Bank reconciliation in Accoxi

Bank reconciliation is the process by which the bank account balance in an entity’s books of account is reconciled to the balance reported by the financial institution in the most recent bank statement. Any difference between the two figures needs to be examined and, if appropriate, rectified. Accoxi provides a Reconciliation system and it helps the user to ascertain the differences between the passbook and company book and to book changes to the accounting records as appropriate.

This video illustrates how to do bank reconciliation in Accoxi. Reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement. The GST Accounting Software, Accoxi provides the Reconciliation system and it helps the user to ascertain the differences between the passbook and company book and to book changes to the accounting records as appropriate.

Key Features of Reconciliation

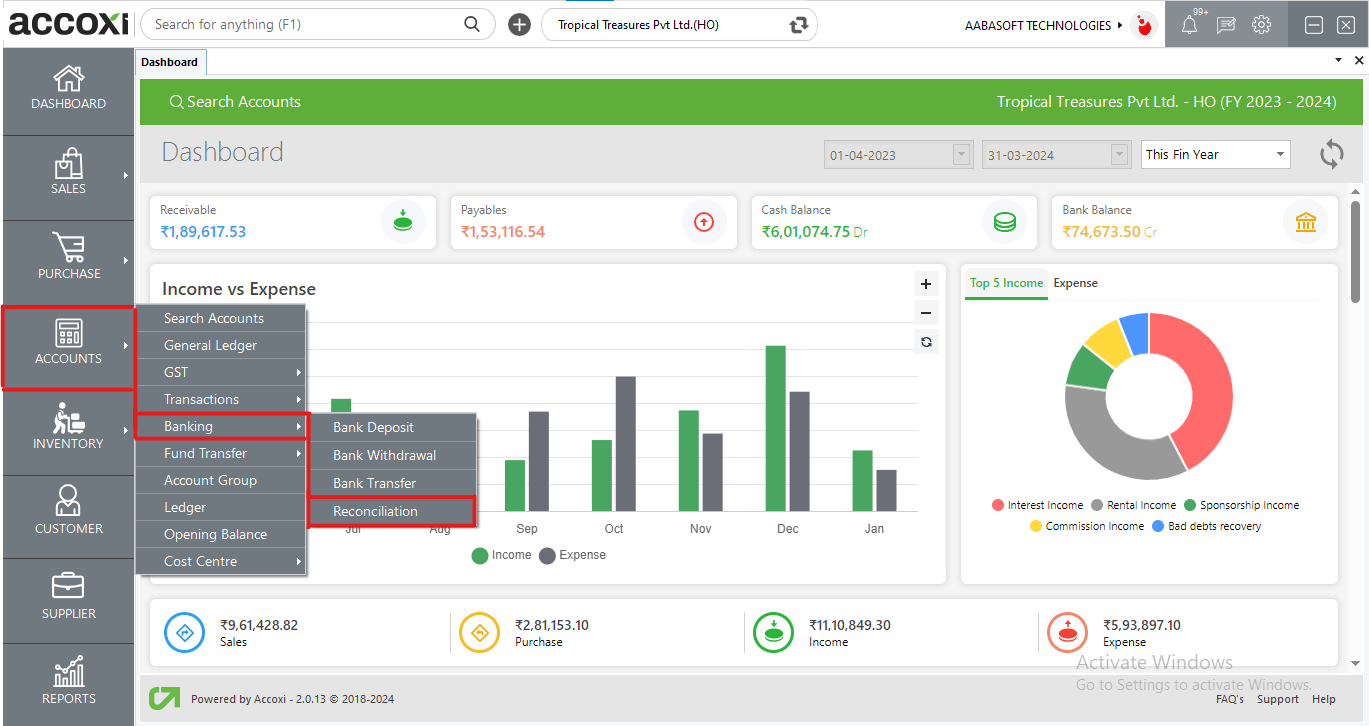

Open the Accounts module, click on Banking and select Reconciliation.

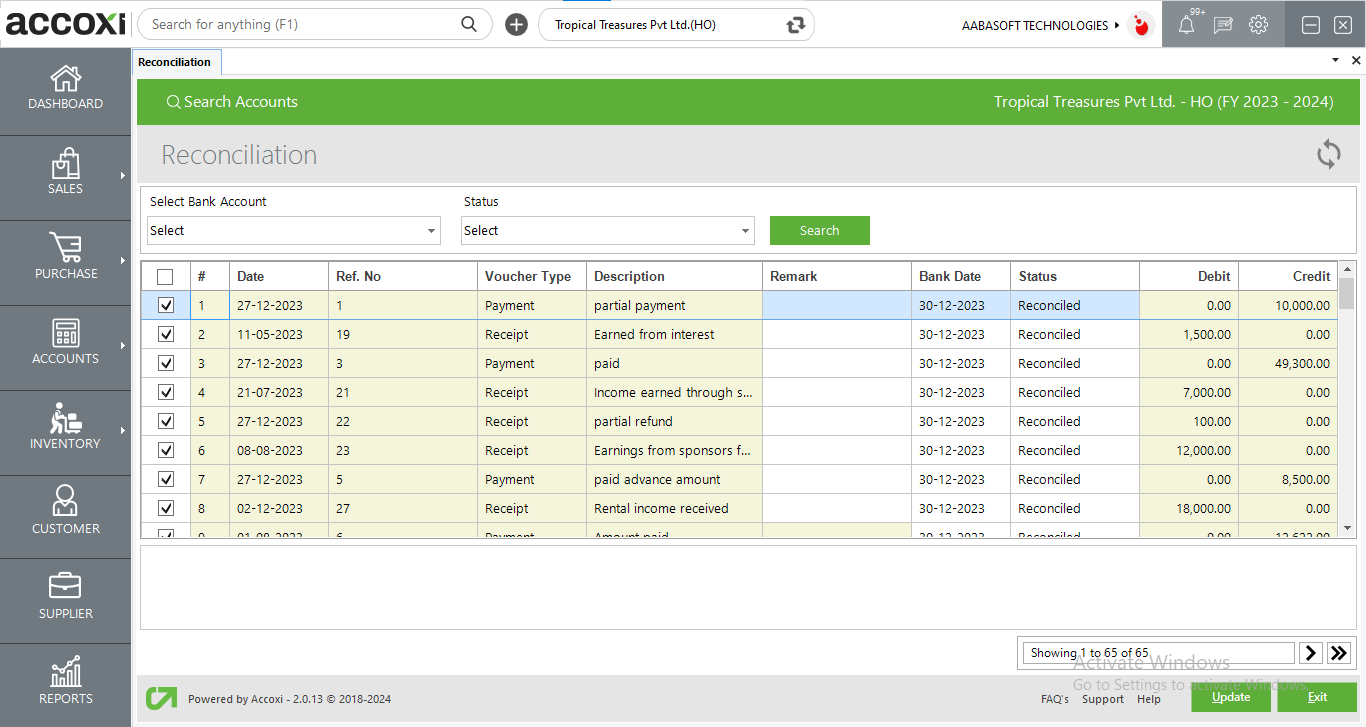

When user click on Reconciliation, Bank reconciliation page will appear on the screen.

Reconciliation

It provides complete details of multiple bank transactions. User can select the bank and can track the details of each bank.

|

Fields |

Description |

|

Bank account |

Users can select the Bank account on the Select bank account field. After selecting a bank account user gets the transaction details of the selected bank.

|

|

Status Search |

In the status menu, users can filter or arrange the transactions on the basis of the status and can search it. Status may be reconciled, not reconciled, need verification, and missing. If the user selects a status then the status of that particular transaction will appear on the screen. |

|

Date |

It shows the date of the particular transaction. |

|

Ref no |

The reference number of the transaction will automatically appear on the field. |

|

Voucher type |

Users can identify each transaction by its voucher type. It shows the exact voucher type of each transaction and it may be a receipt, payment, or contra. |

|

Description |

It shows the description of the transaction. |

|

Remark |

If the user wants to add a remark or short note about the reconciliation of a particular transaction, then it can be done with this field. |

|

Bank date |

The bank date is the date that shows on the bank passbook. While reconciling a particular transaction, the user can enter the passbook transaction date on this field. |

|

Status |

The status column shows the actual status of the bank transaction. Before reconciling a transaction, the status of that particular transaction always shows as Not reconciled. Users can set the status of each and every transaction after verifying it with a bank passbook.

Users can select status as reconciled, not reconciled, need verification, and missing. Status reconciled indicates that reconciliation completed transaction. If the user can't complete reconcile of a transaction or need verification from others, then the status can be set by Need Verification. Missing status implied that transaction was not reconciled due to missing of anything like amount, ref no, etc. |

|

Debit |

Debit balance of the transaction is showing here. |

|

Credit |

Credit balance of the transaction is showing here. |

|

Balance figure |

Users can identify the balances of amounts on the bottom right side of the page. Here user gets the details of Balance as per company books, Balance as per bank, and amount not reflected in the bank.

Balance as per Company books shows the total balance figure of the company account. After reconciliation, the difference amount (between Company books and bank books) will appear on the Amount not reflected in the Bank field. Users can identify the variation by this. Balance as per Bank shows the balance figure of passbook after reconciliation. After reconciliation, it should be the same as company books otherwise, the difference will appear on the amount not reflected in the bank. |

|

Update |

The update menu is used to update or save the data on the reconciliation page. By clicking on Update user can save the entered data and get the latest on the page. |

|

Exit |

The exit menu is for closing the page and entering the previous window. |

Reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement. ACCOXI provides Reconciliation system and it helps you to ascertain the differences between the passbook and company book and to book changes to the accounting records as appropriate. It provides complete details of multiple bank transactions. You can select the bank and can track the details of each bank.

ACCOXI provides the module of Accounts and Reconciliation included in it. In the Reconciliation, provides complete details of multiple bank transactions. In status menu, you can filter or arrange the transactions on the basis of the status and can search it. Status includes reconciled, not reconciled, need verification and missing. If you select a status then status of that particular transactions will appear on the screen.

ACCOXI provides the module of Accounts and Reconciliation included in it. In the Reconciliation, provides complete details of multiple bank transactions. It shows various data in a table and bank date column included in it. Bank date is the date that shows on bank passbook. While reconcile a particular transaction, user can enter the passbook transaction date on this field.