GSTR- 1

It is a monthly return that should be filed by every GST registered taxpayer, except for some persons mentioned in the further section. It shows the details of outward supplies of taxable goods and services. The due date for filing GSTR- 1 is the 10th of the Next Month following the current month.

GSTR-1 In ACCOXI

GSTR-1 In Accoxi enables the user to generate GST returns so easily. It will be generated automatically based on the sales that he made to GST Registered Persons.

Key Features

- User can easily identify their outward supplies which they made to B2B, B2C(Large), B2C(Small), credit or debit note (Registered), credit or debit note(unregistered), export invoice, etc. which will be shown separately.

- Users can apply the filter option in order to sort out GSTR-1 details for a particular period

- Users can easily export GSTR-1 to their Spreadsheet

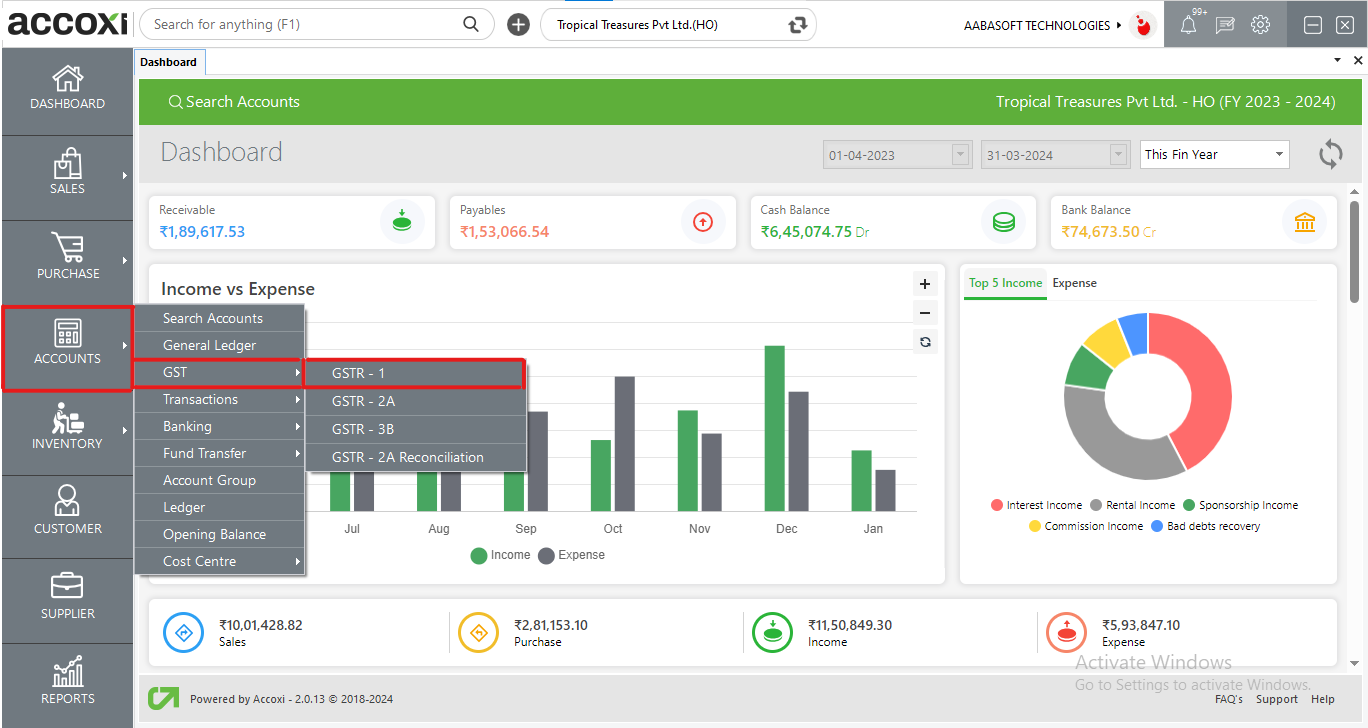

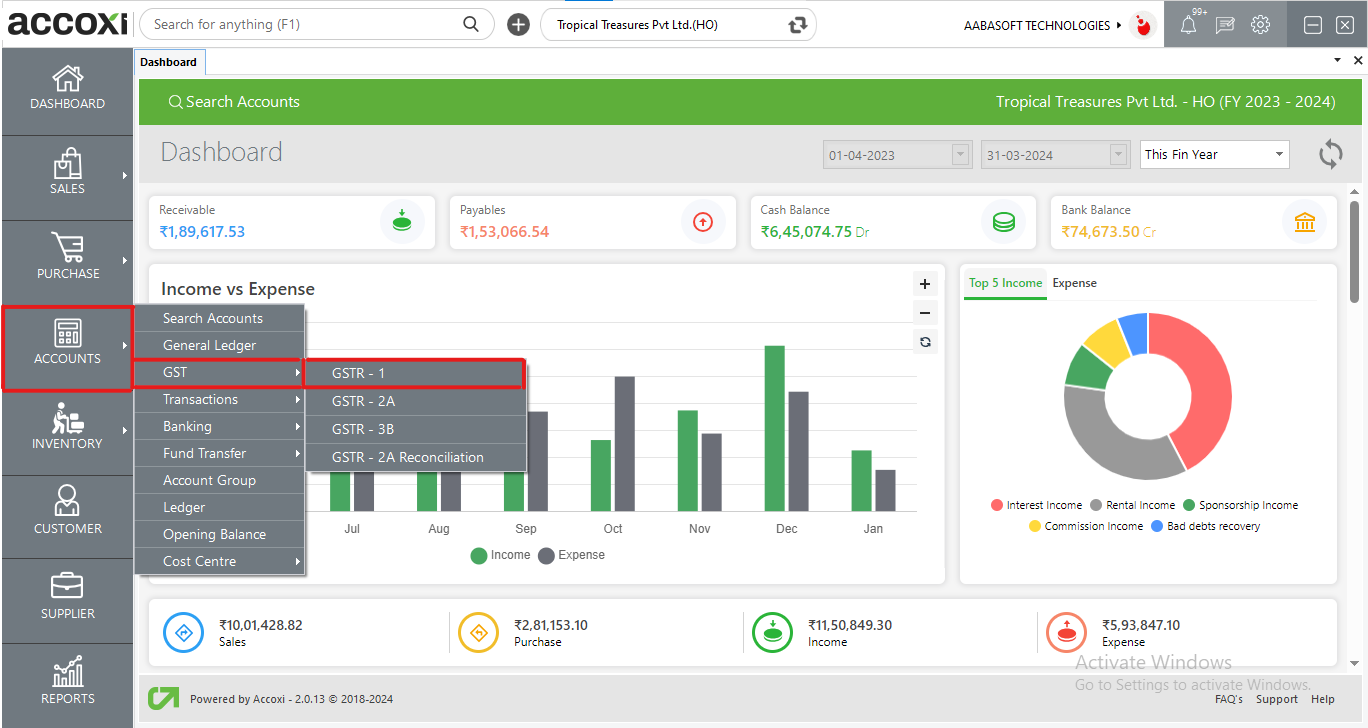

- Click on Accounts Section

- Then click on GST

- Select GSTR-1

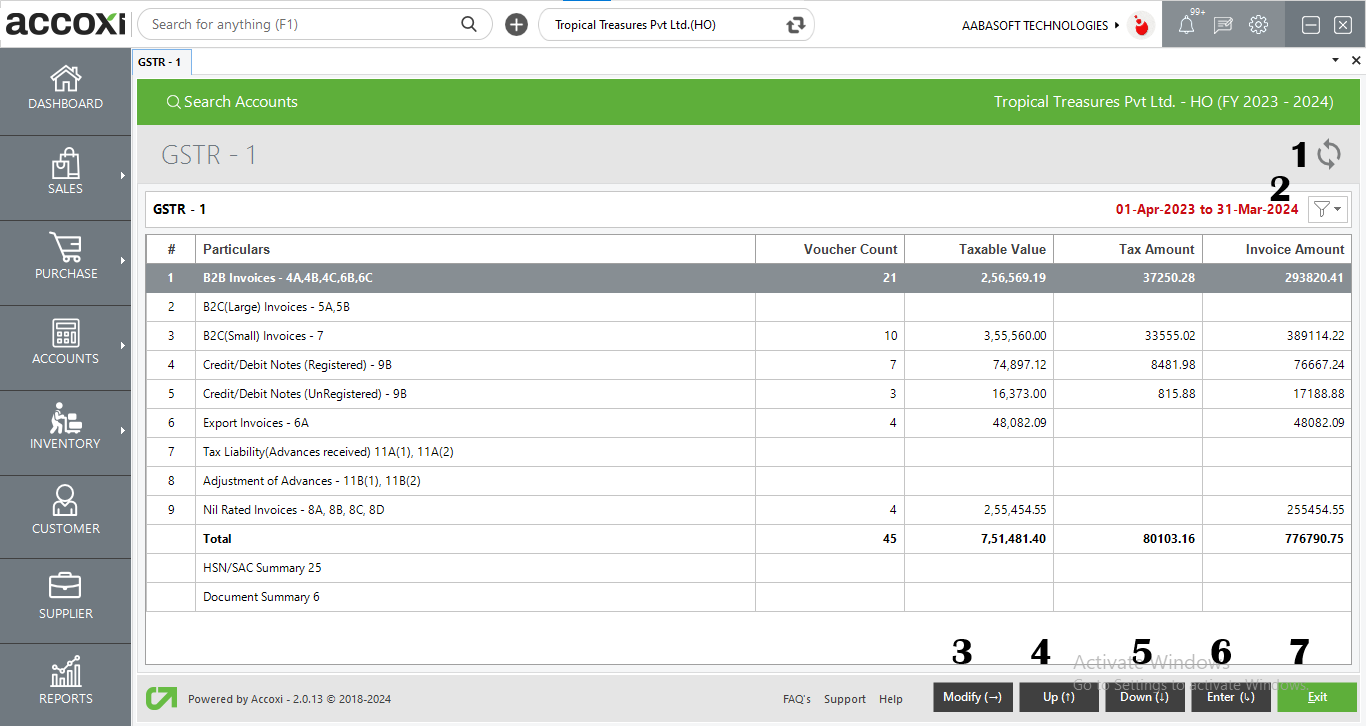

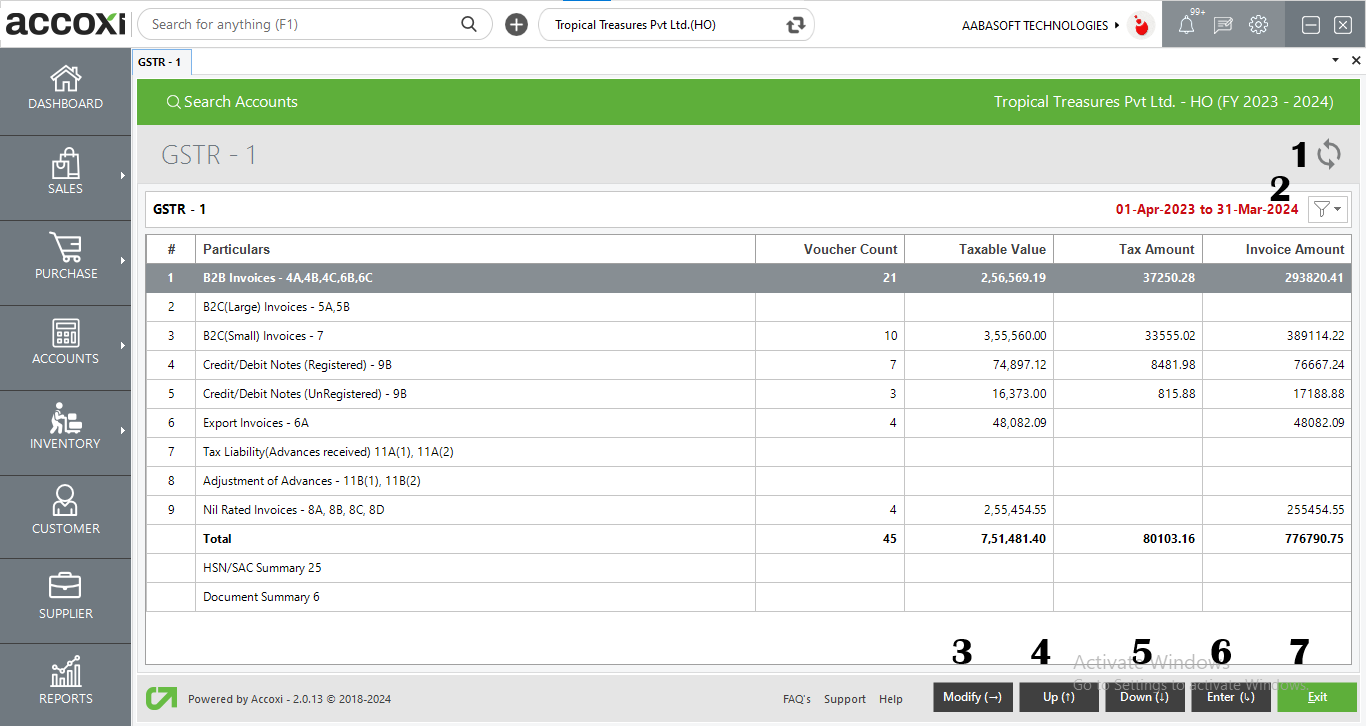

Data Available in GSTR-1 Table

|

Field

|

Description

|

|

#

|

Serial Number of GSTR 1

|

|

particulars

|

It shows the details of the Sales invoice

|

|

Voucher Count

|

It shows the voucher count of different sales

|

|

Taxable value

|

The total value of the transaction except for the tax amount

|

|

Tax Amount

|

Separately shows the tax amount for a transaction

|

|

Invoice amount

|

The total value of a transaction including the GST amount

|

Menus Available in GSTR-1

1. Refresh Option

- If the latest data is not displayed then click on the refresh button

2. Filter Option

- Users can filter the data by selecting the period and can also export GSTR-1 to an excel sheet

3. Modify Option

- It is similar to the filter option users can modify according to period and can also export data to their excel sheet. Users can also use the Right Arrow key to access the modify option instead of using a mouse.

4. Up Option

- The user is allowed to use the Up Arrow key to move up the list

5. Down Option

- Users can use the Down Arrow key to move down the list

6. Enter Option

- The enter option gives users a breakdown of GSTR 1 transactions

7. Exit Option

- Users can exit from this window and it redirects to the previous page

Steps to Generate GSTR-1

- Go to Accounts Section and click on GST

- From that select GSTR-1

- Then a GSTR-1 menu will appears

- If the user wants to know the details of GSTR-1 for a particular period then it will be available at the filter option. Apply the filter and then the changes will be visible

- Users can also export GSTR-1 information to their spreadsheet.

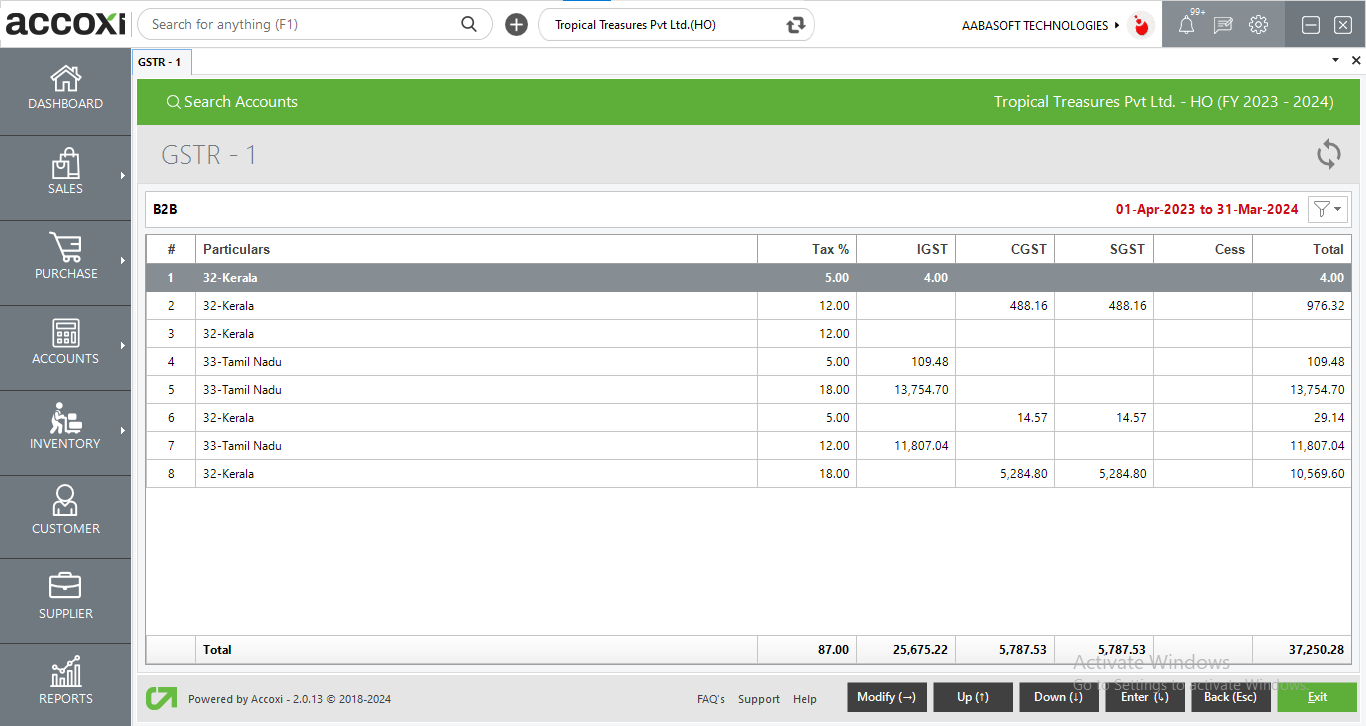

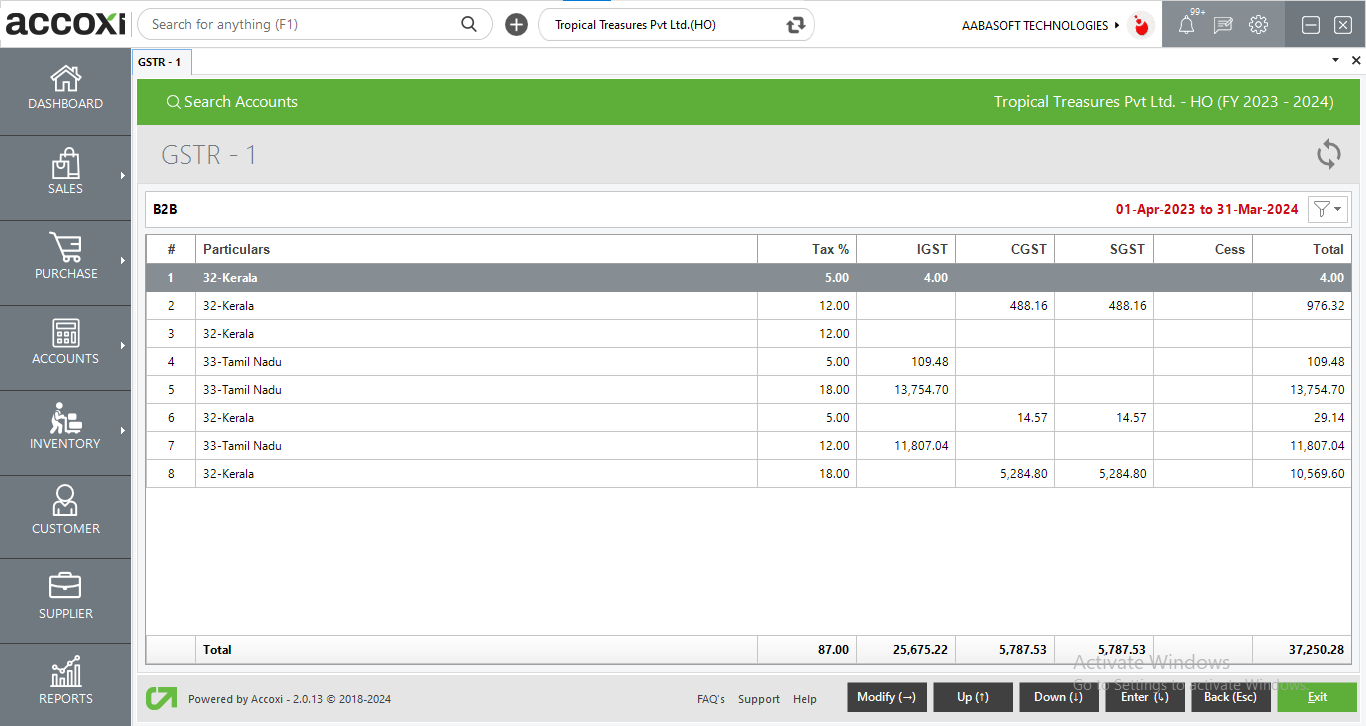

Users can access a breakdown of GST transactions by double-clicking the required head of particulars.

Below is the breakdown after double-clicking on the B2B invoices in GSTR 1

|

Field

|

Description

|

|

#

|

Serial number

|

|

Particulars

|

the states mentioned in which the transaction occurs

|

|

Tax%

|

Whether the transactions are under the 3,5,12,18 and 28%

|

|

IGST

|

the total integrated GST tax in the invoices

|

|

CGST

|

The total CGST rate of the invoice

|

|

SGST

|

Aggregate Value of SGST of the invoice

|

|

CESS

|

The total value of CESS that has been recorded in the invoice

|

|

TOTAL

|

Total Value of the invoice

|

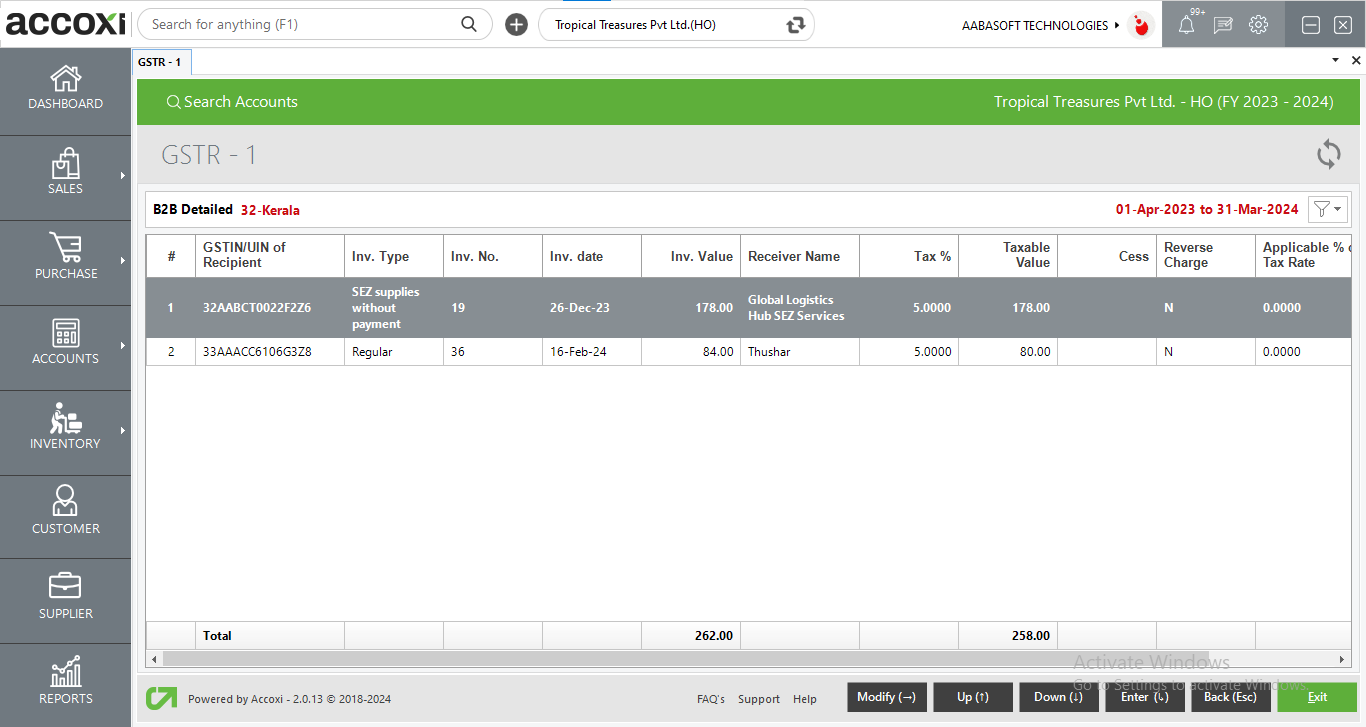

When the user double-clicks on any of the B2B invoices, the system will open a B2B detailed report module within the GSTR 1 interface, presenting comprehensive details for each invoice.

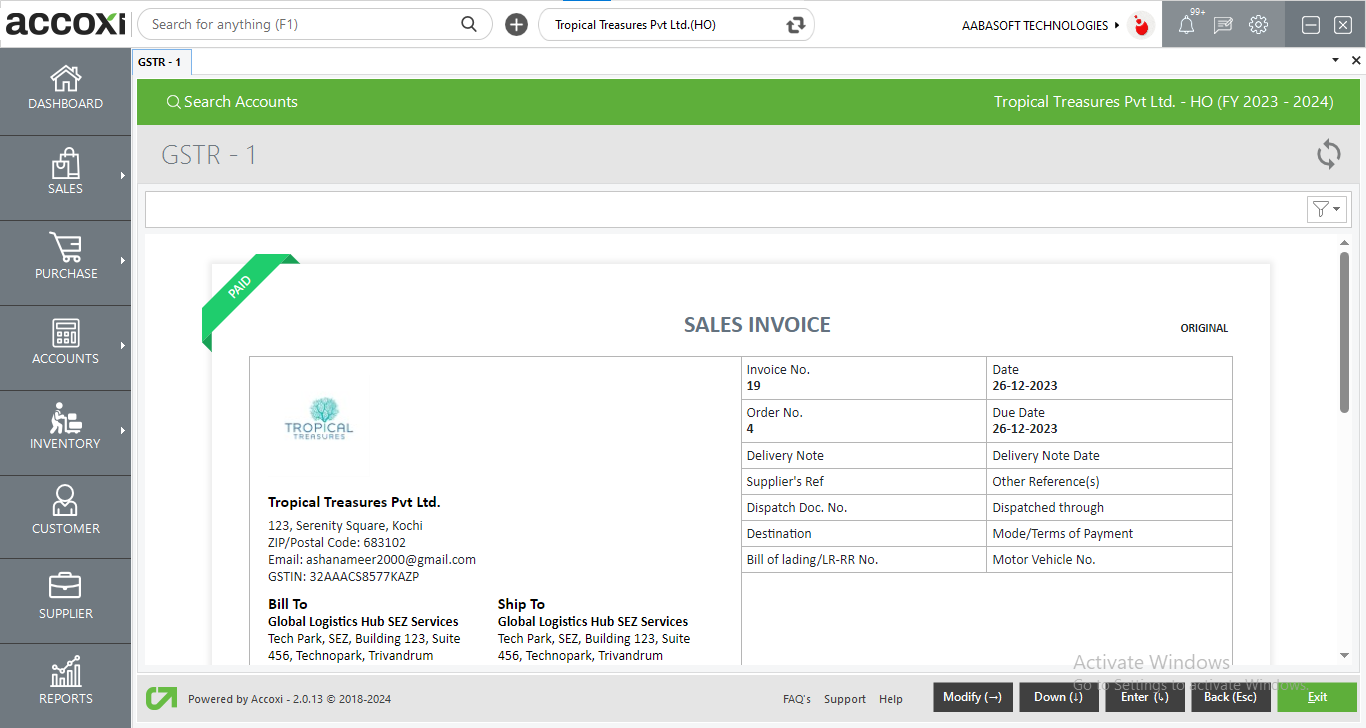

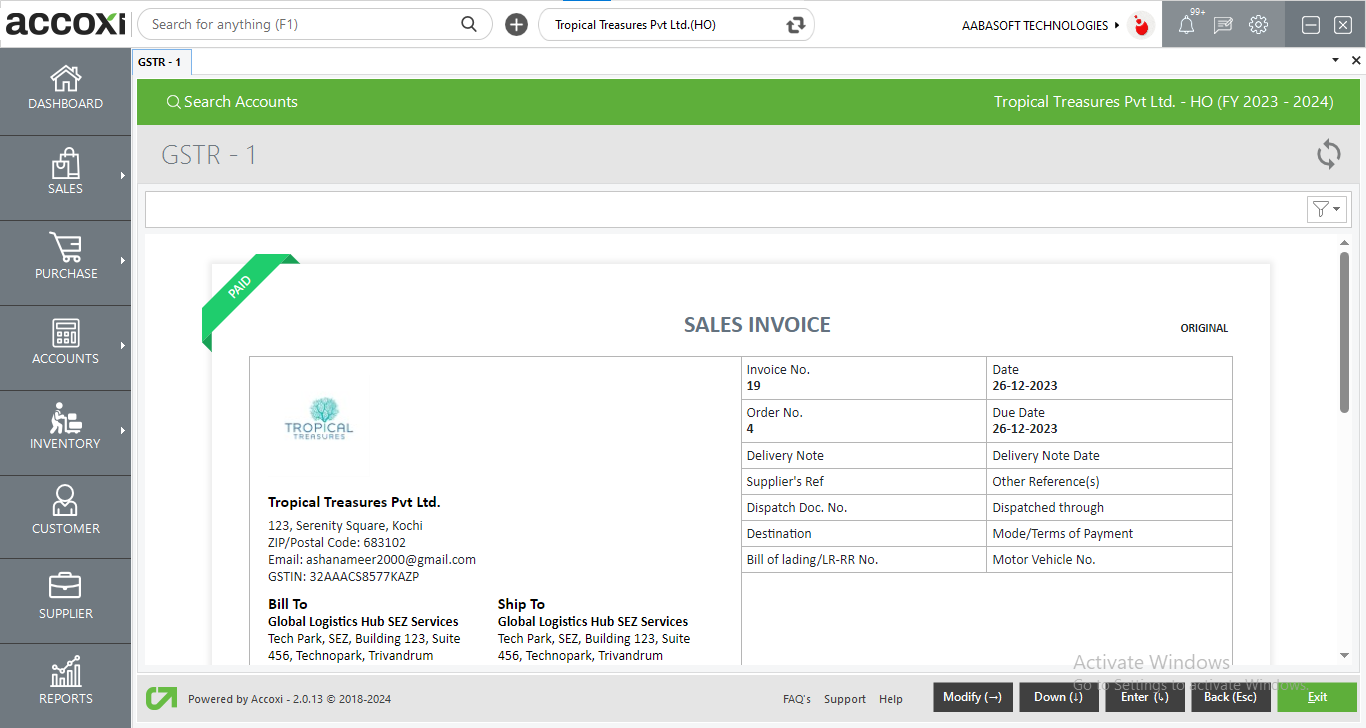

Upon double-clicking on any invoice, the system will open the invoice view, providing an extensive breakdown of the selected invoice's details.

Frequently Asked Questions?

01How can I Filter GSTR-1 details for a particular period?

- Click on Accounts Section → under GST Head → select GSTR-1. Then a GSTR-1 page will appear.

- Filter option is available on the right side of the screen

- Select the ‘period’ provided under the filter option

- Select the ‘From’ and ‘To’ period then click on Apply

02How can I export GSTR-1 details?

- Click on Accounts Section → under GST Head → select GSTR-1. Then a GSTR-1 page will appear.

- Filter option is available on the right side of the screen

- Select the ‘Export’ provided under the filter option. Select the file location and click on save

03How will I see the details of B2B Invoices?

- Click on Accounts Section → under GST Head → select GSTR-1. Then a GSTR-1 page will appears

- Double click/press enter on B2B invoices

- User can see the details of B2B transactions done by the user

04Can I use GSTR-1 form without using mouse?

05Can I get the GSTR-1 Report?

- Yes, it will be generated automatically and it is available under Reports Section