It is a report that summarizes the revenues, costs, and expenses incurred during a specified period .

A Profit and Loss (P&L) report, also known as an Income Statement, summarizes a company's revenues, costs, and expenses over a specific period. It starts with total revenue, deducts the cost of goods sold to calculate gross profit, then subtracts operating expenses. Other income and expenses, as well as taxes, are factored in to arrive at the net income or loss. The P&L report helps assess a company's profitability over time.

ACCOXI stands out as a cutting-edge accounting software, offering user-friendly and intentional outcomes for accounting processes. Among the financial statements, the profit and loss account reveals a company's revenues and expenses within a specific timeframe. This report serves as a summary of the financial activities, detailing revenues, costs, and expenses incurred during the designated period. These reports play a crucial role in evaluating a company's capacity to generate profit, whether through increased revenue, reduced costs, or a combination of both.

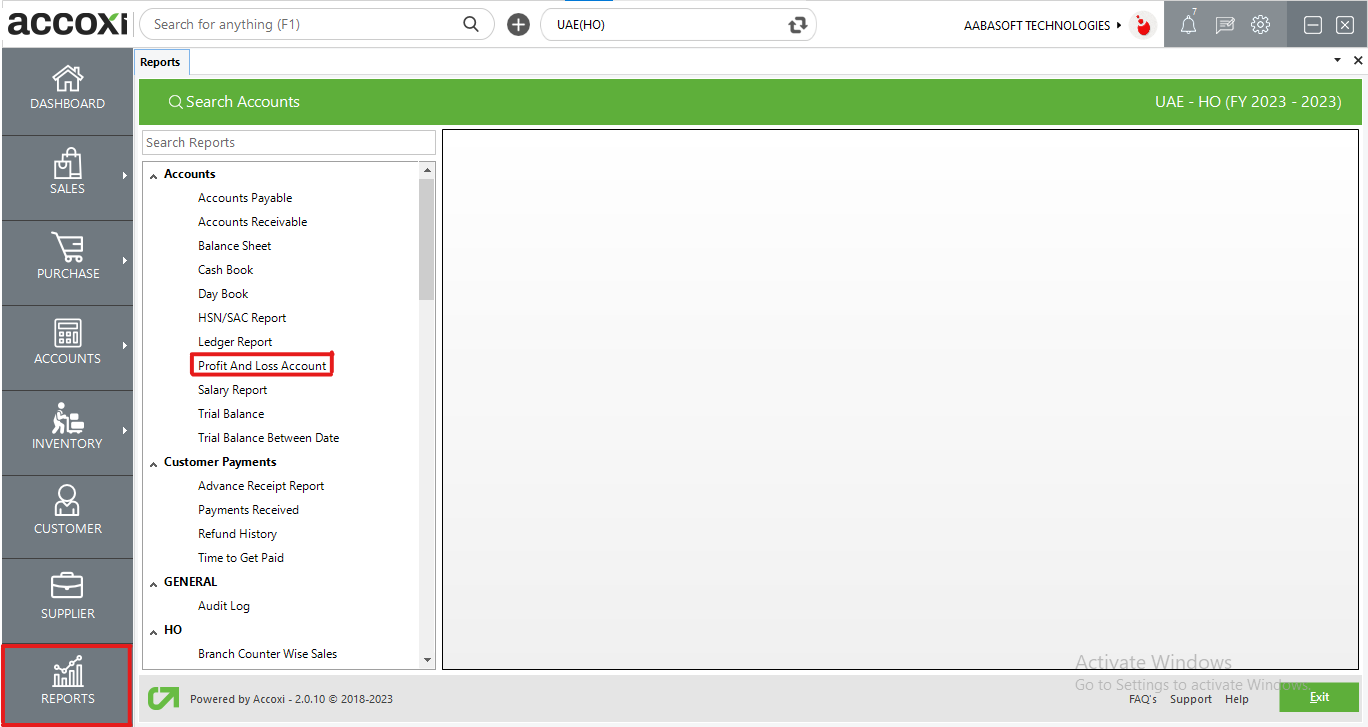

Upon accessing the ACCOXI account, users will find the Reports module located at the bottom left side of the interface. Clicking on this module opens up various financial reports of the organization. To specifically view the Profit and Loss Account, users can navigate to the Reports module, select the Accounts head, and then choose the Profit and Loss Account option. Clicking on this option will promptly display the report on the screen, providing a comprehensive overview of the company's financial performance.

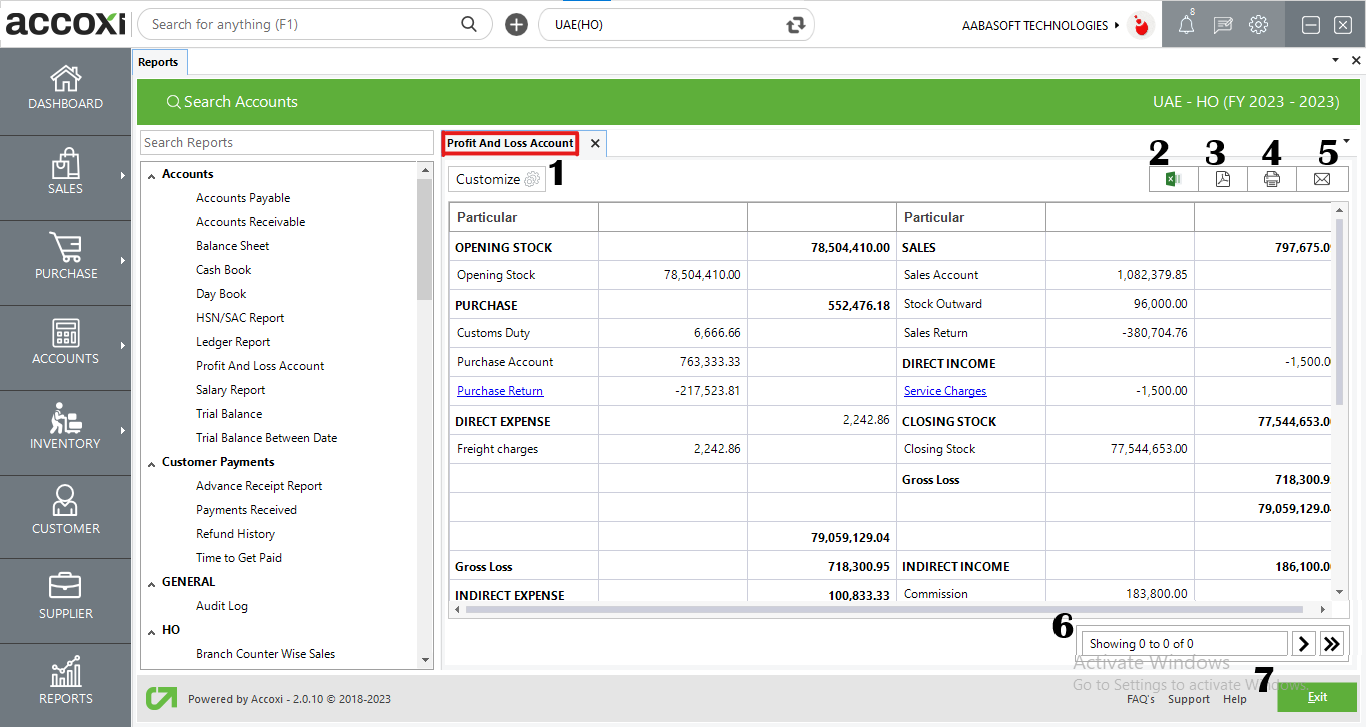

MENU AVAILABLE IN PROFIT AND LOSS ACCOUNT REPORT

|

Field |

Description |

|

Customize |

The user has the flexibility to tailor the report data by clicking on this button. Data filtration is possible based on date. In the filter window, the user can input the As On Date to customize the data according to the specified date. |

|

Export to Excel |

By clicking this button, users can export the report to Excel. |

|

Export to PDF |

Clicking this button allows the user to export the report to PDF. |

|

|

This button enables users to print the profit and loss report. |

|

|

To send the report via email, simply click this button. The report in PDF format will be attached to the email, and you can input the recipient's email address, CC address, subject, and any additional details for the email. |

|

Pagination |

The pagination control offers the capability to navigate from one page to another. |

|

Exit |

Clicking the 'Exit' button allows the user to exit from the report. |

DATA AVAILABLE IN PROFIT AND LOSS ACCOUNT REPORT

|

Field |

Description |

|

Particular (Dr) |

The debit side of the Profit and Loss account includes direct expenses (e.g., production costs), indirect expenses (operating costs), losses, interest expenses, depreciation, and amortization. These entries represent the costs and losses incurred by the business during a specific period. |

|

Debit amount |

The debit amount on the Profit and Loss (P&L) account represents the total expenses, losses, and costs incurred by a business during a specific period. It reflects the financial outflows that reduce the overall profitability. The total on the debit side reflects the overall expenses for that period. The difference between the total debit and credit amounts determines the net profit or net loss for that period. |

|

Particular (Cr) |

On the credit side of the Profit and Loss account, you'll find entries like sales revenue, other operating revenues, interest income, and gains. These entries represent the income and gains earned by the business during a specific period, contributing to overall profitability. |

|

Credit amount |

The credit amount on the Profit and Loss (P&L) account represents the total revenues, gains, and income earned by a business during a specific period. It reflects the inflows and gains that contribute to overall profitability. The total credit amount on the P&L account reflects the aggregate value of these revenues and gains. The difference between the total credit and debit amounts determines the net profit or net loss for that period. |