July 09, 2021

GST CMP-01 and GST CMP-02 are the GST forms to be filed by the composition dealers to intimate the tax authorities as they opt for a composition scheme. We have already discussed the composition scheme in detail and their GST rate earlier here we would examine details regarding GST CMP-01 & GST CMP-02

GST CMP-01 is a form that is made for the migrated taxpayer who would like to choose the Composition scheme. The due date for filing GST CMP-01 is prior to the appointed date or within 30 days of the said date.

A taxpayer is needed to file GST CMP-02 form and inform the tax authorities if he wishes to opt for the composition scheme and pay composition levy during a financial year or in the middle of a financial year. In case the GST CMP-02 filed during the middle of the financial year, the scheme rules would be applicable from the month following in which the form has been filed.

For instance, if a taxpayer files GST CMP-02 on December 2020 as per the rule, the composition scheme would be applicable from January 2021 onwards.

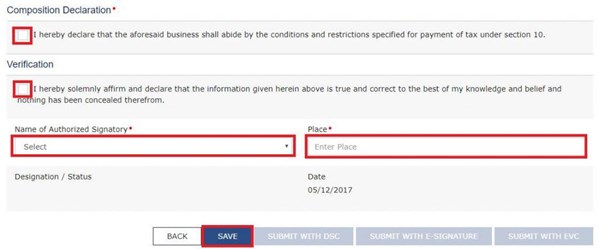

A taxpayer who wishes to opt for a Composition scheme at the starting of an FY or in the middle of an FY has to inform the authorities via GST CMP-02 form. The rules and provisions related to the composition scheme would be applicable following the month in which he has filed GST CMP-02. Moreover, In addition to the form GST CMP-02, the taxpayer is required to make a declaration with regards to the intimation of ITC reversal or tax payment on inputs held as stock, input contained in semi-finished and finished goods in stock, and capital goods within 90 days of commencement of the relevant FY.

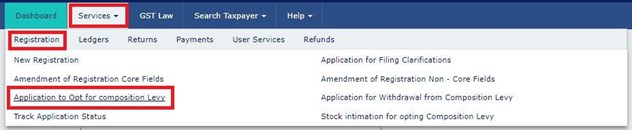

A taxpayer who wishes to choose for composite GST scheme needs to file the intimation with the authority in a prescribed manner in form GST CMP-02. The due date for the GST CMP-02 for the upcoming FY 2021-22 is 31st March 2021.

Note:

GST CMP-08 Form was introduced in April 2019 to simplify the compliance process for composition dealers. It replaced the erstwhile quarterly GST-4 filed by composition dealers and make applicable from FY 2019-20 onwards.

GST CMP-08 is a special statement cum challan form for composition dealers to declare the details or summary of their self-assessed tax to be paid for a given quarter. Besides, it acts as a challan to make payment for tax.

Read More: