July 15, 2021

GST CMP-08 Form was introduced in April 2019 to simplify the compliance process for composition dealers. It replaced the erstwhile quarterly GST-4 filed by composition dealers and made applicable from FY 2019-20 onwards.

GST CMP-08 is a special statement cum challan form for composition dealers to declare the details or summary of their self-assessed tax to be paid for a given quarter. Besides, the CMP-08 form acts as a challan to make payment for tax.

A registered taxpayer selected for the composition scheme should file CMP-08 for depositing payments every quarter. Two kinds of taxpayers register by means of CMP-02 (opt under Composition scheme)

CMP-08 form has to be filed on a quarterly basis on or before the 18th of the month following the quarter of any particular FY.

If the CMP-08 due date is over, the taxpayer would be liable to pay a late fee of Rs 200 per day for the delay. Rs 100 per day each for CGST and SGST.IGST act says that an amount is the same as the late fee for CGST and SGST act that is Rs 200 per day for the delay. The maximum penalty for the late fee would be up to 5000 from the beginning of the due date to the actual filing date of the taxpayer. Along with the late fee. The taxpayer should pay an interest of 18% per annum if he does not pay before the due date. Interest is calculated based on the amount to be paid by the taxpayer. Besides, unless CMP-08 is not filed for two consecutive quarters, the e-way bill generation would be blocked. In order to unblock, the taxpayer is required to apply to the tax official under the jurisdiction in Form GST EWB 05. They are also needed to file all remaining forms for previous quarters. If there is no transaction in the period, then the taxpayer has to file a NIL return for a CMP-08 late fee waiver.

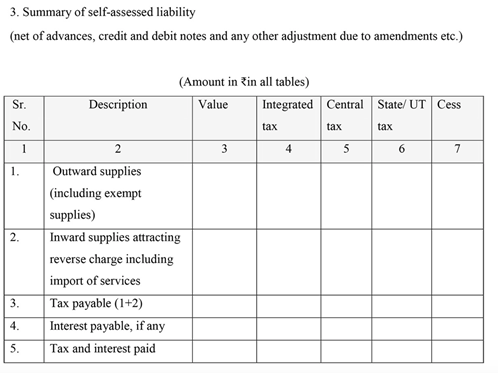

A registered taxpayer is needed to file the following details for filing the form CMP-08. Let us see how to file CMP-08 through the following steps.

A thing has to be noted that a taxpayer could file ‘NIL return' in case the tax liability is zero for a given quarter. A NIL CMP-08 could be filed via SMS.

Let us see how to file CMP-08 in GST portal through steps in detail.

Provide the summary figures of the value of supplies and tax to be paid for three months. If any delay in submission of CMP-08 after the applicable due date, enter the interest amount. Tick the checkbox in ‘File Nil GST CMP-08’ in the following cases:

Then click on ‘SAVE’ to saving the given details.

A taxpayer could make payment either via cash balance remaining in the electronic cash ledger or use the ‘create challan’ option for selecting either the Net banking or NEFT if there is no adequate cash in the cash ledger. Confirm the details through the declaration statement by ticking it. Then, submit the CMP-08 form by means of electronic verification code (EVC) or digital signature (DSC). You could confirm the message after filing CMP-08. Then GSTIN generates an ARN on the successful filing of CMP-08. An SMS and an email would be sent to the taxpayer on his registered mobile number and email id.

Read More: