May 17, 2021

Consolidated eWay bill GST(EWB-02) contains the details regarding various eWay bill consignments. If you are a supplier, transporting multiple consignments in a single vehicle, you could avail the facility of consolidated eWay bill as per the eway bill rules through eway bill generation. For availing this facility, you should make eway bill generation at step 1. We have already discussed how to make eway bill and how to generate eWay bill in an earlier article.

Step 1: Log in to the EWB portal and make individual eWay bill generation.

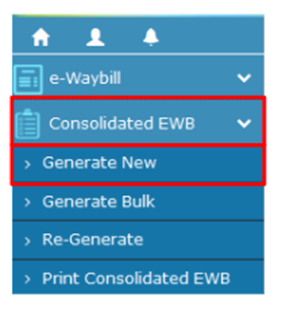

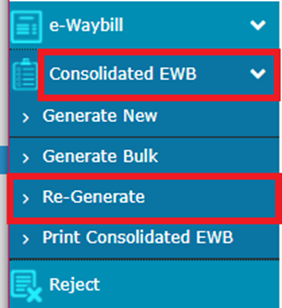

Step 2: Click on ‘Generate new’ under ‘consolidated EWB’ on the left of your dashboard.

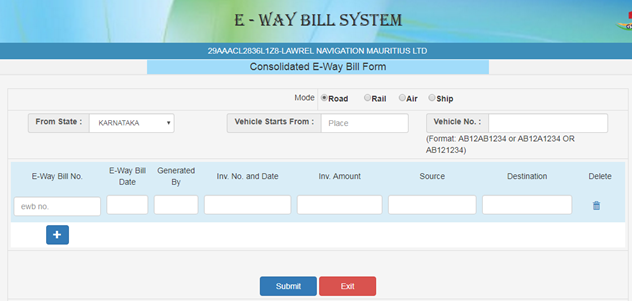

Step 3: Details required in this step:

Provide the details and click on ‘submit

Then Eway bill in form EWB 02 with a unique 12 digit number is generated. Print and carry it with the consignment for transporting the goods.

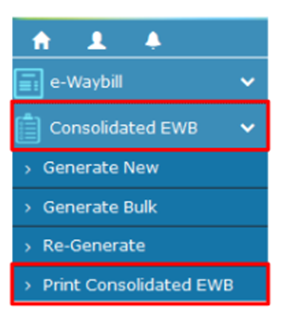

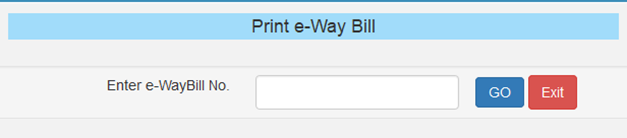

Step 1: You may click on ‘Print EWB’ under the ‘Consolidated EWB ‘ option.

Step 2: Enter your eWay bill GST Number in the space provided and click on ‘Go’

Step 3: Click on the print as it appears.

Transporters could also update their vehicle details for the consolidated eWay bill as per eWay bill rules. Click on the ‘Regenerate ‘ option under the consolidated EWB option.

You can either choose the consolidated eWay bill no or generated date of the consolidated way bill and click on ‘go’.