 1: After login into the e-way bill portal and choose the option of ‘update vehicle No’ as a sub-option under the ‘E-way bill’ option shown on the left side of the dashboard.

It is to be noted that in case the consolidated e-way bill requires an update of transport/vehicle details, opt for the ‘Re-Generate‘ option under ‘Consolidated EWB ‘ shown on the left side of the dashboard.

Other steps remain the same.

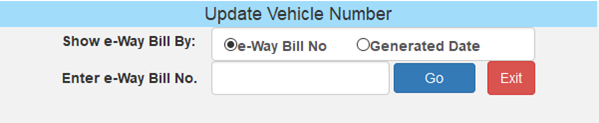

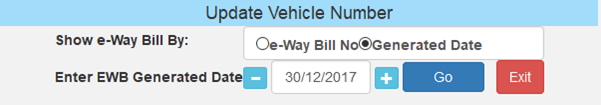

Step 2: it appears the ‘Show e-way Bill By:’ option and choose either ‘e-Way Bill No’ or ‘Generated Date’. Then provide E-way Bill No or Date and click on ‘Go’.

A list of filtered e-way Bills would be shown as per your choice. Opt for the relevant e-way bill for which you wish to update the vehicle no.

Step 3: Provide the details on the page

Then click on the ‘submit button’.

Note: Enter transporter document number, if the way of transportation is air, rail or ship, in place of the vehicle number.

New details with the e-way bill could get updated instantly. In case of errors, it would be displayed. Even consolidated E-way bills could be edited for the vehicle details.

The actual assigned transporter/seller who generated e-way bills could modify/reassign the transporter ID by replacing the existing transporter with a new one. In case the actually assigned transporter assigns another transporter, then the seller can't make any modifications. Besides only part B details could be edited.

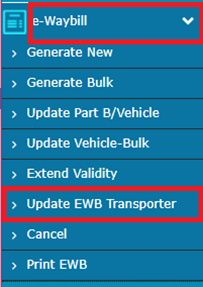

Step 1: Firstly choose a sub-option, ‘Update EWB Transporter’, under the ‘e-way bill’ option shown on the left side of the dashboard.

Step 2: Provide the e-way Bill number and click ‘Go’. (You can give transporter GSTIN or Transporter enrolment ID) .

Step 3: Next, enter the new transporters ID and choose ‘submit’.

Then you could see the updated e-way bill on the screen. You may select the print option to print the e-way bill. It is to be noted that the e-way bill number would remain the same even after the changes in the transporter details.

There is an option for the taxpayer to reject the e-way bills generated by other parties on the former’s GSTIN. For instance, if the consignment didn’t reach the destination since it was canceled on the way, the recipient could reject the e-way bill.

Prerequisites:

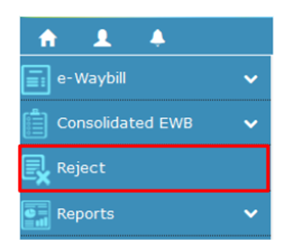

Firstly, you log in and select the ‘Reject’ option and click it.

Once you click ‘Reject’ you could see a screen showing Reject e-way bill by others with the date. After setting the date on which the bill was generated, click on ‘submit’. As you provide the date, you could get the list of e-way bill that were generated on that particular date. Give a tick mark against the e-way bill that you want to reject on the right-hand side. After this, you may get a message on the screen once the e-way bill is successfully rejected.

It is to be noted that one could convey the message regarding the acceptance or rejection of such consignment detailed in the e-way bill as a second party. Unless it is communicated within 72 hours since the generation of the e-way bill, it means that he has accepted the details.

In case the goods were never or not transported as per the precise details provided in the e-way bill, then the generator of such e-way bills could cancel it through the following steps.

Note:

Let us see how to cancel e-way bill through the following steps

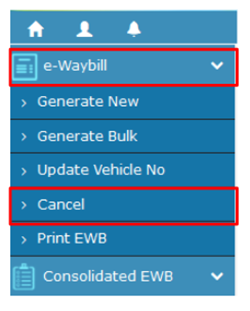

Step 1: Click ‘e-way bill’ or ‘consolidated EWB’ and choose ‘cancel’ from there

Step 2: Then provide the 12 digit e-way bill no that you want to cancel and click on ‘Go’.

Then the EWB selected appears. Provide a reason for the cancellation. For instance, even as goods are not being moved, or an improper entry in the e-way bill entered.

After the expiry of the validity of the e-way bill, goods cannot be moved normally. But, under exceptional cases, the transporter could extend the validity of the e-way bill after updating the reason for the extension and the details in PART B of FORM GST EWB-01.So it is possible to extend the validity of the e-way bill unless the consignment reached the destination owing to exceptional cases like natural calamity, law and order issues, transshipment delay, accident of vehicle, etc. As said the reason is to be given properly.

It is to be noted that the transporter who carries the goods as per the bill system at the time of expiry could extend the validity of the e-way bill.

As we have discussed above, the extension of validity is possible under exceptional circumstances. This option is available before eight hours or within eight hours after the expiry of the validity of the e-way bill. Here, the transporter would provide the e-way bill no and furnish the reason for the extension, from the current place, approximate distance to be travelled & part B details. It is to be noted that Part A details cannot be modified. He would get the extension based on the remaining distance to travel.

Step 1: Firstly login into the portal. Then choose the sub-option ‘Extend validity under ‘E-waybill on the dash dashboard.

Step 2: Provide the e-way bill number of the e-way bill that you want to get an extension.

Step 3: As the e-way bill is shown, click on ‘Yes’ against the question’ Do you wish to get an extension for this EWB?’ at the bottom of the screen and give the reason for the extensions well. There you may reenter the distance, place of dispatch and place of delivery.

It is to be kept in mind that once the validity is extended, the new ‘e-way bill no’ would be allotted instead of the old one. The user cannot change the details of Part A. He would get the extended validity for the remaining distance to travel.

Read More