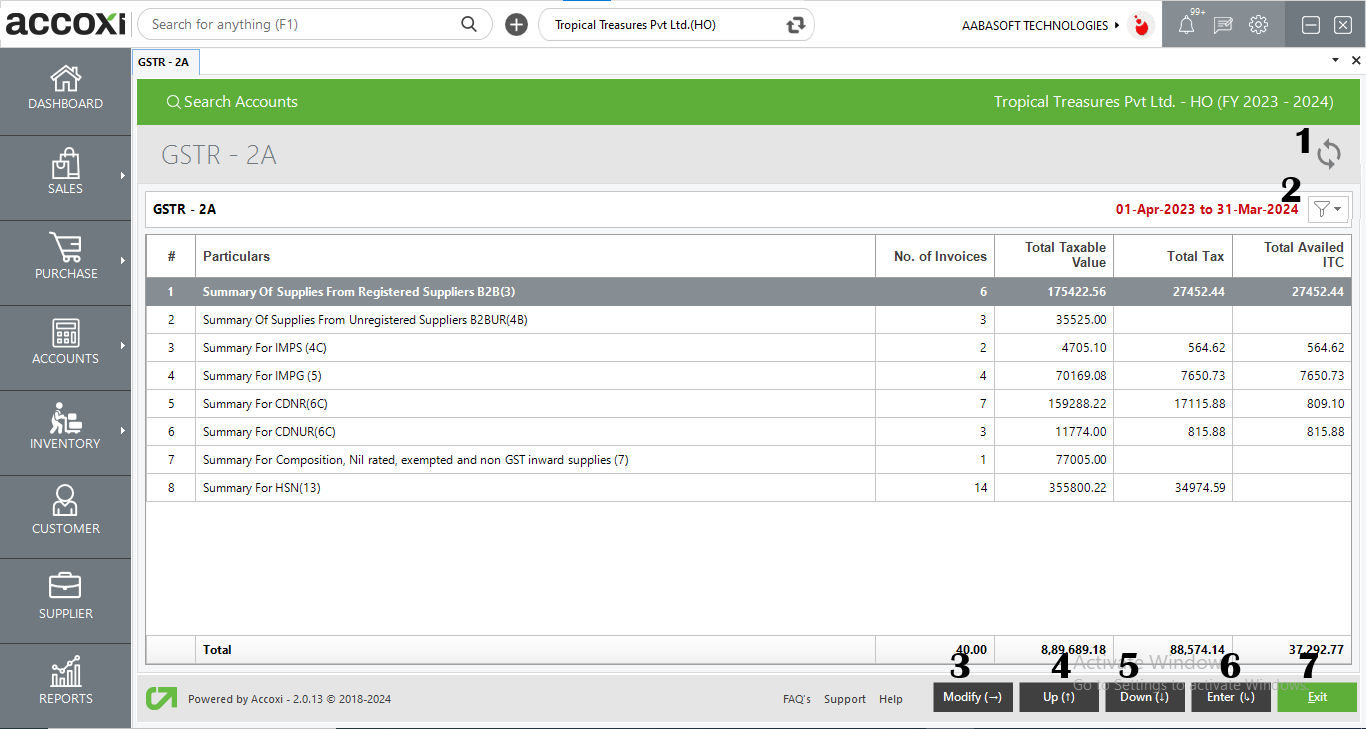

GSTR-2A enables automatic generation of GST return based on their purchase.

GSTR 2A is a purchase-related document that is automatically generated for each business by the GST portal. When a seller uploads all tax invoices issued through GSTR-1, then that information is captured in GSTR 2A. It takes the information of goods and/or services that have been purchased in a given month from the seller's GSTR-1. It should be filed on the 11th of the succeeding month.

GSTR-2A enables automatic generation of GST return based on their purchase, which is from registered and unregistered suppliers, and also it shows the details of available ITC.

|

Field |

Description |

|

# |

Serial Number of GSTR-2A |

|

Particulars |

It Shows The Summary Of Inward Supplies |

|

No. Of Invoices |

Total Number Of Inward Supply Invoices From B2B, B2C, etc. |

|

Total Taxable value |

Total Taxable Value Of The Transaction Except for Tax Amount |

|

Total Tax |

Separately Shows The Tax Amount |

|

Total Availed ITC |

The Amount Of ITC Can Be Claimed By The User From A Transaction |

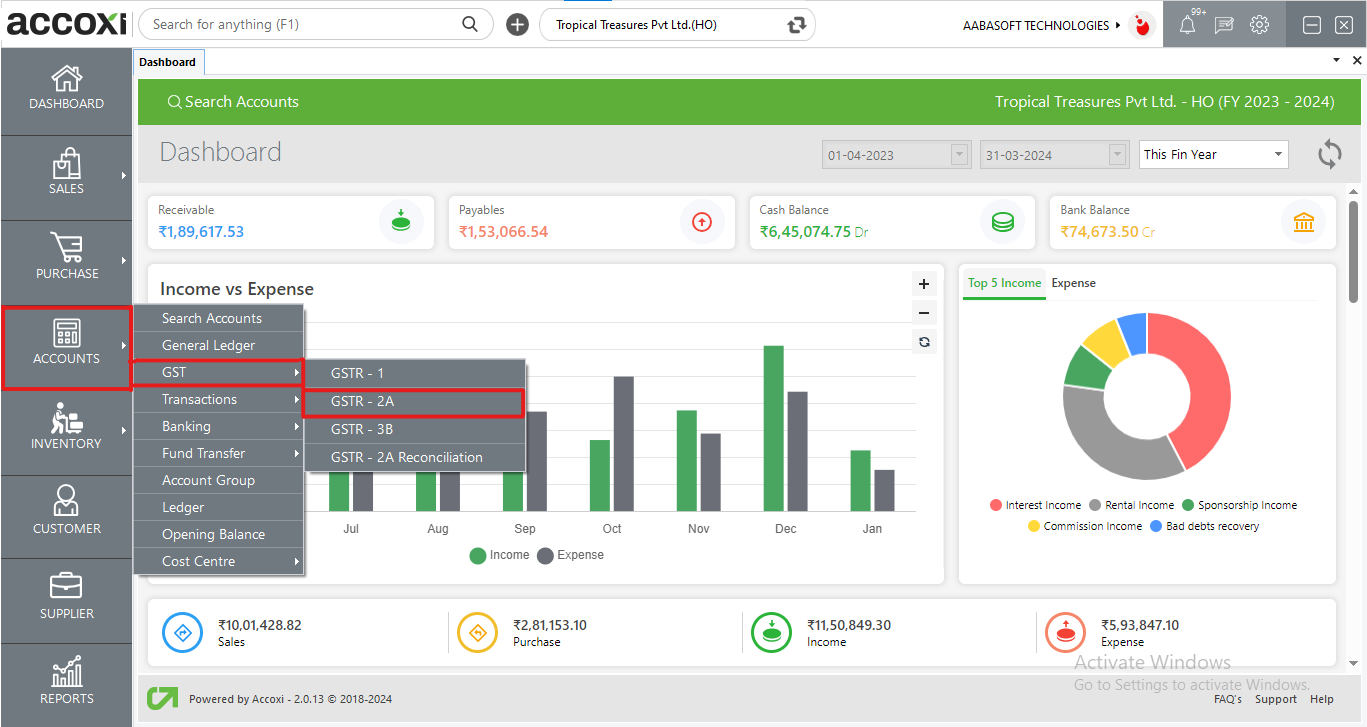

1. Refresh Option

2. Filter Option

3. Modify Option

4. Up Option

5. Down Option

6. Enter Option

7. Exit Option

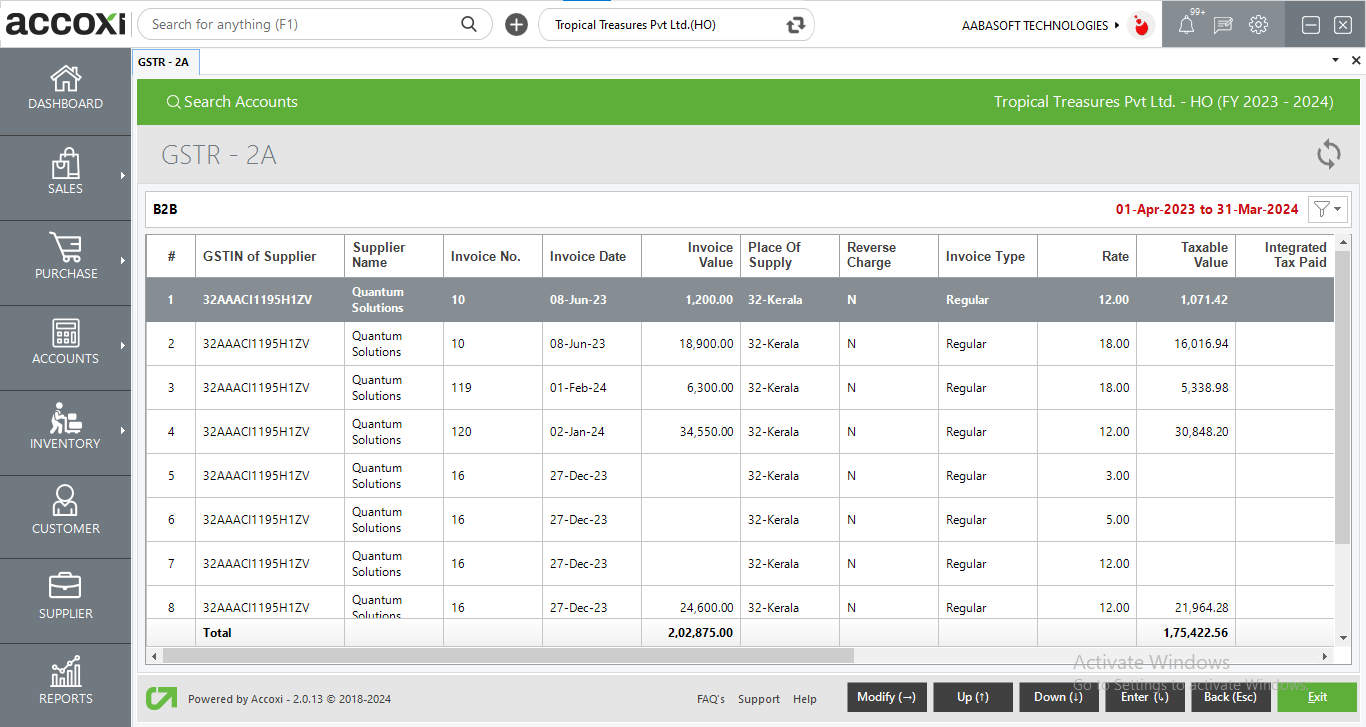

When the user double-clicks on any of the B2B supplies, the system will open a B2B detailed report module within the GSTR 2A interface, presenting comprehensive details for each invoice.

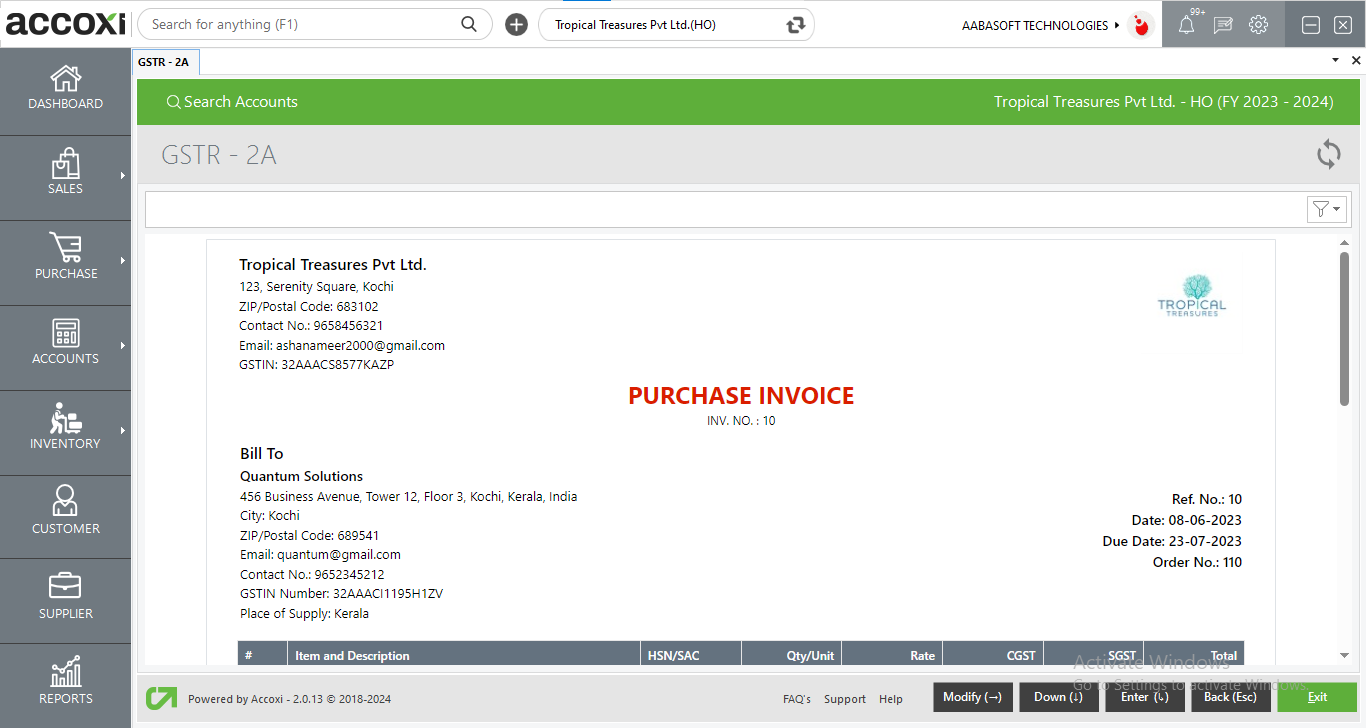

Upon double-clicking on any invoice, the system will open the invoice view, providing an extensive breakdown of the selected invoice's details.

Yes. User can use GSTR-2A with the keyboard itself