Bank reconciliation in Accoxi

Bank reconciliation is a crucial process where the bank account balance in a company's books of account is compared and reconciled with the balance reported by the financial institution in the most recent bank statement. The goal is to identify any discrepancies between the two balances and, if necessary, make corrections. Accoxi provides a reconciliation system that assists users in determining differences between the passbook (bank statement) and the company's books, facilitating adjustments to the accounting records as needed. This helps ensure the accuracy and integrity of financial data.

Key Features of Reconciliation:

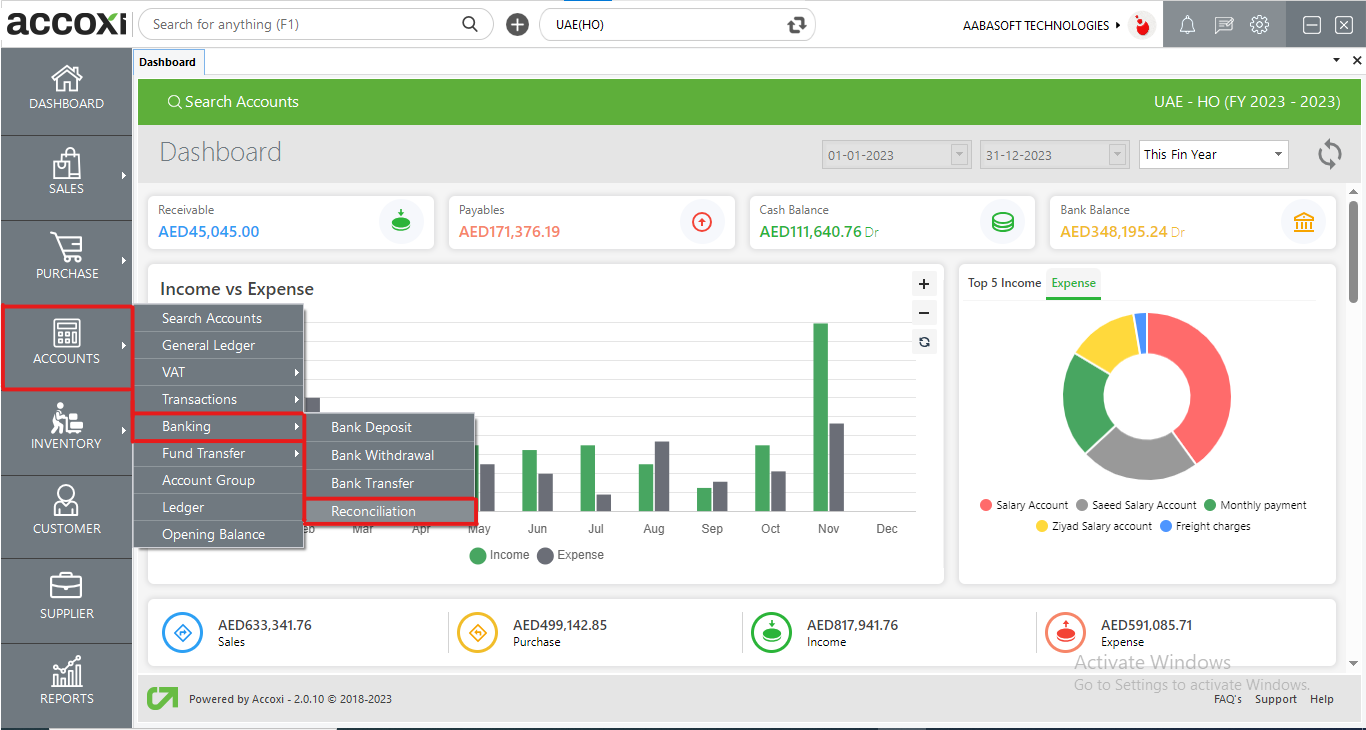

To access the Reconciliation feature in Accoxi, follow these steps:

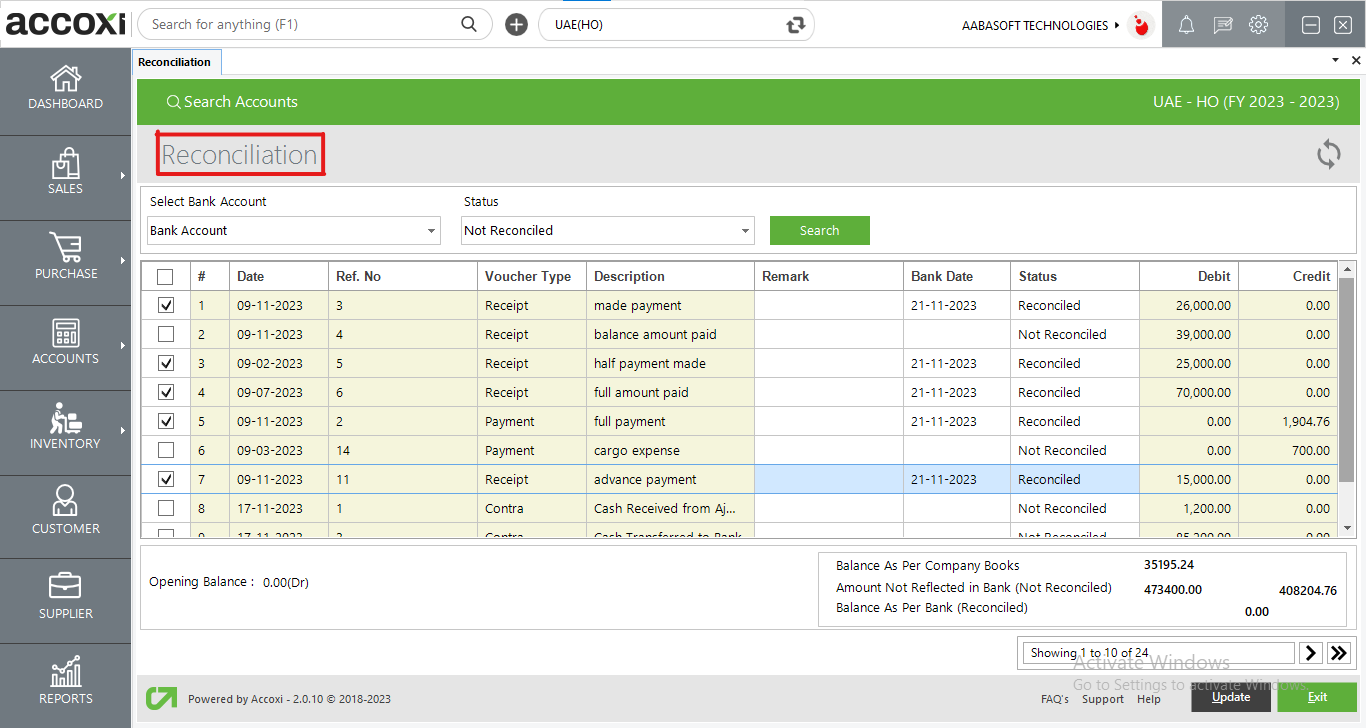

Upon clicking on Reconciliation, the Bank Reconciliation page will appear on the screen. This is where users can perform the reconciliation process, compare the company's books with the bank statement, and manage the status of various transactions.

Reconciliation

Accoxi's Reconciliation feature offers complete details of multiple bank transactions. Users have the flexibility to select a specific bank and can then track the details of each transaction associated with that particular bank. This functionality allows for a detailed and organized view of bank transactions, facilitating effective management and reconciliation processes.

|

Field |

Description |

|

Bank Account |

Users can choose the bank account in the "Select Bank Account" field. After selecting a specific bank account, the system provides transaction details related to the selected bank. This feature enables users to focus on and review transactions specific to a particular bank account, streamlining the reconciliation process. |

|

Status Search |

In the "Status" menu, users have the capability to filter or organize transactions based on their status and conduct searches accordingly. The available status options include "Reconciled," "Not Reconciled," "Need Verification," and "Missing." When a user selects a specific status, transactions with that particular status will be displayed on the screen. This feature enhances the ability to categorize and manage transactions based on their reconciliation status. |

|

Date |

The system displays the date of each particular transaction in the reconciliation. This date information provides users with a chronological overview of when each transaction occurred, aiding in the analysis and understanding of the transaction history during the reconciliation process. |

|

Ref No |

The reference number of the transaction will automatically appear in the designated field. This automatic retrieval ensures that the reference number is accurately associated with the transaction, providing a convenient and error-free way of identifying each transaction within the reconciliation process. |

|

Deposit |

This column displays the amount of the bank deposit for each transaction. It provides a clear and organized view of the deposited amounts associated with each transaction during the reconciliation process. |

|

Withdrawal |

The Withdrawal column displays the sum of funds withdrawn from the bank. |

|

Voucher Type |

Users have the ability to distinguish each transaction based on its voucher type, which indicates whether it is a receipt, payment, or contra. The specific voucher type of each transaction is clearly indicated. |

|

Description |

The transaction description is presented or displayed. |

|

Remark |

Should the user wish to append a comment or a brief note regarding the reconciliation of a specific transaction, this can be accomplished using this field. |

|

Bank Date |

The bank date refers to the date displayed on the bank passbook. When reconciling a specific transaction, the user has the option to input the passbook transaction date in this field. |

|

Status |

The Status column reflects the real-time status of a bank transaction. Prior to reconciliation, the status for a specific transaction is consistently marked as "Not Reconciled." Users have the flexibility to designate the status of each transaction after cross-verifying it with a bank passbook.

Users are empowered to choose from various status options such as "Reconciled," "Not Reconciled," "Need Verification," and "Missing." A "Reconciled" status signifies the successful completion of the reconciliation process. In cases where users cannot finalize the reconciliation independently or require validation from others, the status can be set to "Need Verification." The "Missing" status indicates that a transaction was not reconciled due to the absence of essential details such as amount, reference number, etc. |

|

Balance Figure |

Users can locate the balances of amounts on the bottom right side of the page. In this section, users receive details about the Balance as per Company Books, Balance as per Bank, and Amount Not Reflected in the Bank.

The Balance as per Company Books presents the overall balance figure of the company account. Following reconciliation, any variance between the Company Books and Bank Books will be reflected in the Amount Not Reflected in the Bank field, allowing users to identify and analyze the discrepancy.

Balance as per Bank displays the passbook balance after reconciliation. Post-reconciliation, this balance should ideally align with the Company Books. Any disparity will be evident in the Amount Not Reflected in the Bank field, indicating the need for further investigation or resolution. |

|

Update |

The Update menu serves the purpose of saving or updating the data on the reconciliation page. By clicking on Update, users can save the entered data, ensuring that the page reflects the most recent information. |

|

Exit |

The Exit menu is designed for closing the current page and returning to the previous window. |