GSTR 8 Format - Details to Know

GSTR 8 is a GST return that is to be filed by the e-commerce operator who needs to deduct TCS (Tax Collected at Source) under GST. GSTR 8 includes the supply details done through the eCommerce platform by both registered and unregistered persons, customer’s basic information, and TCS amount collected on such supplies.

How to file GSTR 8 Returns?

GSTR 8 collects some details from eCommerce operators. Let us examine it in detail:

- Give GSTIN (Provisional id could also be used as GSTIN unless you have a GSTIN )

- The legal name of the registered taxpayer: The name of the taxpayer would be auto-populated at the time of logging into the common GST portal.

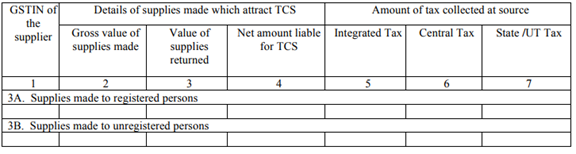

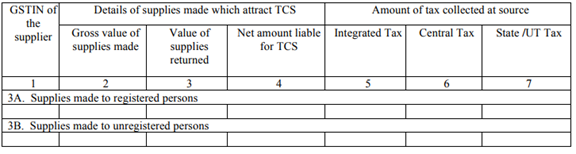

- Details of supplies made through e-commerce operators: Furnish the gross value of supplies made to registered and unregistered persons and the value of supplies returned by that registered and unregistered persons. The difference between the supplies returned would be the net amount liable for TCS.

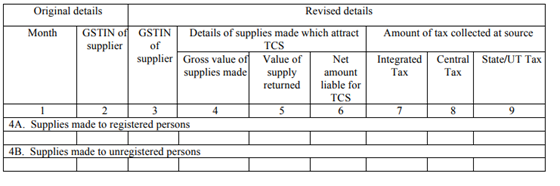

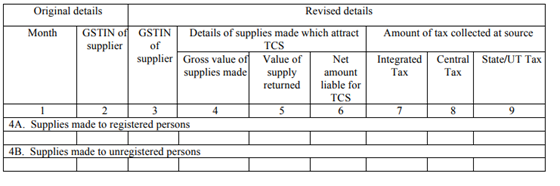

- Amendments to the details of supplies with regards to an earlier statement: Any modification to data submitted in the return of earlier months could be done by filing under the section.

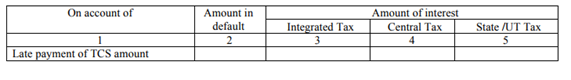

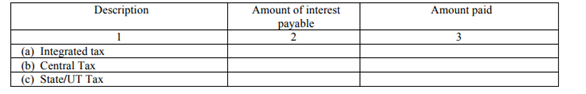

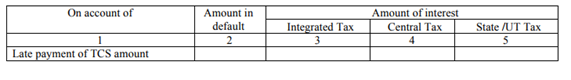

- Details of interest: In case the TCS amount is not paid by the e-commerce operator, then interest is imposed on account of the late payment of the TCS amount.

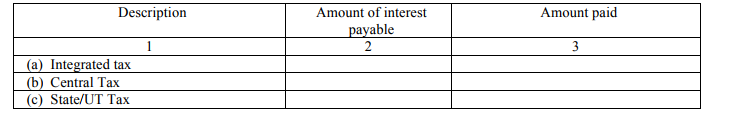

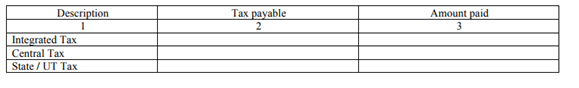

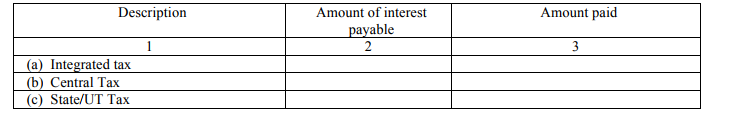

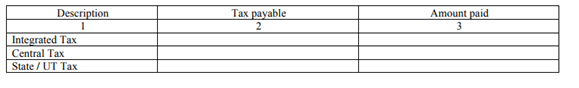

- Tax payable and paid : This section includes the total amount of tax payable under each section of SGST, CGST, and IGST and how much tax has been paid until the date.

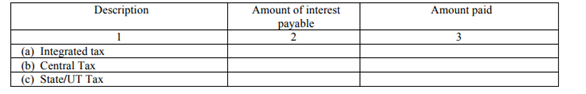

- Interest payable and paid : 18% interest is levied for the delayed payment of GST. The interest is assessed on the outstanding tax amount

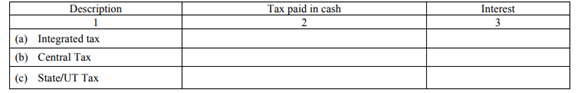

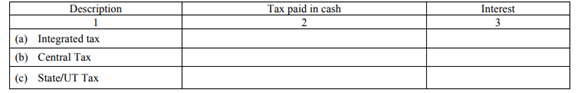

- Refund from electronic cash ledger : Refunds from the electronic cash ledger could only be claimed as all the TCS liability for the tax period has been cleared

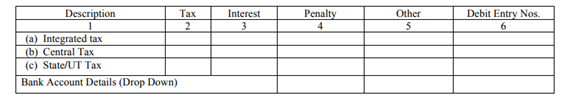

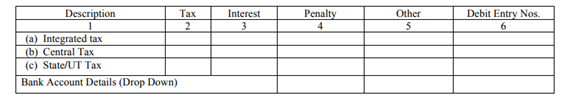

- Debit entries in cash ledger/payment of interest (to be populated after the tax payment and return submission): The tax amount collected at the source would flow to part C GSTR 2A of the taxpayer on the filing of GSTR 8.

Finally, you are required to digitally sign the declaration to authenticate that the given details are genuine and true at the end. This could be done by either using a DSC or Aadhaar based verification system.