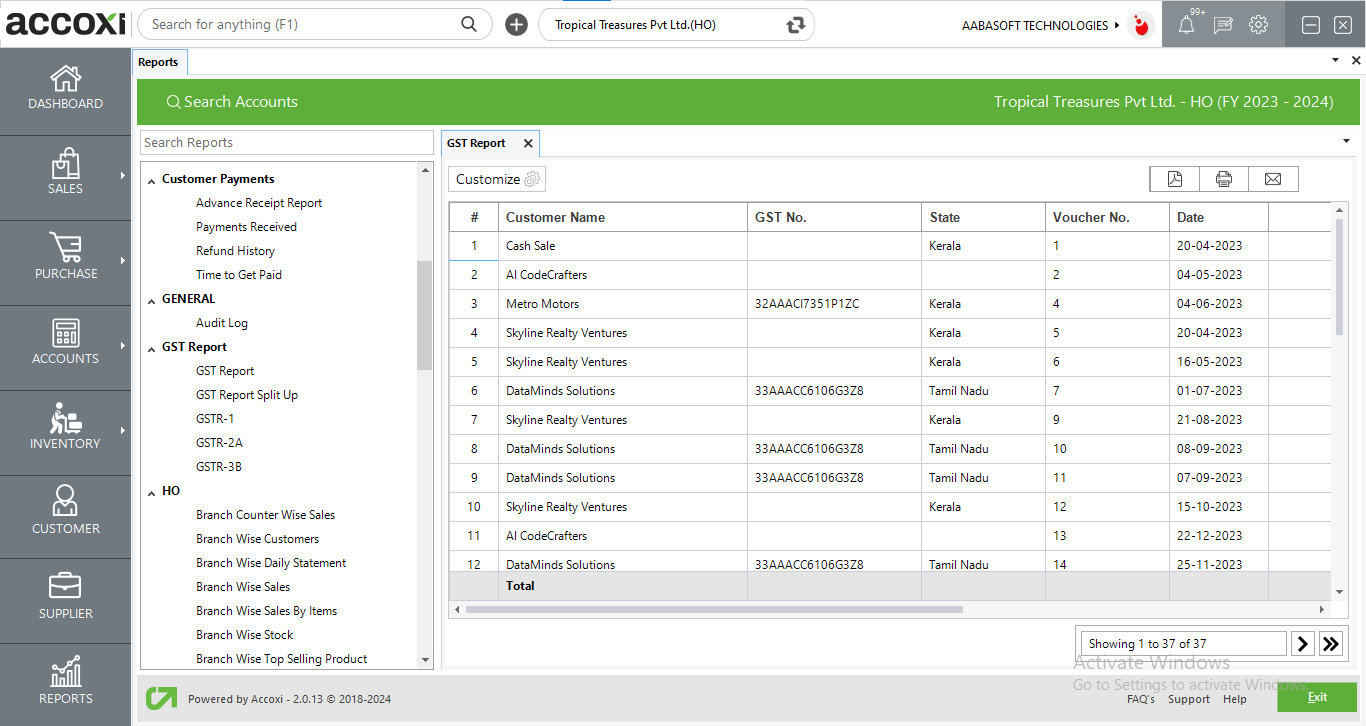

It shows the list of transaction details of the outward transaction such as Customer Name, Voucher number, GST No, State, Date, Taxable amount etc.

A GST report for sales transactions provides a comprehensive overview of the Goods and Services Tax (GST) collected on sales by a business during a specific period. This report typically includes details such as the date of each sale, the customer's name or identification number, the total sales amount, the GST amount charged, and any applicable tax rates. Additionally, it may summarize the total GST collected, provide breakdowns by tax rate or product/service category, and reconcile the GST collected with the corresponding sales invoices or receipts. This report is crucial for businesses to accurately report and remit GST liabilities to tax authorities, as well as to analyze sales performance and tax compliance.

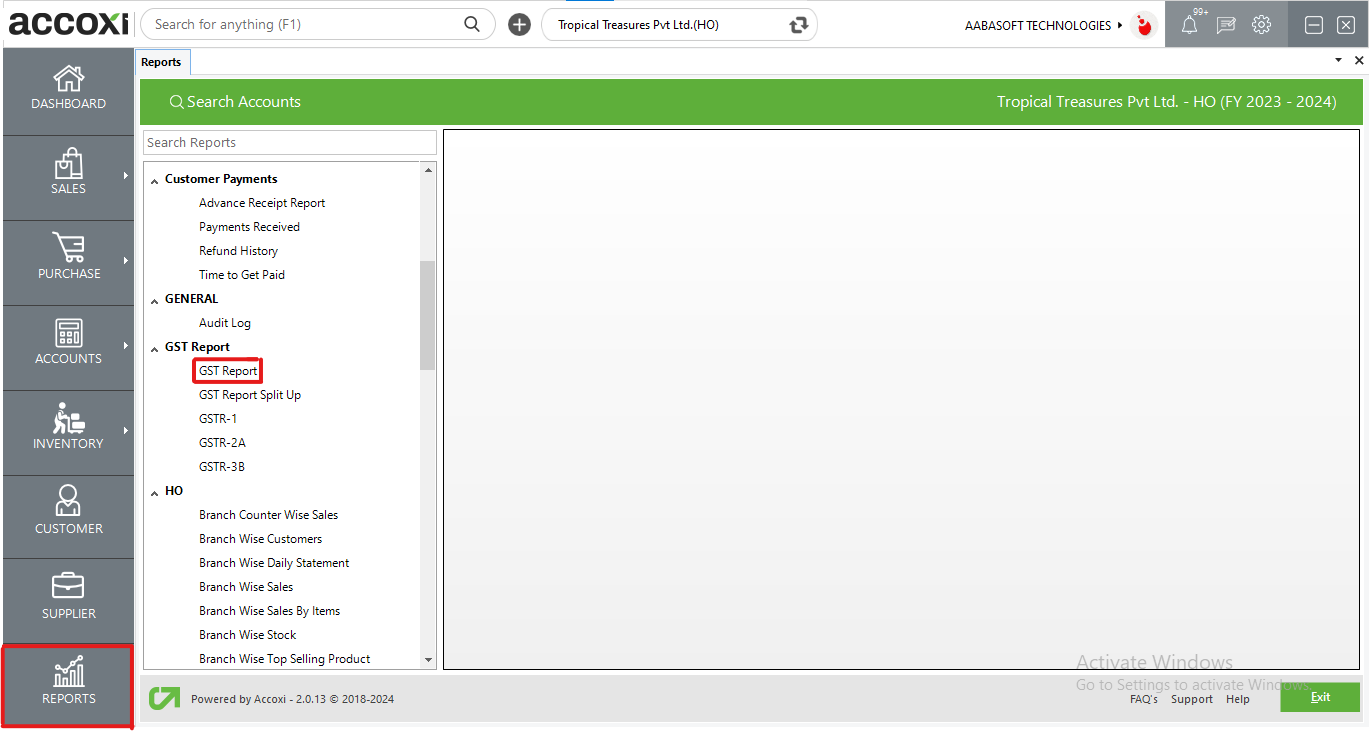

ACCOXI is the most modern accounting software that provides easy and deliberate results for accounting. It provides the module of Reports and GST report included in it. This report displays the summary of the GST received details from various Customers and broken down by various tax codes. When the user opens the ACCOXI account, the Reports module will appear on the bottom left side of the modules. Click on the Reports module, it opens to various financial reports of the Organization. There are various heads of reports like Payables, GST Report, Receivables, Accounts, Purchase, sales, etc. Click on the GST Report head and select the option GST Report.

Menu available in GST Report

|

Field |

Description |

|

Customize |

The user has the flexibility to tailor the report data by clicking on this button. Data filtration is possible based on date period. |

|

Export To PDF |

Clicking this button allows the user to export the report to pdf. |

|

|

This button enables users to print the GST Report. |

|

|

To send the report via email, simply click this button. The report in pdf format will be attached to the email, and you can input the recipient's email address, cc address, subject, and any additional details for the email. |

|

Pagination |

The pagination control offers the capability to navigate from one page to another. |

|

Exit |

Clicking the 'exit' button allows the user to exit from the report. |

Data available in GST Report

|

Field |

Description |

|

# |

The symbol '#' represents the number of lines in the given context. |

|

Customer Name |

Showing the customer name associated with the transaction. |

|

GST no |

Display the GST no of the customer. |

|

State |

Showing the state of the customer. |

|

Voucher No |

Voucher no of the transaction is displayed here. |

|

Date |

Transaction date is displaying here. |

|

Taxable Amount |

Taxable amount in the transaction is showing here. It is the amount calculated before considering the tax amount. |

|

CGST Amount |

CGST amount applicable to the transaction is showing here. It is calculated from the taxable amount considering the tax%. CGST amount is applicable only incase if the transaction is made within the state. Ie, The state of customer and supplier is same. |

|

SGST Amount |

SGST amount applicable to the transaction is showing here. It is calculated from the taxable amount considering the tax%. SGST amount is applicable only incase if the transaction is made within the state. Ie, The state of customer and supplier is same. |

|

IGST Amount |

IGST amount applicable to the transaction is showing here. It is calculated from the taxable amount considering the tax%. IGST amount is applicable only incase if the transaction is interstate. i.e., The state of customer and supplier is different. |

|

Total Amount |

Total amount is the amount calculated after considering the tax amount. i.e., Total amount is the sum of taxable amount and tax amount. |

|

Total |

Total field shows the total sum of taxable amount, tax amount and total amount considering all transactions. |

The GST report shows the summary of the GST received details from various Customers and broken down by various tax codes. It shows the list of transactions details of outward transaction such as Customer name, Voucher number, GST No, State, Date, Taxable amount, CGST amount, SGST amount, IGST amount, KFC amount and Total amount.

Yes. You can filter the GST report by using the option Customize Report. It can be done by following steps;