Creation of E-way bill in Accoxi

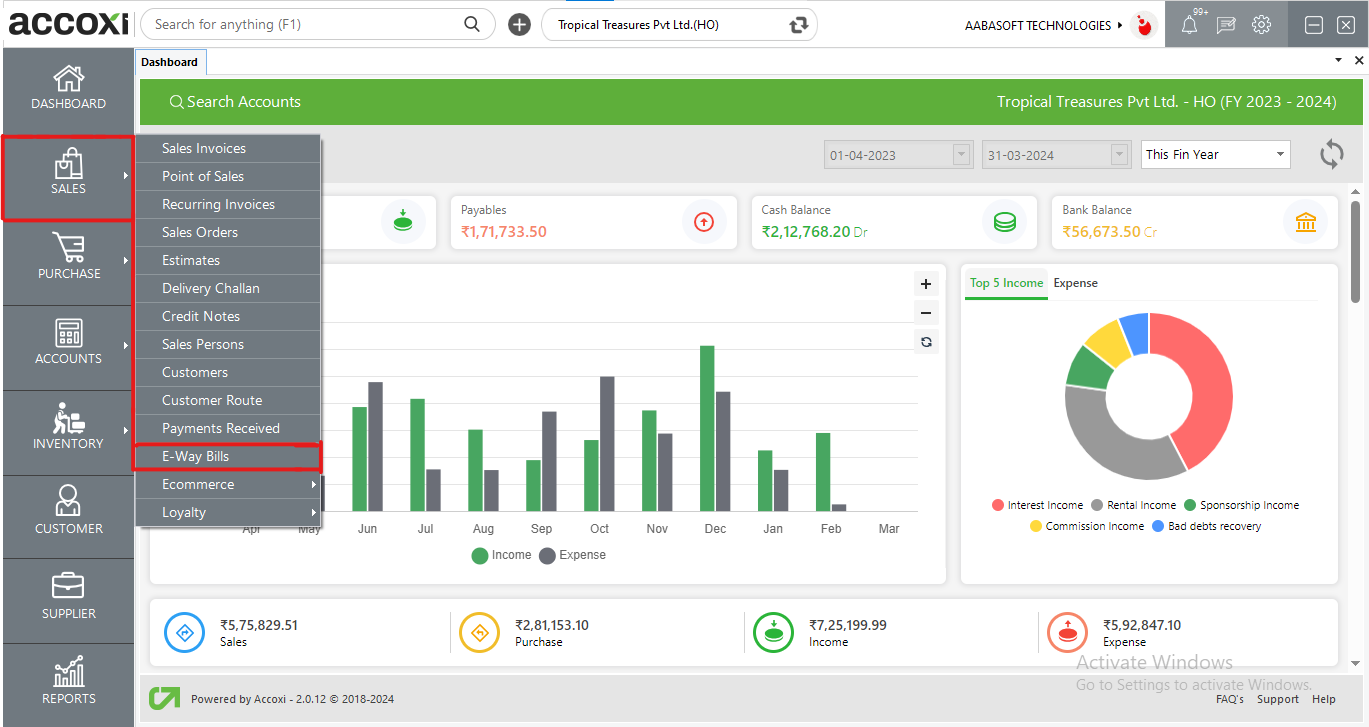

E way bill is an electronic way bill for movement of goods to be generated on the e way bill portal. A GST registered person cannot transport goods in a vehicle whose value exceeds RS. 50,000 (single invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in. Alternatively, e way bill can also be generated or cancelled through SMS, android app and by site-to-site integration through API. When an e way bill is generated, a unique e way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter. When the user creates a sales invoice more than 50000 rupees an automatic e way bill is created and it is shown in the sales module => e way bills.

E way bill is an electronic way bill for movement of goods to be generated on the e way bill portal. A GST registered person cannot transport goods in a vehicle whose value exceeds RS. 50,000 (single invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in. Alternatively, e way bill can also be generated or cancelled through SMS, android app and by site-to-site integration through API. When an e way bill is generated, a unique e way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

Key features:

|

FIELDS |

DESCRIPTION |

|

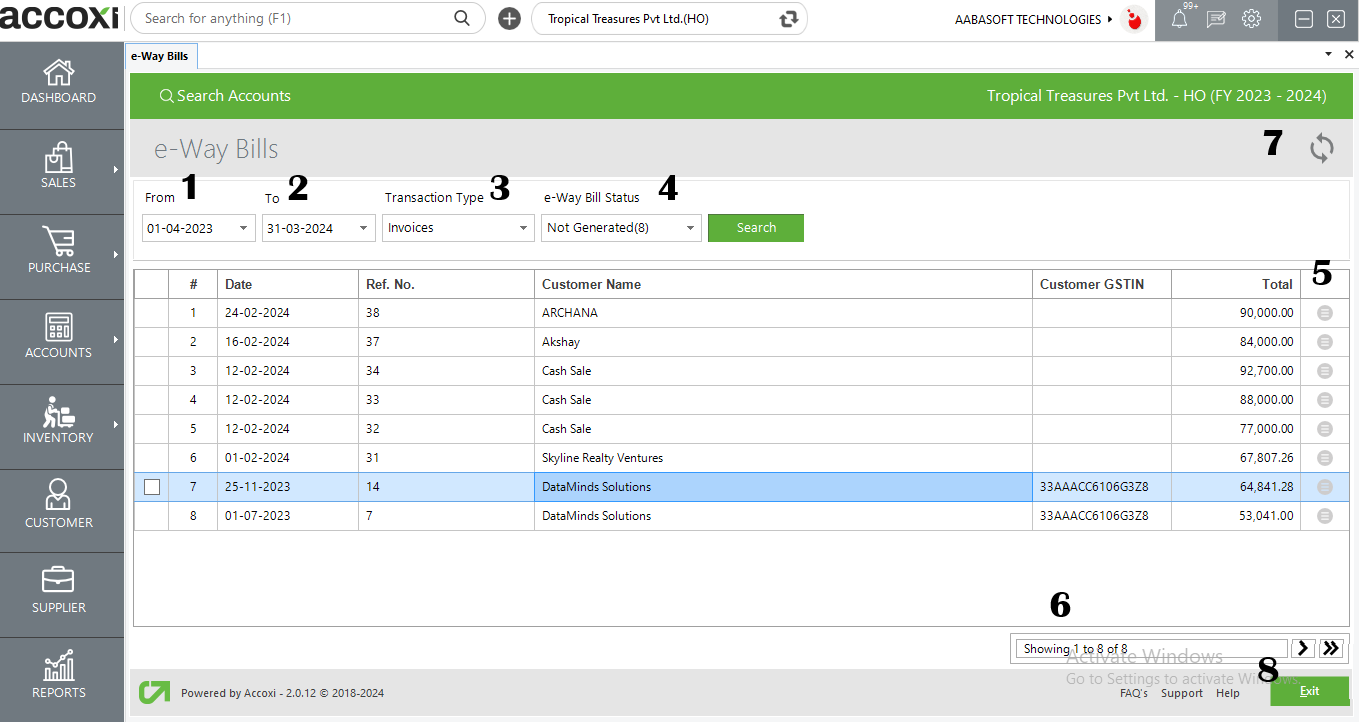

1. FROM |

To give FROM date of the e-way bill to filter data according to dates |

|

2. TO |

gives TO date of the e way bill to filter data according to dates |

|

3. TRANSACTION TYPE |

The type of transaction in which e way bills is created can be selected in here. It may be invoices or credit notes |

|

4. E WAY BILL STATUS |

E way bills can be filtered using its status it may be excluded, generated or not generated |

|

5. MORE OPTION |

1. Associate e way bill: By using this option user can associate an e way bill to a transaction by entering e way bill number and date of the bill 2. Exclude : User can exclude an e way bill added to a transaction using this option. By clicking this following validation message will pop up 3. Create e way bill User can add a new e way bill to the transaction using this option |

|

6. PAGINATION CONTROL |

It controls the page navigation and the page size. Page size can be set to 10, 20, 50 or 100. And by giving page number in the box and clicking on Go button. It jumps to the said page. |

|

7. REFRESH |

If your latest data is not displayed, click on the refresh icon on the top left corner of the page to fetch the new data. |

|

8. EXIT |

To exit the E WAY BILLS view window |

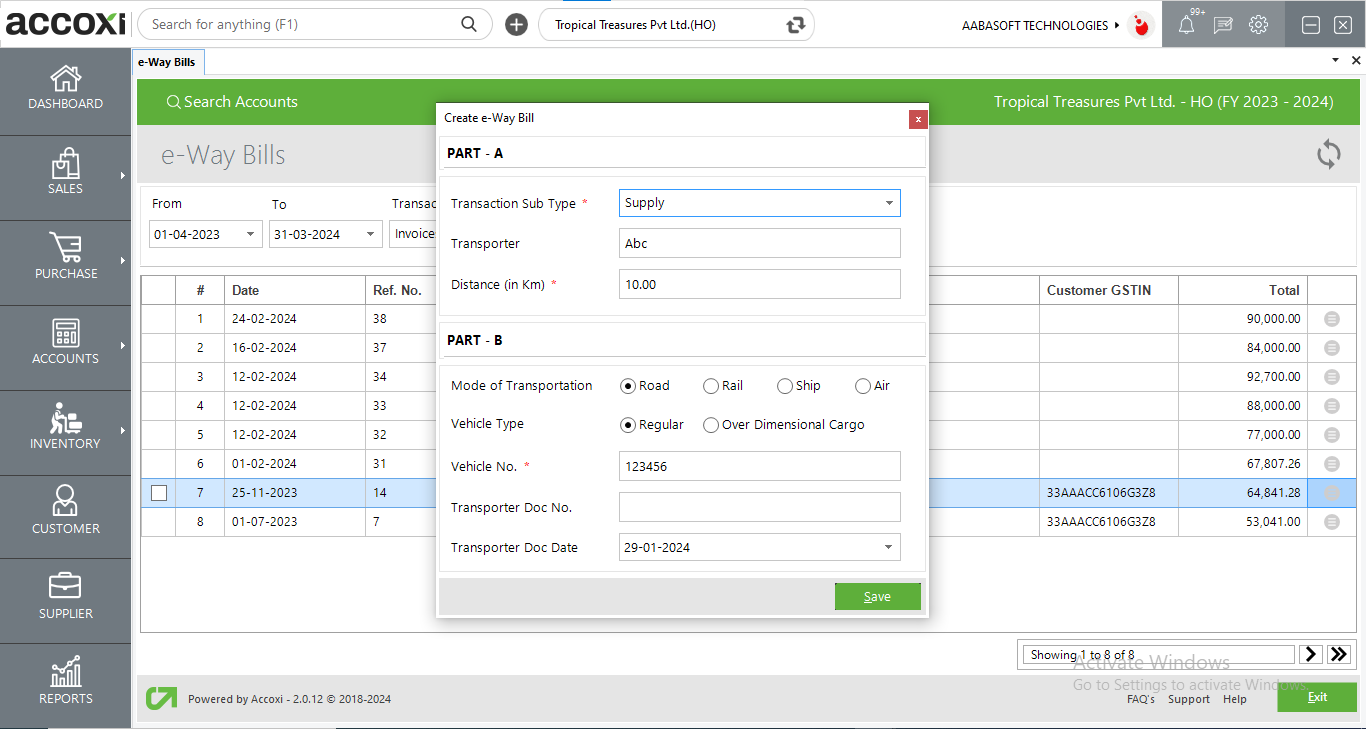

CREATE A NEW E WAY BILL:

STEPS:

|

FIELDS |

DESCRIPTION |

|

PART A Transaction subtype |

The goods type can be defined here goods may be for supply, maybe for export, or maybe semi-knocked down product or completely knocked down product. |

|

Transporter |

The transporter name can be added in the field |

|

Distance (in km) |

The distance of transit can be added here |

|

PART B Mode of transportation |

The mode of transportation of the good should be marked here |

|

Vehicle type |

The type of vehicle used for the transit can be selected here |

|

Vehicle no. |

The registration number of the vehicle used for the transit can be entered here |

|

Transporter doc no. |

The transporter doc no should be filled here |

|

Transporter doc date. |

The transporter doc date should be filled here |

|

save |

The save button saves the data in the form and a new e-way bill is generated. |

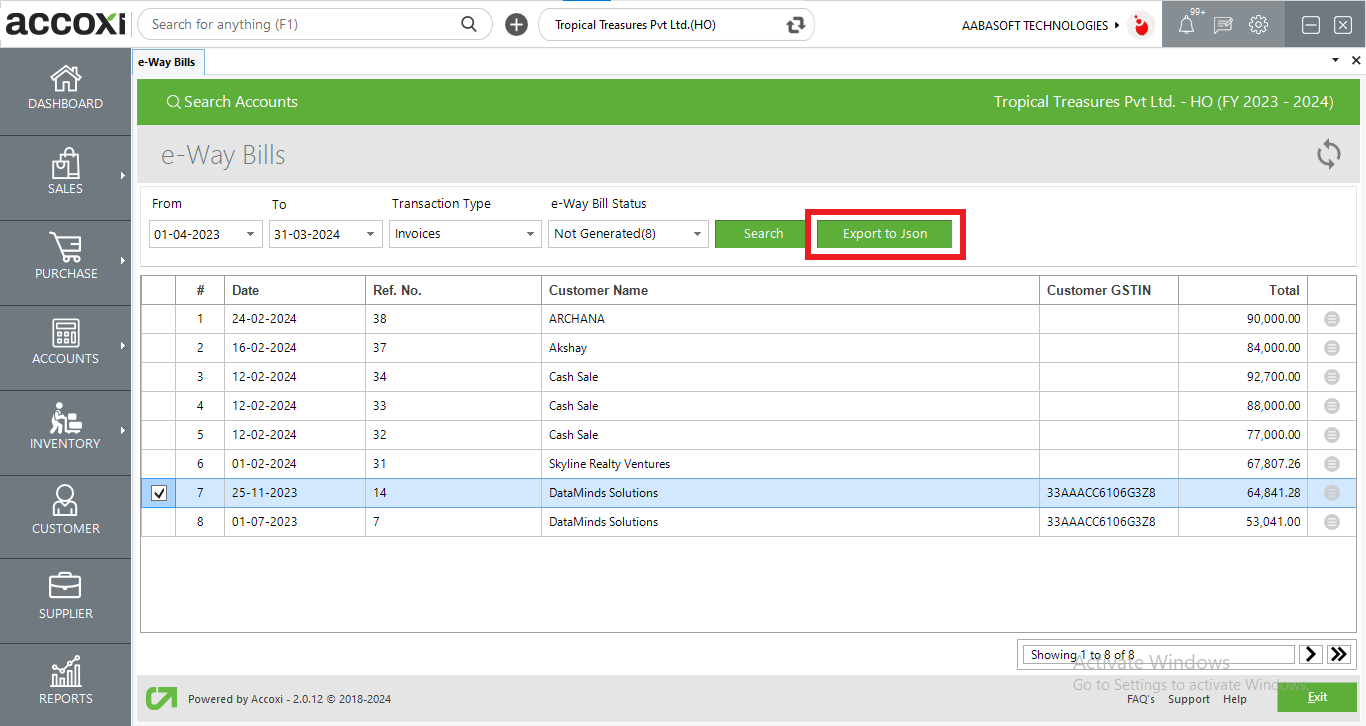

Upon generating the e-way bill, a checkbox will become visible, and selecting it will reveal a button for exporting the data to JSON format. This exported JSON file can then be uploaded to the GST site in order to obtain the e-way bill number.

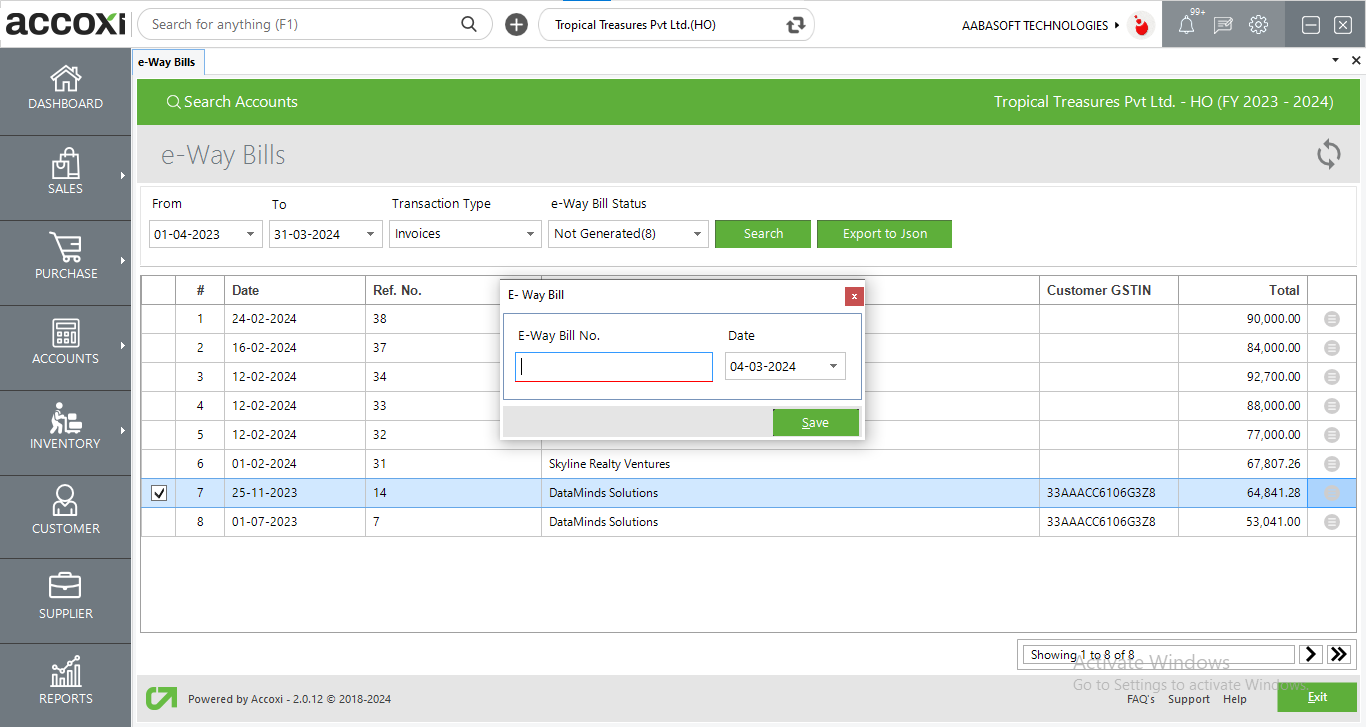

Upon obtaining the E-way bill number, it can be linked to the invoice within Accoxi. To do so, navigate to the "More" option, then choose "Associate E-way Bill." Selecting this option will prompt a popup window where the E-way bill number and date can be linked.

Yes by inputting “from and to” dates you can filter e way bills of two dates.