By using the year closing feature the user can close their books of the Organization in it.

An accounting procedure undertaken at the end of the year to close out business from the previous year, carry forward balances from the previous year, and open posting account for the upcoming year. Year-end closing is part of a company’s closing operations and is used to create a company’s financial statements.

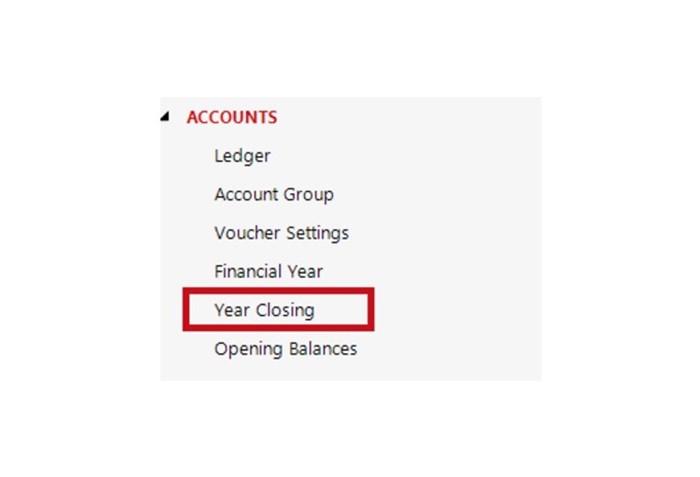

ACCOXI is the most modern accounting software that provides easy and deliberate results for accounting. It provides the function of Year closing settings and the user can close their books of the Organization in it. Click on the Settings menu on the top right side of the page. Then a list of settings tab will open. Select the option Year Closing from Accounts option, then it opens do closing procedure.

Steps to Year Closing

1.The first important step to ensure that all financial activity for the year is accurately recorded in the accounts before closing the accounts. User need to check and ensure that the trial balance account of the Organization must be tally and the accounts should be accurate. Otherwise it can’t close the year.

2.Click on the Settings menu on the top right side of the page. Then list of settings tab will open. Select the option Year Closing from General settings option, then it opens to new tab.

When the user click on year closing option, a validation message will popup on the screen regarding to close all the opened windows. Click the option Yes to continue.

3.Then a new tab will be popup on the screen and user needs to enter the password of the software on it. Enter the password on the field and click on confirm to enter the next step to close the year.

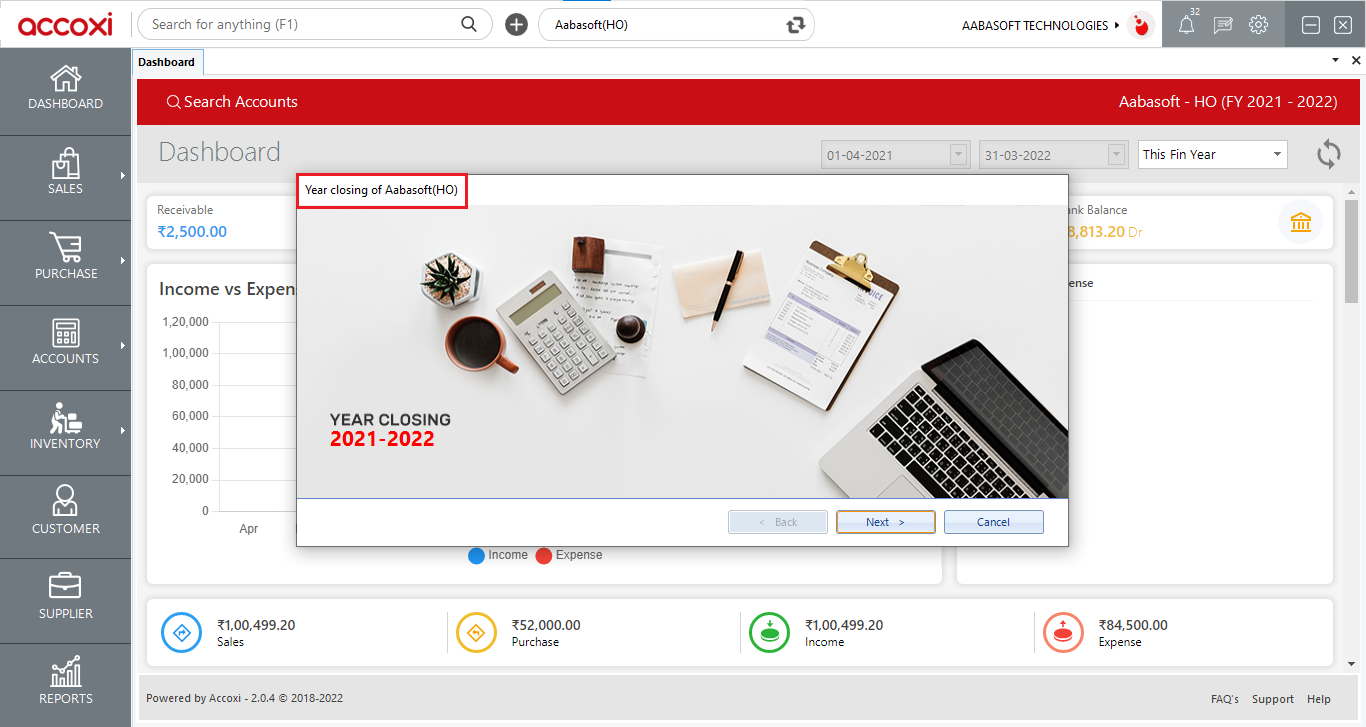

4.After enter the password, year closing tab will appear on the screen. Then click on the Next option to continue.

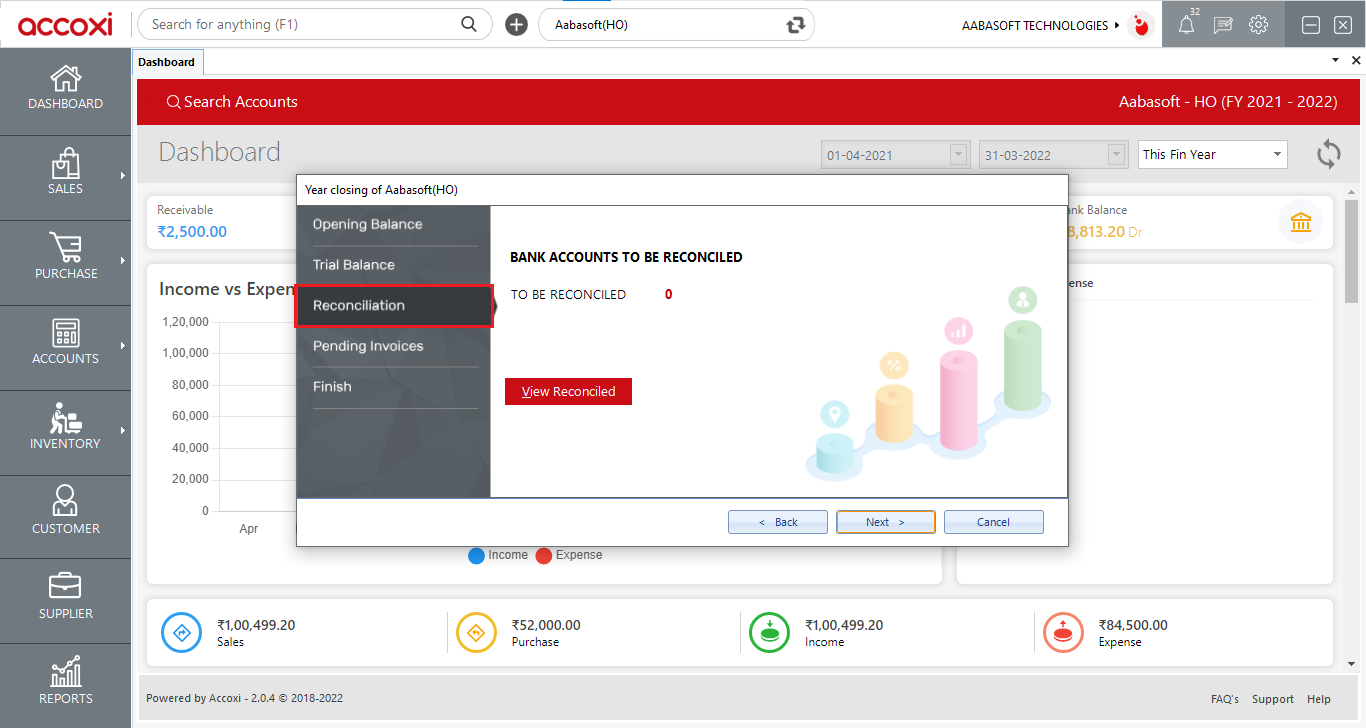

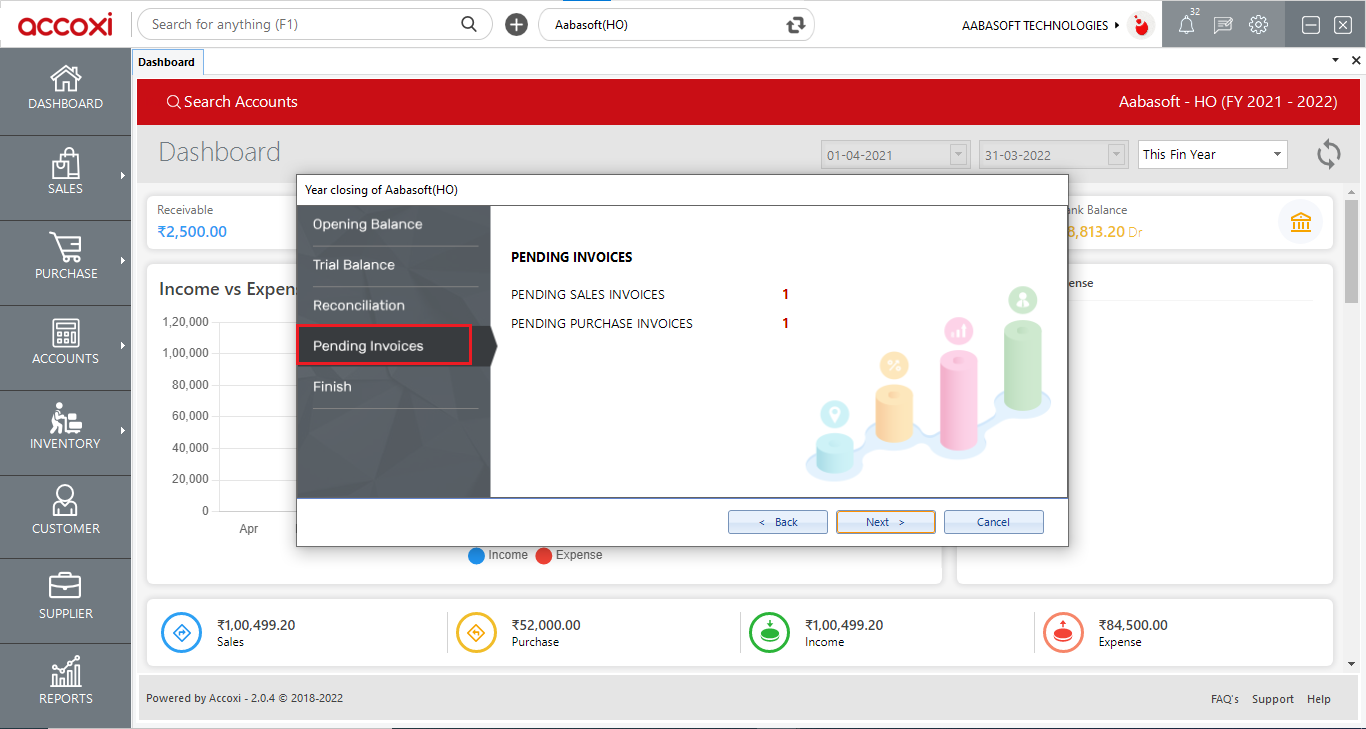

5.Then it includes five steps to complete the year closing procedure. They are Opening Balance, Trial Balance, Reconciliation, Pending Invoices and Finish.

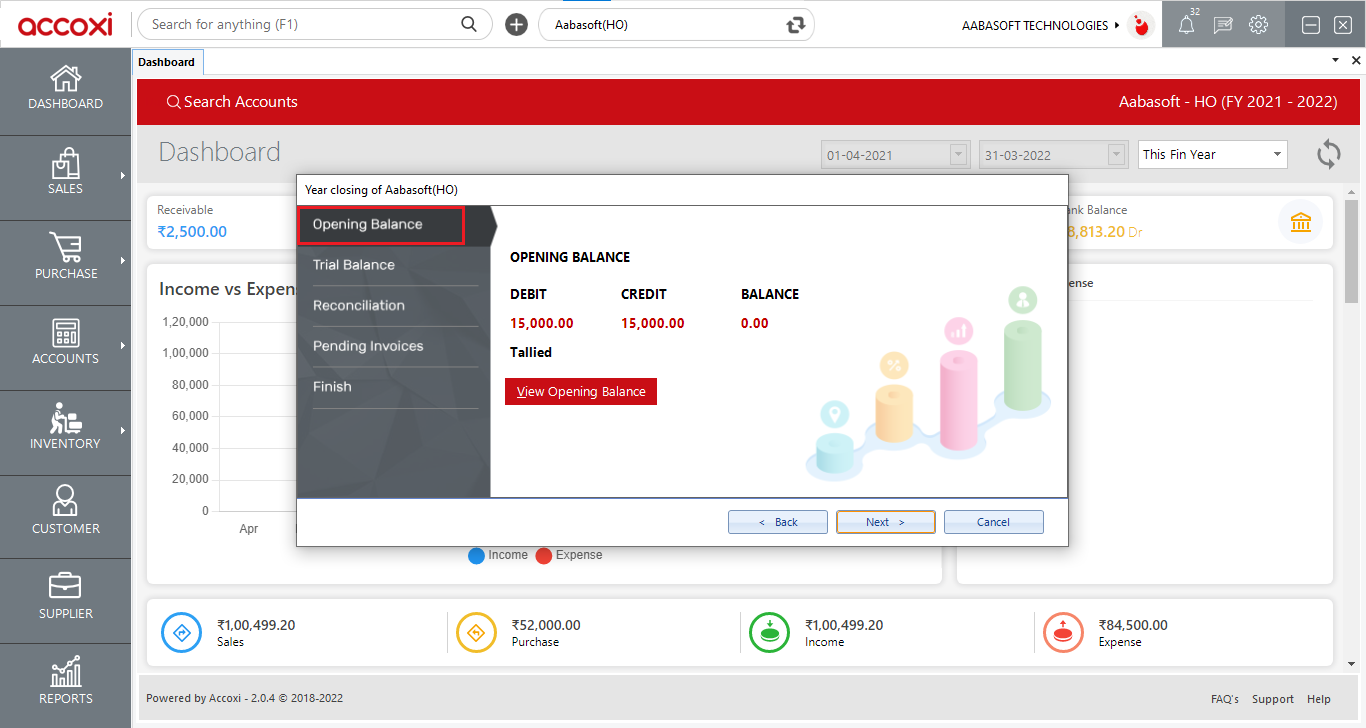

6.First it shows the details of Opening Balance of the organization. User can identify the debit and credit balance amount and it also shows the balance amount of the opening balance. It shows the status of the account, whether it is tallied or not tallied. It must be tallied to close the financial year otherwise, can’t move to the next step.

View Opening Balance menu enable the user to view the opening balance account. By clicking on the menu, it opens to Opening Balance account. Then click on the Next option to continue.

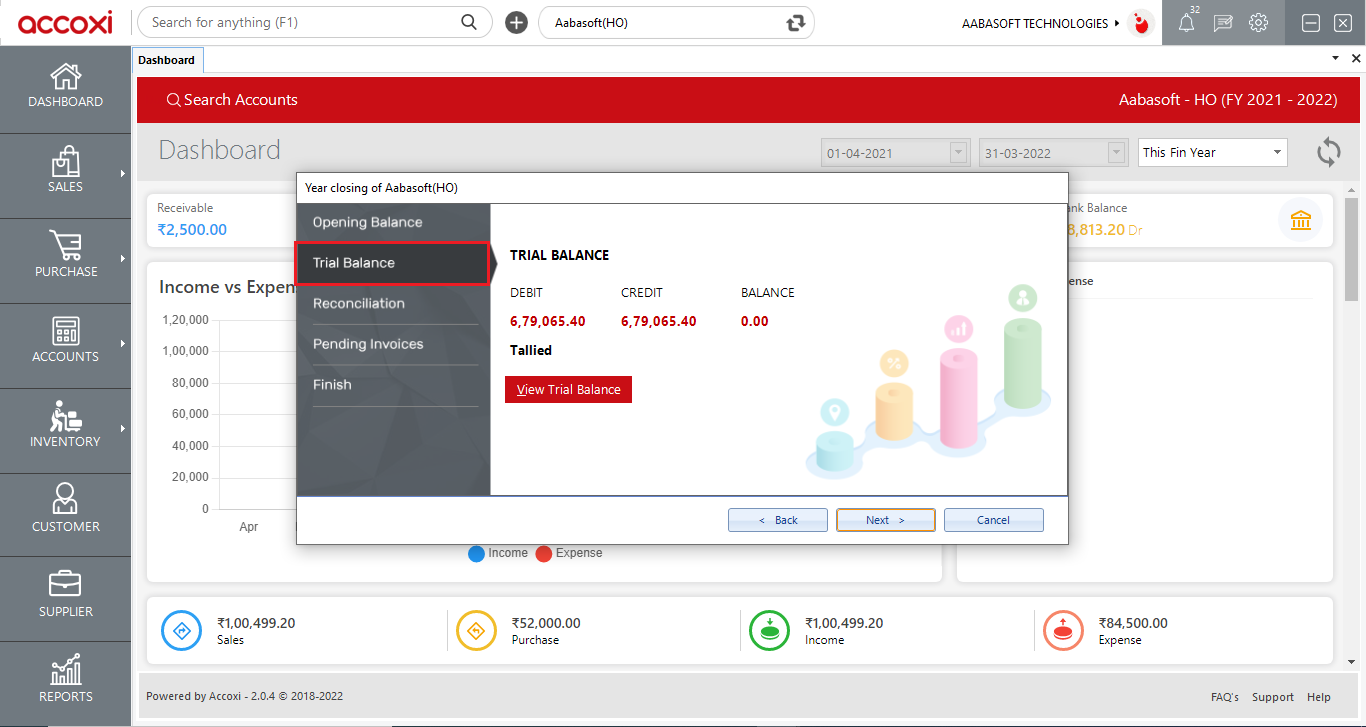

7.While click on next option, it shows the details of Trial Balance of the organization. User can identify the debit and credit balance amount and it also shows the balance amount of the trial balance. It shows the status of the account, whether it is Tallied or not tallied. It must be tallied to close the financial year otherwise, can’t move to the next step.

View Trial Balance menu enable the user to view the trial balance account. By clicking on the menu, it opens to Trial Balance account.

Then click on the Next option to continue.

8.Next procedure is the Reconciliation and it shows the details of bank accounts reconciled. View Reconciled menu enable the user to view the Reconciliation account. By clicking on the menu, it opens to Reconciliation account.

Then click on the Next option to continue.

9.The next function is the Pending Invoices. It shows the number of pending sales and purchase invoices. There must be no pending invoices to close the financial year of the Organization.

Click on the Next option to move to next step.

10.While clicking on the Next option, it opens to the next step of Finish and it shows the details of click on Finish to perform year closing.

After click on the Finish, the perform year closing function will process and complete. Then it change to next financial year and the change will appear on the top right side of the financial year.

Changes Reflect after the Year Closing

After the financial year closing, there are several changes will occur. The closing balance account of the financial year will be transfer to the opening balance of the new financial year.

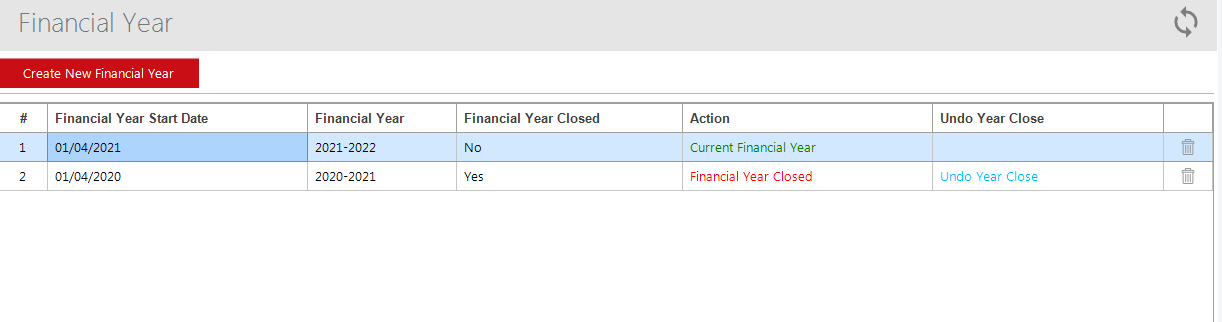

If the user wants to check the closed and current financial year details, it can be done by Financial Year option in Settings. To check the details, click on the ACCOXI Settings and select the option Financial Year.

It shows the details of financial year and the status of the financial year that is Current Financial year and Closed Financial year.

|

Fields |

Description |

|

Financial Year start date |

It shows the starting date of the financial year. |

|

Financial year |

This field shows the financial year range, that is starting year to the end year. |

|

Financial Year Closed |

It shows the status of closed financial year. |

|

Action |

Action column includes Current financial year, Closed financial year and Set as Current financial year option. Current financial year is shows with a green color font and user can change the current financial year by clicking on the option Set as Current financial year. Closed Financial year shows with red color font.

|

|

Undo Year close |

It is the option to cancel the financial year closing. By clicking on the option, validation message will popup on the screen. Select the Yes option to confirm the undo year close and then the financial year changed to the previous year. |

|

Delete |

This menu helps the user to delete the un-wanted financial year.

|

Using the Year closing function in settings you can close the books of the Organization.

Click on the Settings menu on the top right side of the page. Then a list of settings tab will open. Select the option Year Closing from General settings option, then it opens to year closing procedure.

The first and important step is to ensure that all financial activity for the year is accurately recorded in the accounts before closing the accounts. You need to check and ensure that the trial balance account of the Organization must tally and the accounts should be accurate. Otherwise you can’t close the year.

After the financial year closing, there will be several changes will occur. That are; the closing balance account of the financial year will be transferred to the opening balance of the new financial year. If you want to check the closing and current financial year details, it can be done by Financial Year option in Settings. To check the details, click on the ACCOXI Settings and select the option Financial Year. It shows the details of financial year and the status of the financial year that is Current Financial year and Closed Financial year.

Yes. You can cancel the financial year closed by the following steps.