Using GSTR-3B in Accoxi

GSTR-3B is a self-declared summary GST return filed every month (quarterly for QRMP scheme). It must be filed by a registered taxpayer from July 2017 onwards.

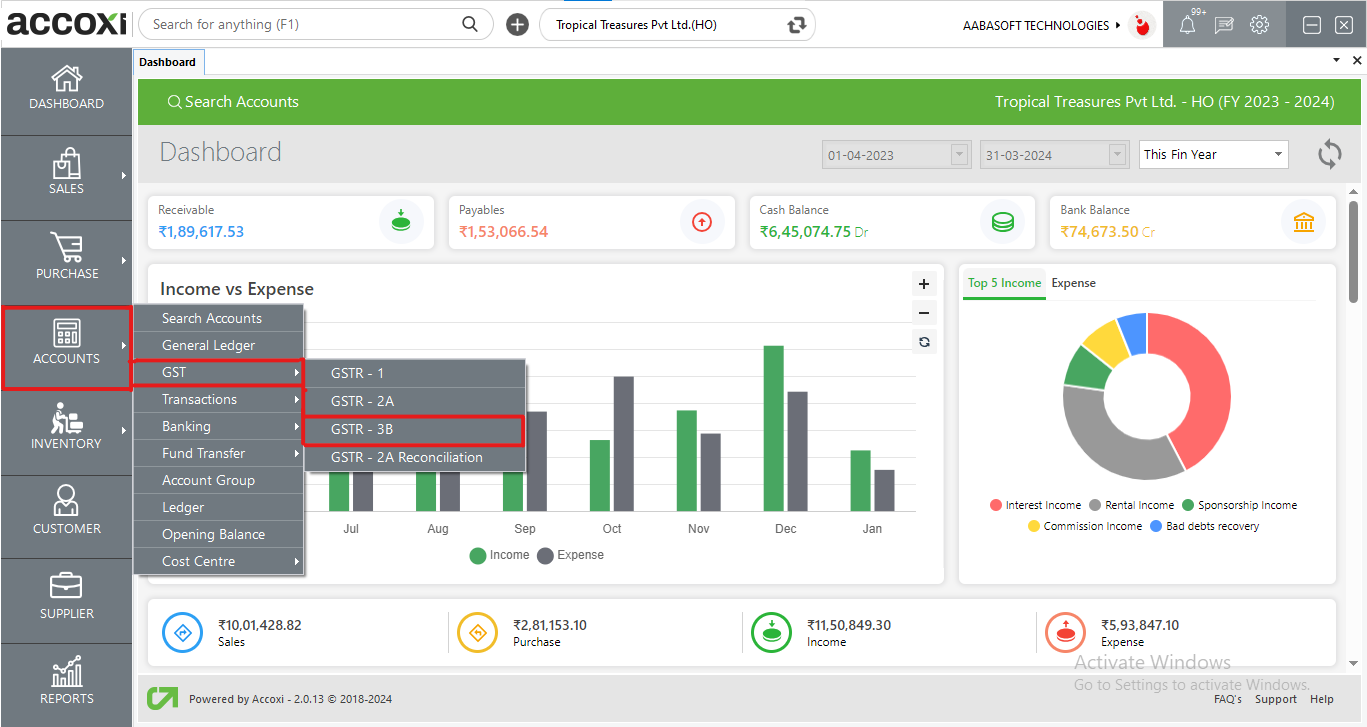

Users can access GSTR 3B data from

Accounts section -> GST -> GSTR3B

|

FIELD |

DESCRIPTION |

|

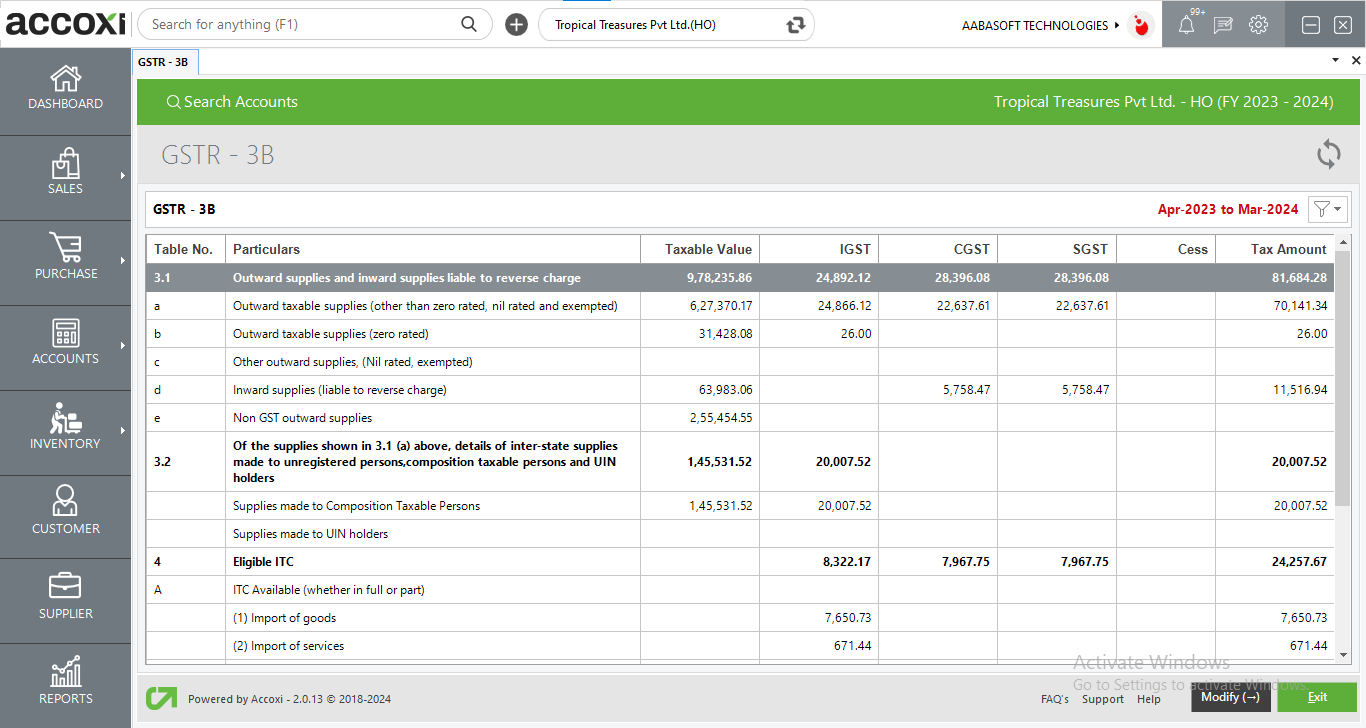

GSTR 3B |

Shows the title of the form |

|

Period |

It shows the GSTR 3B period name that the user selected using the filter option |

|

Filter Option |

|

|

Table No. |

GSTR 3B form table number shows here |

|

Particulars |

The particulars/content in each table shows here |

|

Taxable value |

Taxable value is the value on which tax is to be charged. |

|

IGST |

IGST is a tax levied on all Inter-State supplies of goods and/or services |

|

CGST |

CGST stands for Central Goods and Services Tax. It subsumes all the taxes that were earlier applicable as central indirect taxes. They are levied by the central government for the intrastate movement of goods and services. Intrastate means within one state. |

|

SGST |

SGST is one of the tax components of GST in India. SGST Act expands to State Goods and Service Tax. |

|

CESS |

SGST is one of the tax components of GST in India. SGST Act expands to State Goods and Service Tax. |

|

Tax amount |

The total tax amount shows in this field |

|

Modify |

Modify option enables the user to access the filter option. Users also can use the right arrow key to quickly access the modify option |

|

Exit |

Use this button to exit from the GSTR3B form. |

Yes