February 03, 2021

What is GSTR 1 is a common question for all tax payers. It is a return where details of all sales are filed with the government. GSTR 1 of a particular month should be filed on or before 10th day of the immediately succeeding month.

GSTR 1 needs to be filed even if there is no business activity. If the GSTR 1 is not registered properly it will impact on the trustworthiness of one’s business. The person should properly file GSTR 1 and its avoidance may lead to many future complexities.

GSTR 1 is a statement in which every dealer should capture all sales transactions in every month. The GSTR 1 format requires all the outward supplies made by the businesses.

Following are the details to be provided in GSTR 1

Step 1: Provide GSTIN

Step 2: Legal name of the registered person: Name of the taxpayer will be auto-populated at the time of logging into the common GST Portal.

Step 3: Aggregate Turnover in the preceding Financial Year: Aggregate Turnover is the total value of all taxable supplies made exempt supplies, exports of goods or services or both.

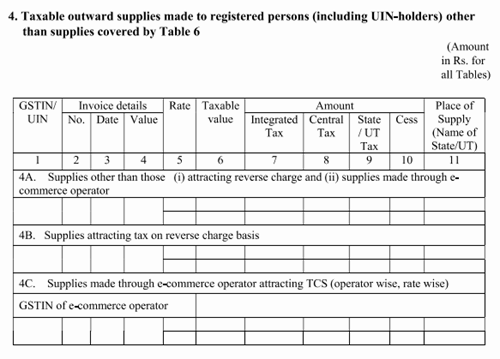

Step 4: Taxable outward supplies made to registered persons: All B2B supplies should be mentioned in this section.

4A. In this section, invoice wise details of all supplies other than those under reverse charge and supplies made through e-commerce operator should be mentioned.

4B. All outward supplies on which reverse charge is applicable and which has been excluded in 4A should be shown here

4C. Supplies made through e-commerce operator which attract TCS has to be reported here.

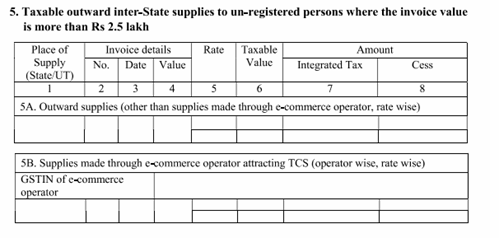

Step 5: Taxable outward inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 lakh should be mentioned here.

Invoice wise details of all supplies made to unregistered dealers is to be mentioned here:

5A. This will include sale to the unregistered dealer

5B. The details of supplies made online through e-commerce operator

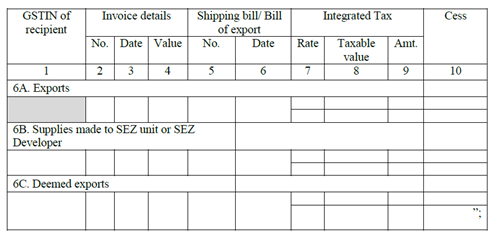

Step 6: Zero-rated supplies and deemed exports:

All type of zero-rated supplies, exports, deemed exports has to be mentioned under this head.

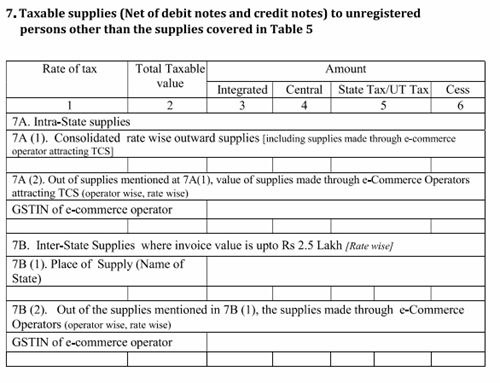

Step 7: This section contains a rate wise summary of all sales made during the month.

7A. All sales including sales made through e-commerce operators have to be mentioned here.

7B. B2C interstate supply along with the place of supply where invoice value is up to Rs 2.5 lakhs should be specified here

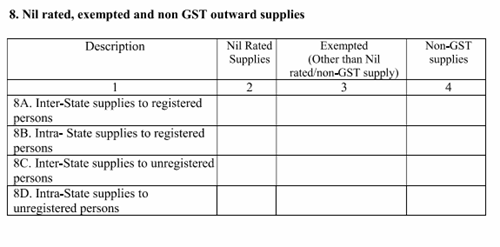

Step 8: Nil-rated, exempt and non-GST outward supplies

All the other supplies whether nil rated needs to be reported under this head.

All the other supplies whether nil rated needs to be reported under this head.

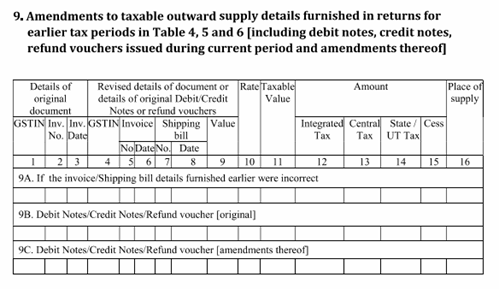

Step 9: Corrections to data submitted in GSTR 1 of previous months can be done by filling in this section. All debit notes, credit notes and refund voucher should also be entered here.

The following details cannot be amended here:

These details must match with the details of the linked invoice.

No Amendment can be made with respect to those invoices that are accepted or modified by the receiver of goods. The reason is that those invoices will automatically get reflected in the GSTR-1 of the supplier in the month of such acceptance under the relevant amendments table.

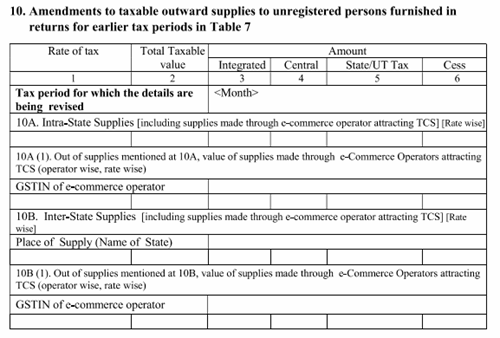

Step 10: The following details cannot be amended here

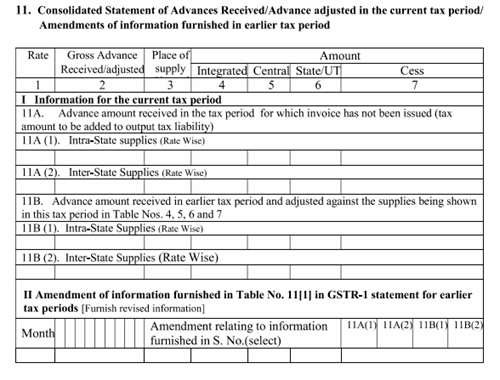

Step 11: In this table, mentions all advances received in the month for which the invoice was not raised.

Step 12: This section requires a registered dealer to provide HSN wise summary of goods sold.

Step 12: This section requires a registered dealer to provide HSN wise summary of goods sold.

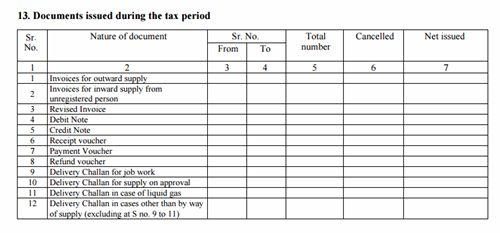

Step 13: Documents issued during the tax period: Details of all invoices issued in a tax period, any kind of revised invoice, debit notes, credit notes should be included here.

The format of GSTR 1 consists of a variety of information such as the taxpayer's sales and outward supplies. The GSTR-1 filing form consists of 13 tables in which the details of the supplies is needed to be filled by the person who runs the business. The GSTR 1 form filing is a mandatory return form under GST.

|

Tables in GSTR 1 |

Details |

|

Table 1, 2 & 3 |

Details of GSTIN, legal and trade names and aggregate turnover in the previous year. |

|

Table 4 |

Taxable outward supplies made to registered persons (including UIN-holders) avoiding zero-rated supplies and deemed exports |

|

Table 5 |

Taxable outward inter-State supplies to un-registered persons where the invoice value is more than INR 2.5 Lakh |

|

Table 6 |

Details of zero rate supplies and deemed exports |

|

Table 7 |

Details of taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies covered in table 5. |

|

Table 8 |

Details of nil rated, exempted and non-GST outward supplies. |

|

Table 9 |

Details of debit notes, credit notes, refund vouchers issued during the current period and any amendments to taxable outward supply details furnished in the GSTR-1 returns for earlier tax periods in table 4, 5 & 6.

|

|

Table 10 |

Details of debit note and credit note issued to unregistered person.

|

|

Table 11 |

Details of advances received/advance adjusted in the current tax period or amendments of information furnished in the earlier tax period. |

|

Table 12 |

HSN wise summary of outward supplies |

|

Table 13 |

Documents issued during the tax period. |

All registered individuals, traders, organizations, and companies should provide details of their sales and purchases of the goods and services plus the tax paid and collected in GSTR return filing. A registered user has to submit 4 forms to file their GST return, which are; return for purchases, return for sale/supplies, monthly return, and annual return.

In short we can conclude that GSTR 1 filing is important to maintain the trustworthiness of an organization. Its avoidance may lead to future perplexities.