GSTR 3 Form - Details to Know

GSTR 3 is a monthly return document, which compiles the transactions regarding the sales, purchases, interstate movement of a stock, and GST liability during a month. It is auto-generated information based on the information from GSTR 1 and GSTR 2.

Let us see the GSTR 3 format and look into ‘how to file GSTR 3’ in detail. Following explanation in detail furnish you the details to be provided for GSTR 3 in gstr 3 format.

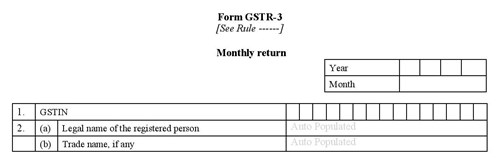

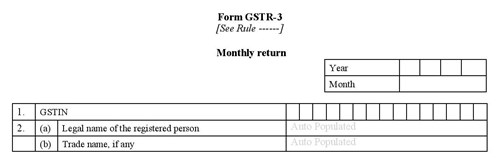

The first part of the GSTR 3 form asks for the year and month for which GSTR3 is filed.

1. GSTIN

Goods and Services Taxpayer Identification Number (GSTIN) is a 15 digit unique number that you may use for filing GSTR 3 form.

2. Name of the Taxpayer

There should have registered taxpayers’ legal names and trade names ( which would be auto-populated ).

Two parts are there: Part A is autogenerated from GSTR 1, GSTR 1A & GSTR 2 and part B is about to be filled up manually.

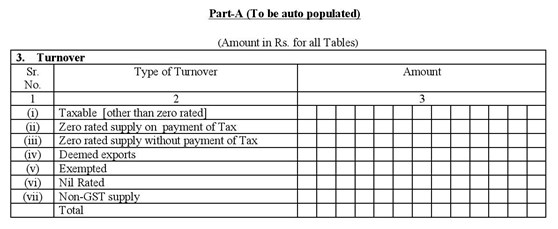

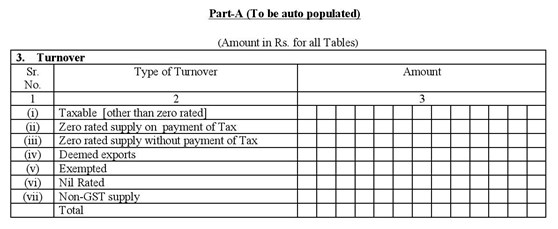

Part A ( Auto Populated)

3. Turnover Supply Details

It contains the details of all types of turnover of the supplies.

Total turnover distribution would like this:

Total turnover distribution would like this:

- Taxable Turnover: Taxable turnover includes the normal sales, registered and unregistered buyers. It excludes the turnover of zero-rated items.

- Zero-rated supply on Payment of Tax : This will include exports which are paid by paying IGST (later reclaimed as a refund)

- Zero-rated supply without Payment of Tax: this refers to exports made along with a LUT aka Letter of Undertaking which gives an exporter the ability to sell goods overseas/to SEZ units without charging GST

- Deemed Exports: These are items sold to SEZ (the goods do not actually leave the country)

- Exempted Supplies: These are goods that are not liable for GST.

- Nil Rated Supplies: Goods and services without liability of 0% GST.

- Non-GST Supplies: Some items like petrol and diesel which is out of the purview of GST and may attract local taxes like VAT.

4. Outward Supplies

It would furnish a summary of your sales during the month. The data would be drawn from your GSTR 1.

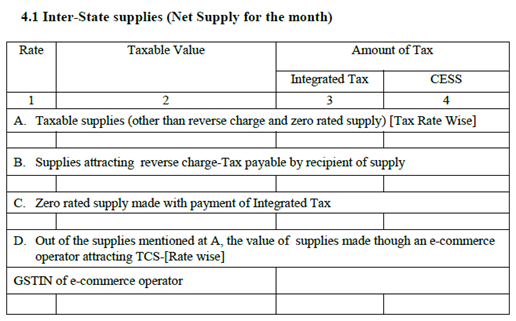

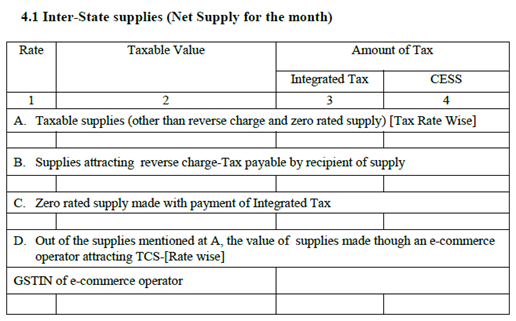

4.1 Inter-State Supplies

It includes the interstate sales with the following details:

- Taxable supplies ( excluding reverse charge & zero-rated supply ): All sales excluding the reverse charge applied sales and exports.

- Supplies attracting reverse charge-tax payable by the recipient of supply: These are sales on which your buyer will pay GST under reverse charge

- Zero-rated supply made with payment of IGST: Taxes for the exports paid as IGST and refund could be reclaimed late.

- Out of the supplies mentioned at A, the value of supplies made through an e-commerce operator attracting TCS-[Rate wise]: This will contain the portion of sales made through e-commerce (point A has the total sales including e-commerce sales). GSTIN of the e-commerce operator will also be displayed.

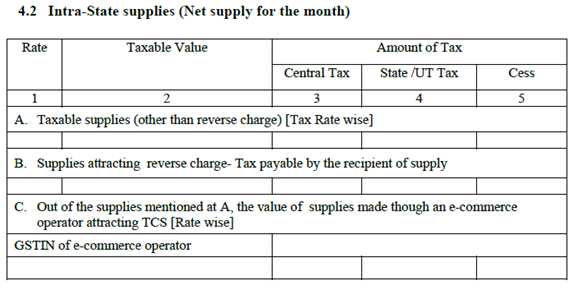

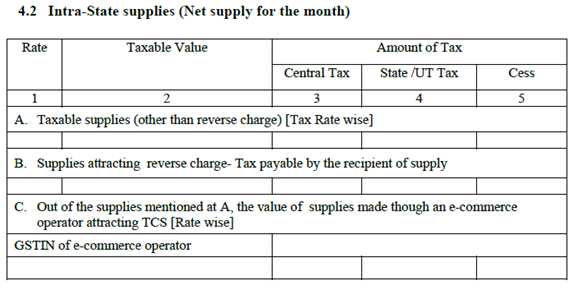

4.2 Intra State Supplies

Net supplies for the month, taxable supplies within the state which could be either with the reverse charge or no reverse charge and sales via an e-commerce platform.

4.3 Tax Effect of Amendments made in respect of Outward Supplies.

Tax liability changes regarding your sales invoice would be entered here for GST3 filing. The tax payable to the government would also be determined by the amount of ITC. Excessive or underpayment could be evident. In brief, This section helps you to track the changes made and their impact.

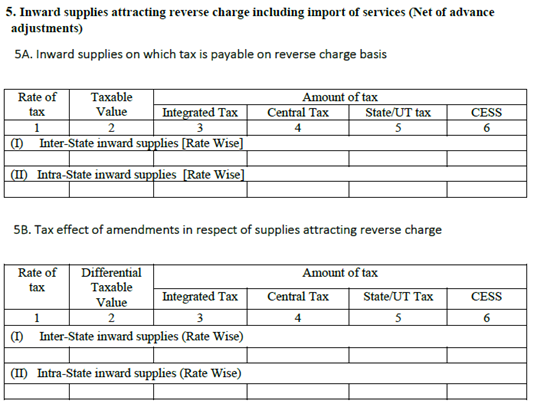

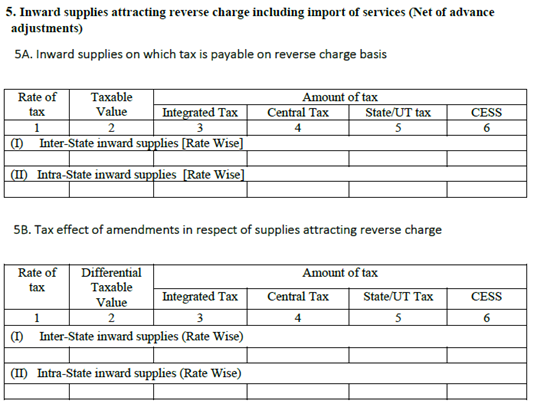

5. Inward Supplies attracting reverse charge including import of services. (Net of advance adjustments)

It contains the purchase and the supplies received in the course of a month. The information would be drawn from the data of GSTR 2.

5.A Inward supply on which tax is payable on a reverse charge basis.

It is both for interstate and intrastate sales. It included the purchases where the reverse charge is applicable. Liability owing to reverse charge is net of debit, credit note, advance payments, invoices, and advances adjustment.

5B. Tax effect of amendments with respect to supplies with reverse charge.

This will contain the changes made to your purchases which attract a reverse charge. If the amount is changed, the amount of ITC also changes which changes the tax payable. It may result in excess or under payment. The information under this heading helps to keep track of invoices on which changes have been made and the impact of the change on the tax amount.

You could claim the credit by the government for the tax you paid on inward taxable supplies including imports soon after you get the invoice for the purchase from the vendor.

- This credit could be used to pay your sales tax.

- The following table shows all details of your ITC including those from ISD

- It also shows the whole details of all debit and credit notes received during the present tax period.

- ITC would also show separately for Inputs ( raw materials ), input services ( consulting fees), and capital goods like laptops.

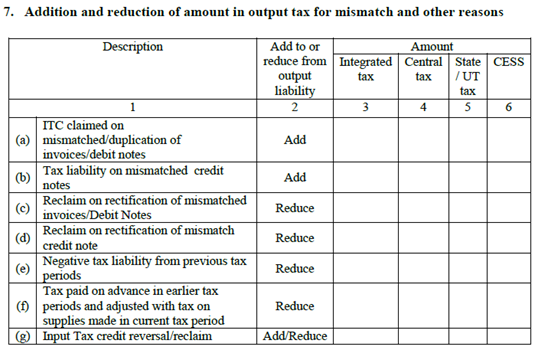

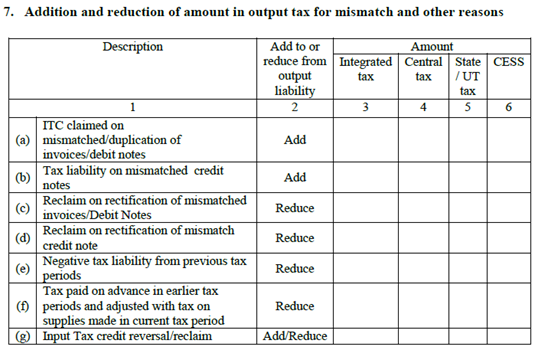

7. Addition and Reduction of the amount in Output Tax for mismatch and other reasons

This section deals with the mismatches of ITC and tax liability between the returns and changes added to it during a month. Like in other cases, the information required for the GSTR 3 format would be drawn from GSTR2.

- ITC claimed on mismatched or duplication of invoices or debit notes: If a mismatch appears on the invoice, there would be a double claiming for ITC. That double-claimed, excessive ITC from the mismatched invoice would be reversed and added to the tax liability.

- Tax liability on mismatch credit notes: Issuing of incorrect credit notes would definitely result in incongruent ITC. That extra ITC claimed also would be added to your tax liability.

- Reclaim on rectification of mismatched invoices/debit notes: It is quite contrary to the above-mentioned scenario (a). Here the mismatch resulted in lowering ITC claim. You are entitled to more ITC and so the additional amount will be reduced from the output tax liability.

- Reclaim on rectification of mismatch credit note: It is again contrary to (b). Lower ITC has been claimed and works as (c).

- Negative tax periods from previous tax periods: It is the result of excessive tax payment in the previous months and a reduction is likely for output tax liability during this month.

- Tax paid in advance in earlier tax periods and adjusted with a tax on supplies made in the current tax period: It mentions the tax paid with advance payments received during this month.

- Input tax credit reversal/reclaim: It refers to the reversed ITC or reclaimed owing to some other reason.

8. Total Tax Liability

After furnishing the details of sales and purchases in a month a per GSTR 3 format, GSTIN would assess the tax you are supposed to pay for the month under CGST, SGST, and IGST and that data would be shown here.

- 8A. On outward supplies: This is the tax payable on your normal sales including inter-state sales.

- 8B. On inward supplies under reverse charge: This is the tax payable on purchases attracting reverse charge.

- 8C. On account of ITC reversal or reclaim: This is the additional tax payable/or reduction available due to ITC reversal or reclaim. The information flows from Table 11 of GSTR-2.

- 8D. On account of mismatch/ rectification /other reasons: This will include tax liability due to any other reason.

9. TDS & TCS Credits

It contains the details of TDS and TCS payments. TDS and TCS payments would be deducted from the total liability to calculate the amount you pay for GSTR 3 filing.

- The credit of TDS during a month: It is drawn from the GSTR 2 and the GSTR 7 which provides all transaction details of TDS.

- The credit of TCS during a month: Here this data is listed here particularly for eCommerce operators. It is sourced from the GSTR 2 and GSTR 8 filed by e-commerce operators.

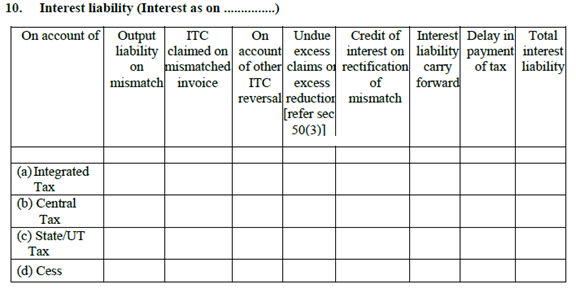

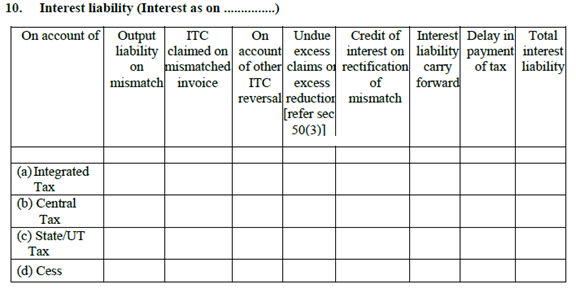

10. Interest Liability

Interest is applicable on the delay of payment. Interest is 18% per annum. It has to be calculated by the taxpayer on the amount of outstanding tax to be paid. The time period will be from the next day of filing (20th of the month) to the date of payment. This heading shows the reason and the amount of interest applicable. Breakup into CGST, SGST, IGST & Cess will be given.

- Output Liability on mismatch: Your tax liability has increased due to a change in sales invoice and you must pay interest on the increased amount

- ITC claimed on mismatch invoice: Your tax liability has increased due to a change in purchase invoice and ITC was claimed on such invoice. You must pay interest on the increased amount.

- On account of other ITC reversals: Your ITC claimed was reversed which has increased your tax liability and so interest is payable.

- Undue excess claims or excess reduction [refer sec 50(3)]: You have claimed extra ITC and now you are required to pay interest

- The credit of interest on rectification of mismatch: You had paid interest on mismatch and now the interest is reversed or credited back.

- Interest liability carries forward: You had an interest liability which you have paid partly. The balance amount will be carried forward.

- Delay in payment of tax: This is due to late payment/ late filing of return.

- Total interest liability: Finally, it will show the total interest payable under CGST, SGST & IGST.

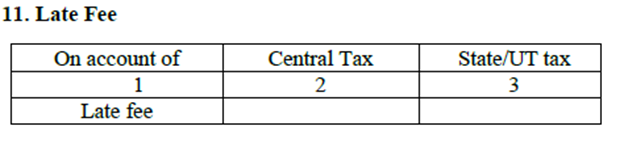

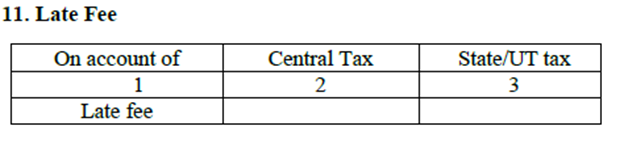

11. Late Fee

A late fee is also applicable for the payment of interest or GSTR 3 due date. The late fee is 100 Rs per day and the maximum is 5000. It is to be borne in mind that no late fee for IGST.

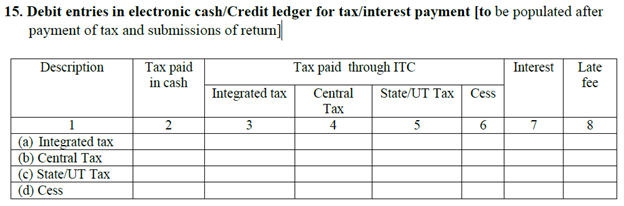

PART B ( It is filled up manually by the taxpayer)

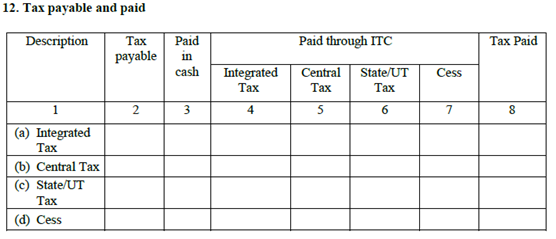

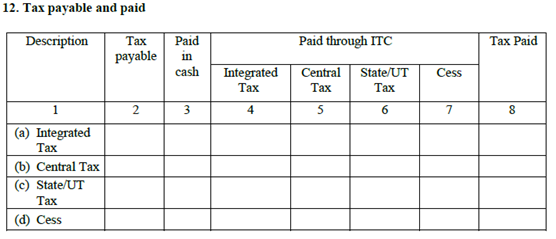

12. Tax Payable and Paid

Fill the appropriate amount in the appropriate columns. For instance , If the tax liability is 60000 and ITC of Rs 20000, you could pay 40000 in cash ( fill col 3) and Rs 20000 via ITC ( fill col under 4,5,6 as per ITC claim rules)

13. Interest, Late fee, and any other Amount Payable and Paid

The penalties are there on the taxpayers who fail to comply with the GST tax regime and which are separated by the types of GST returns and tax heads too. It is applicable only if you fail to comply with the GSTR3 format too.

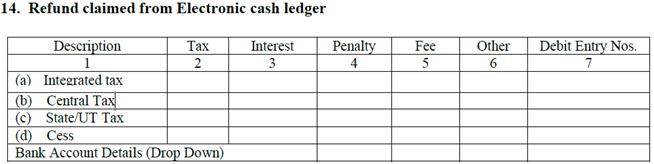

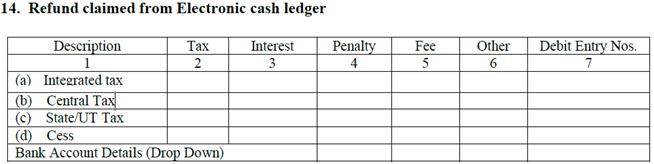

14. Refunds Claimed from Cash Ledger

If you pay excess tax, you would be refunded.

- Refunds could be claimed only after you clear the liabilities during the month.

- Refund claimed table 14 would result in a debit entry in cash ledger for GSTR3 filing on a valid basis.

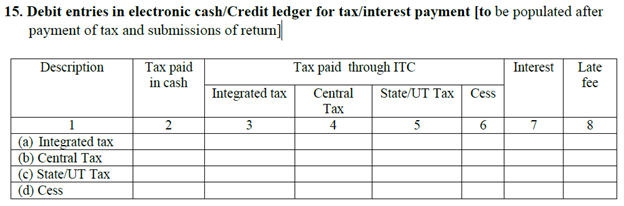

It would automatically be filled once you pay taxes and submit returns.

Before filing GST 3 return, authenticate it either through Digital Signature Certificate (DSC) or by using an Aadhaar based signature verification system.

Finally, you have to authenticate and sign off with a declaration that all the information provided here is correct. Add Final Sign-in details also.

Read More

What is GST Return?

Total turnover distribution would like this:

Total turnover distribution would like this: