Seamless VAT Return filing done with Accoxi

The VAT report is a document that provides a summary of Value-Added Tax (VAT) transactions over a specific period. It typically includes details such as sales, purchases, VAT amounts collected on sales, and VAT amounts paid on purchases. This report is essential for businesses to track their VAT liabilities and ensure compliance with tax regulations.

The VAT return form in Accoxi is a document or electronic form that businesses use to report their Value-Added Tax (VAT) obligations to tax authorities. It typically includes details of sales, purchases, and Net VAT due during a specific reporting period. Businesses are required to submit VAT returns regularly, usually on a quarterly or monthly basis, depending on the jurisdiction. The VAT return form helps ensure that businesses accurately report their VAT transactions and calculate the correct amount of VAT owed or owed to them. It is an essential component of tax compliance for company’s subject to VAT regulations.

The key features of a VAT report include:

These features collectively contribute to the efficiency, accuracy, and compliance of VAT reporting

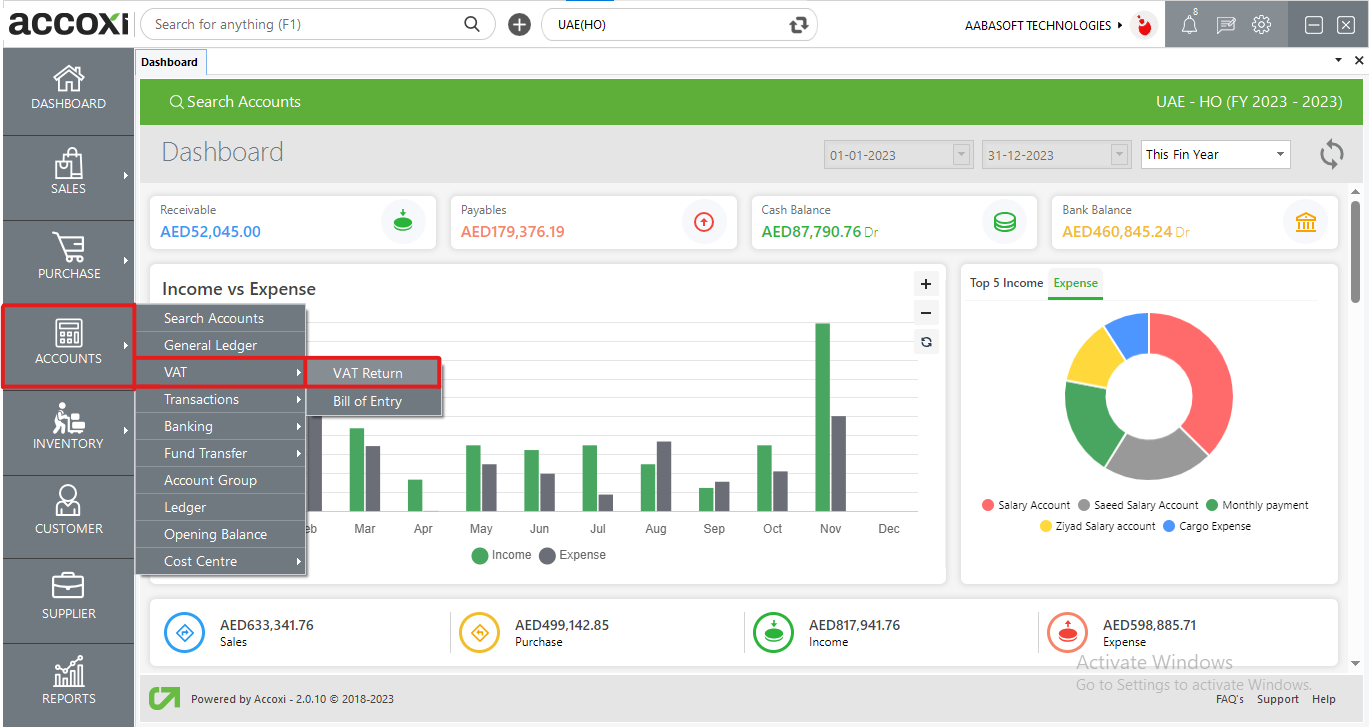

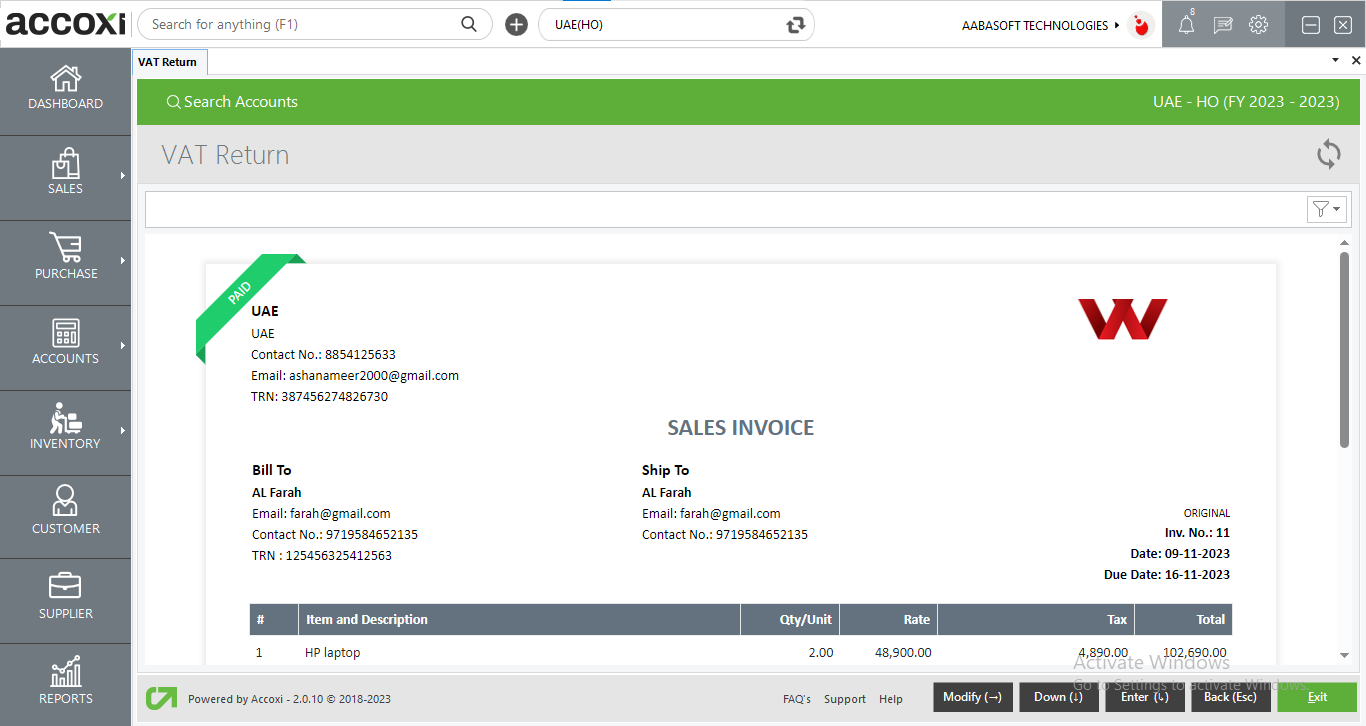

VAT RETURN FORM

This form enables you to generate the VAT Return, presenting summarized information about the VAT report. Additionally, it includes a feature that allows you to mark it as filed, indicating completion and submission of the VAT Return.

|

Field |

Description |

|

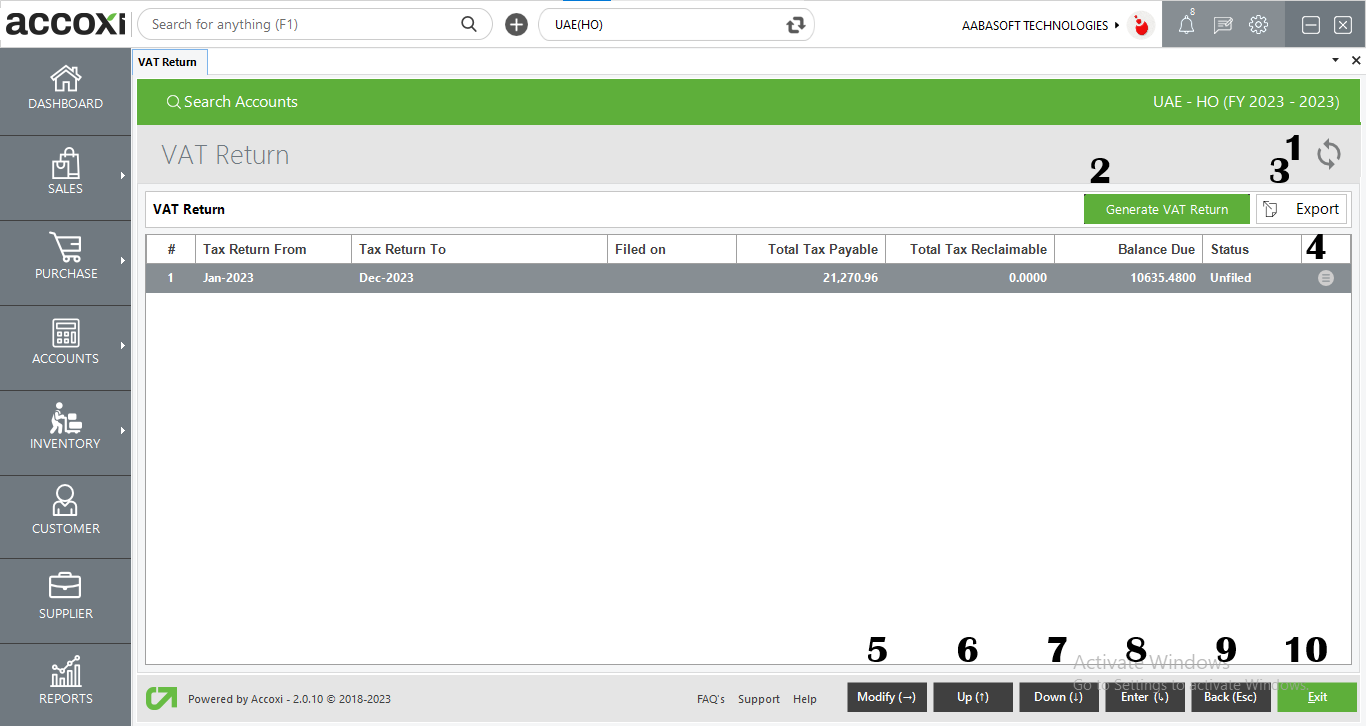

Refresh |

If the most recent data is not displayed, simply click on the refresh icon located at the top right corner of the page to fetch the updated information. |

|

Generate VAT Return |

Upon clicking "Generate VAT Return," a popup window appears, allowing you to choose the start and end month from the dropdown menu. Additionally, there is a checkbox that provides the option to include unfiled transactions from previous periods along with the current period. |

|

Export |

Data can be exported to Excel format. Click on the export button at the top right corner. Select the file location and click on Save. |

|

More Feature |

The "More" feature offers several functionalities:

Once marked as filed, transactions within that specific period are typically locked, and modifications are restricted. This is a standard practice to maintain the integrity of the filed VAT return and ensure compliance with tax regulations. It prevents inadvertent changes that could affect the accuracy of the filed information.

These features contribute to the flexibility and accuracy of managing VAT returns within Accoxi, ensuring that businesses can adjust, mark filings, export data, and address discrepancies efficiently. |

|

Up |

The "Up" button is utilized to scroll upward. |

|

Down |

The "Down" button is utilized for scrolling in a downward direction. |

|

Enter |

Pressing the "Enter" key provides access to a detailed VAT report, offering in-depth information and insights into VAT-related transactions. |

|

Back |

To return to the previous page, you can either press the "Back" button or the "Esc" key. |

|

Exit |

The "Exit" button is employed to close the Cost Centre Summary window. |

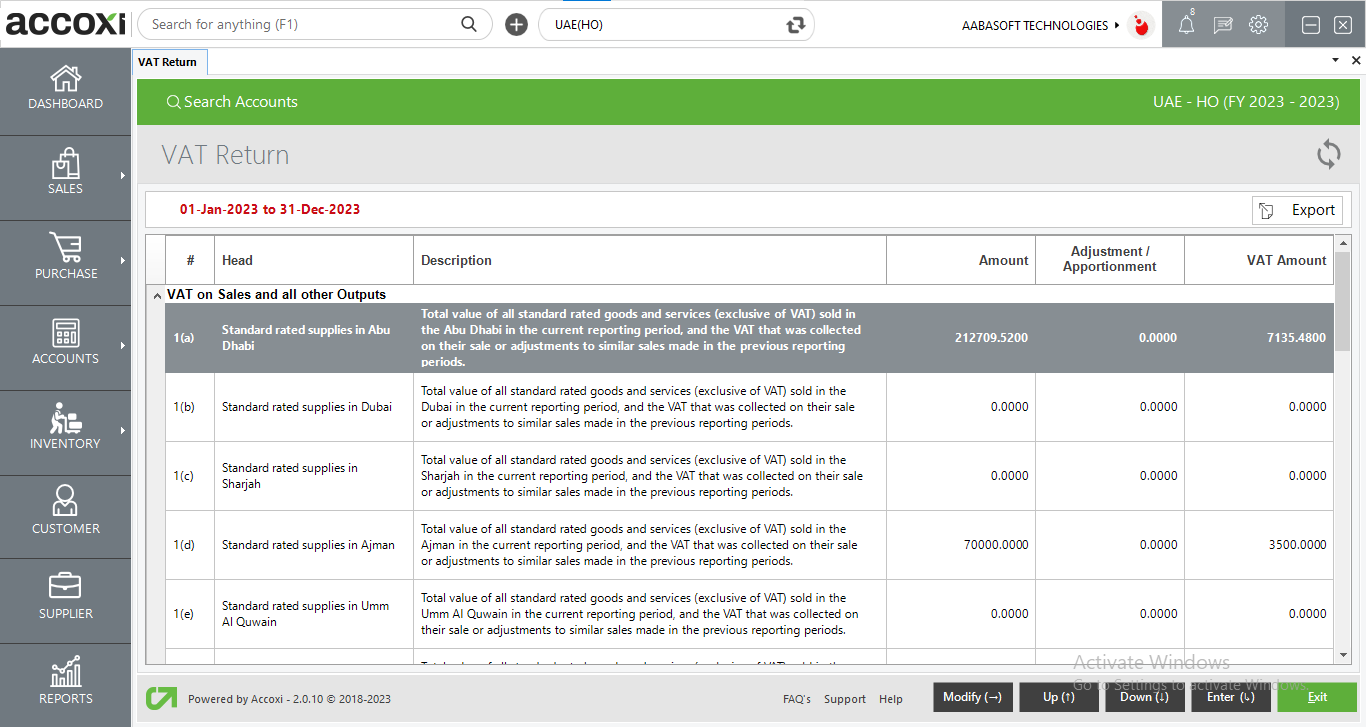

In the detailed VAT return form, various sections of VAT are presented. This includes distinct sections such as VAT Output (VAT on Sales), VAT Input (VAT on Expenses), and Net VAT Due. The form displays detailed information, including the section name, description, the amount allocated to each section, any adjustments or apportionment amounts, and the resulting VAT amount. This comprehensive breakdown provides a detailed overview of VAT-related transactions, facilitating a thorough understanding of the VAT return.

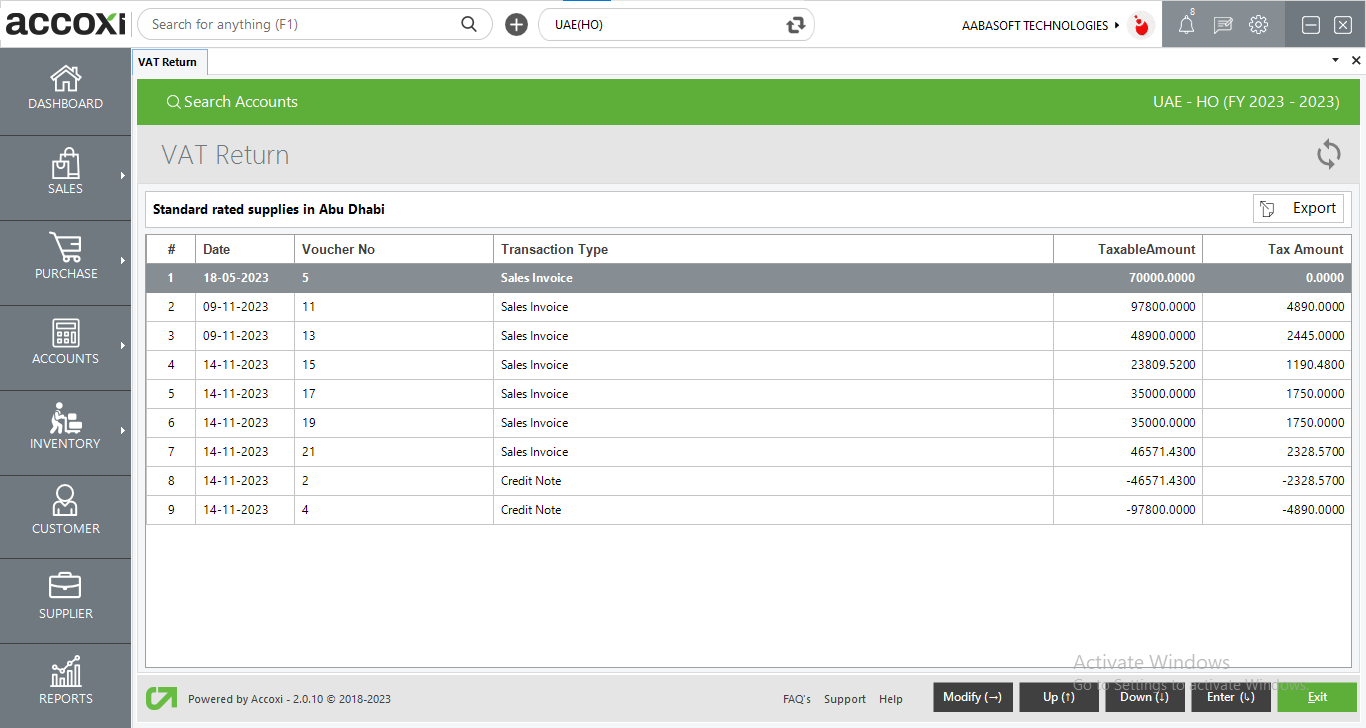

The detailed report of each section is showcased in this section. The report encompasses transaction-specific details such as transaction type, voucher number, transaction date, taxable amount, and the corresponding tax amount for each transaction relevant to the selected section. It provides a transaction-wise breakdown, offering a granular view of the details within each selected section.

Clicking on the transaction summary within the section form of the VAT Return provides you with a view of the selected transaction. This detailed view offers comprehensive information about the chosen transaction, enhancing understanding and analysis.