March 23, 2021

GSTR 2 contains the details of all transactions and purchases made by the registered person in a particular month. It is necessary to check buyer-seller reconciliation. Both the GSTR 1 and GSTR 2 should match otherwise it will create many perplexities. The filing of GSTR 2 is necessary to maintain trust and transparency in businesses. GSTR 2 filing date is the 15th day of every month.

How to file GSTR 2 in gst portal and When to file GSTR 2 are relevant questions. It should be filed on or before the 15th day of every month. There are 13 headings in the GSTR 2 form. Following are the details to be filled in GSTR 2 form:

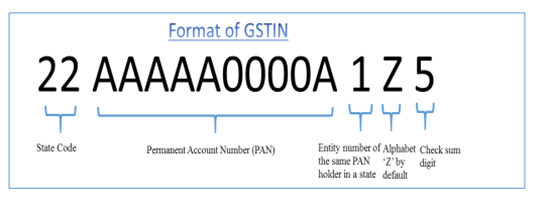

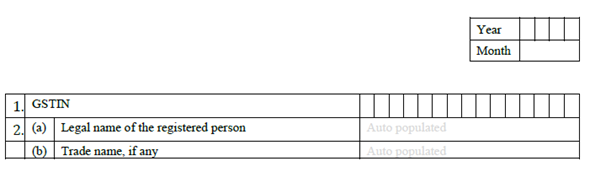

GSTIN is the unique identification number for all registered tax people. The first two numbers are state code, and the next 10 digits are PAN numbers.

The legal name of the registered person and trade name must be included. Also include the month and year in which GSTR 2 is filed.

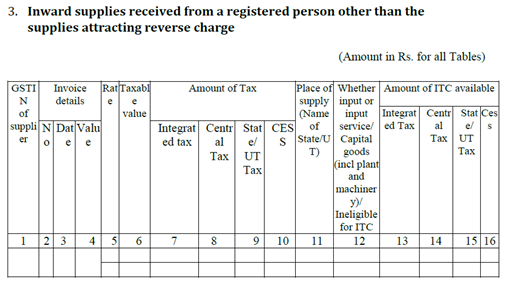

All purchase details of the registered person are auto-generated to the form by GSTR .1. It will have details of all purchase transactions. If the buyer did not file GSTR 1 and if the seller missed the transaction certain transactions may not be auto-populated. The buyer can manually add these transaction details and the seller will get a notification to accept it.

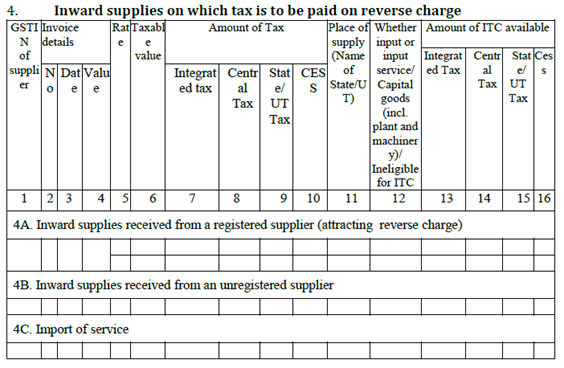

A registered dealer who is buying more than RS 5000 from an unregistered person is liable to pay reverse charges. All purchases on which reverse charge applies will be reported in this part.

4A. Under this head, all purchases in which reverse charge specifically applies by law must include.

4B. This head includes purchases from the unregistered person from an unregistered dealer which is more than 5,000 per day.

4C. Under this head, import of services must be included.

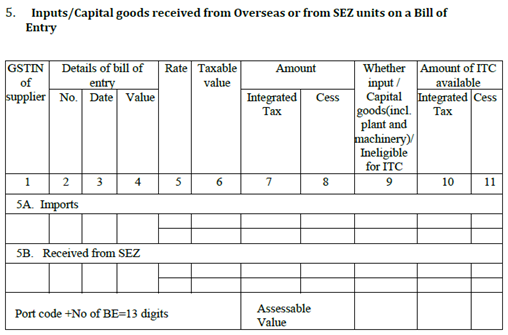

Import of inputs or capital goods received against a bill of entry must be mentioned under this head. Goods received from SEZ also come under this category. In 5A category, Import of inputs or capital received against a bill of entry should be marked and in 5B goods received from SEZ should be marked.

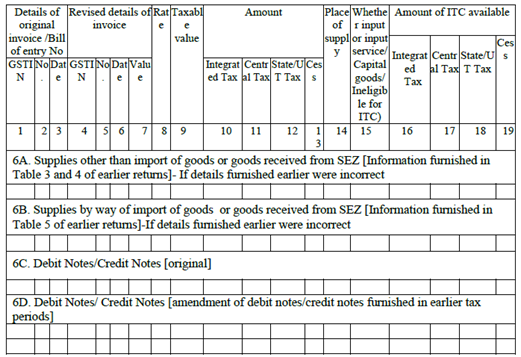

A taxpayer cannot change the details once entered. The changes can be made in the next month’s GSTR 2 form. The taxpayer can amend the details of the earlier month. The information can be filled in manually. The seller needs to accept it.

6A: Revisions of all input goods and services. (except imports)

6B: Changes in the amount calculated in imported goods and services from SEZ can be made. In this head, the taxpayer must mention the changes made in the Bill of entry or import report.

6C: The taxpayer must report all debit and credit notes. Any debit/credit note issued under the reverse charge mechanism will get auto-populated here from counter-party GSTR-1 and other applicable returns.

6D: Any changes in debit /credit note of previous months will be reported under this heading.

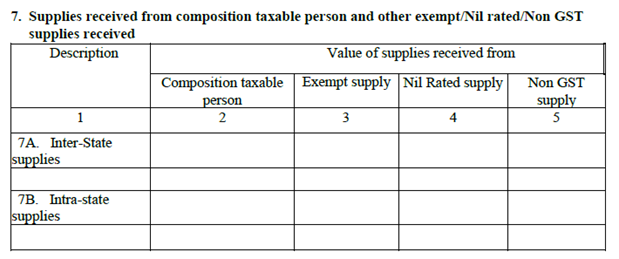

Under this head, all purchases from the composition dealer and exempt Non-GST supplies and nil-rated supplies are mentioned under here. Both inter-state and intra -state supplies should also be mentioned here.

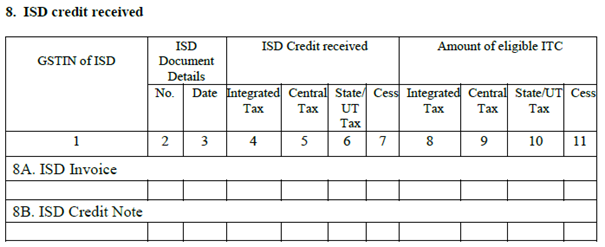

Details of the input tax credit received from a registered Input Service Distributor should be mentioned here

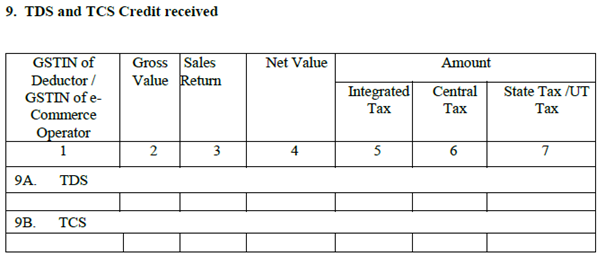

TDS Credit Received: This section is applicable to the taxpayer who is engaged with specified bodies, especially the government. In such cases, the government will deduct a certain amount of transaction value.

TCS Credit Received: This section is only applicable to online sellers who are registered with E-commerce. They should collect tax from the source at the time of money payment. This data will again be auto-populated from GSTR 8 of the GSTR operator.

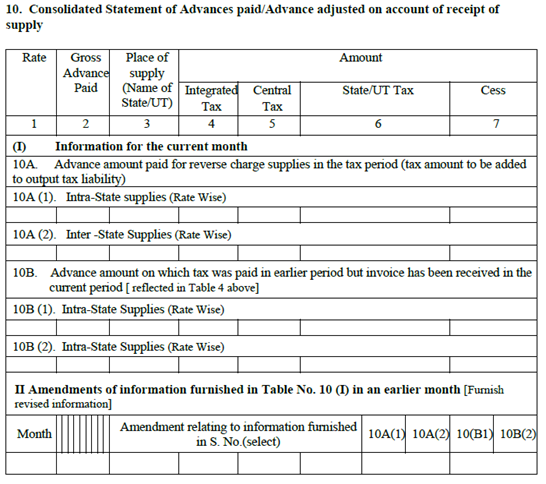

Any advance payment made during the month will appear here. If you paid advance tax on goods or services received during an earlier tax period, but only received the invoices this month, declare the details here. Advance receipts issued under reverse charge are also covered here. Part 1includes the advance amount paid for reverse charge supplies in the current month and also advances paid in earlier months against which invoices have been received in the current month. Part 2 includes changes to the above part I in relation to an earlier month.

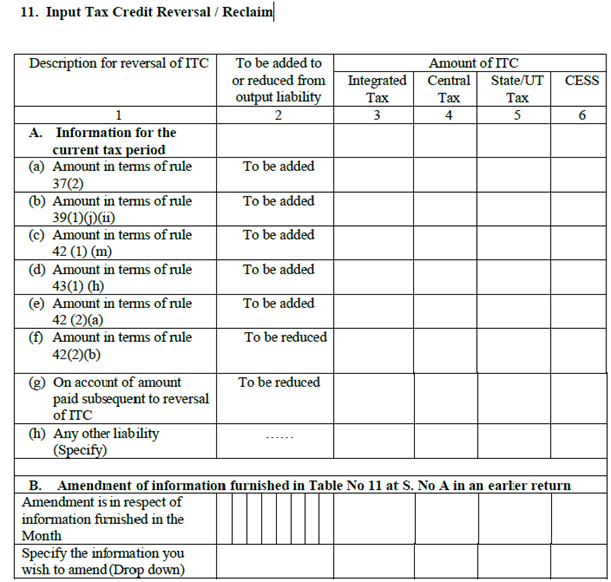

ITC can be availed only on goods and services for business purposes. If they are used for non-business (personal) purposes, or for making exempt supplies ITC cannot be claimed.

Under this head, the taxpayer should fill in details of ITC that cannot be claimed during the month due to various ITC rules. The 11A section will cover all input tax reversals for the current month. It will also include ITC reversal on account of exempt and personal supplies. In the 11B section the taxpayer can manually amend any details of ITC under 11A of earlier months.

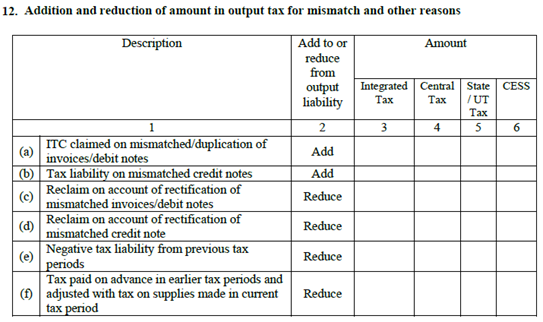

This section includes any additional charges that can arise due to the corrections made to the GSTR-3 of the previous month.

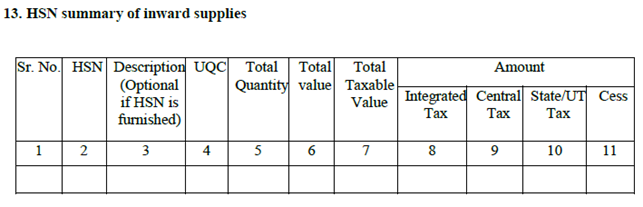

This section requires a registered person to provide a HSN-wise summary of goods purchased. It will be entered by the taxpayer.

The above-described points will give a clear-cut answer to the question of how to file GSTR 2 in the GST portal. The process of filing GSTR 2 can be done easily by following the above steps. There are types of GST returns and it includes GSTR 1, GSTR2, GSTR 3, GSTR 3B, GSTR 4 etc. These details are necessary to maintain transparency in businesses and its avoidance may lead to many liabilities and penalties.