In ACCOXI users can use the GSTR 2A reconciliation form to compare and reconcile the GSTR 2A data.

GST reconciliation primarily involves matching the data uploaded by the suppliers with those of the recipient’s purchase data. This basically includes comparing the GSTR-2A auto-populated from supplier’s data and the purchase data recorded by the receiver of the supplies. This matching concept also ensures that all the transactions which took place in a particular period have been recorded.

In ACCOXI users can use the GSTR 2A reconciliation form to compare and reconcile the GSTR 2A data. This will ensure no ITC loss on any invoices and to avoid any duplication, taxpayers must consolidate and reconcile the values. This will ensure the correct declaration and maximize the credit of input taxes.

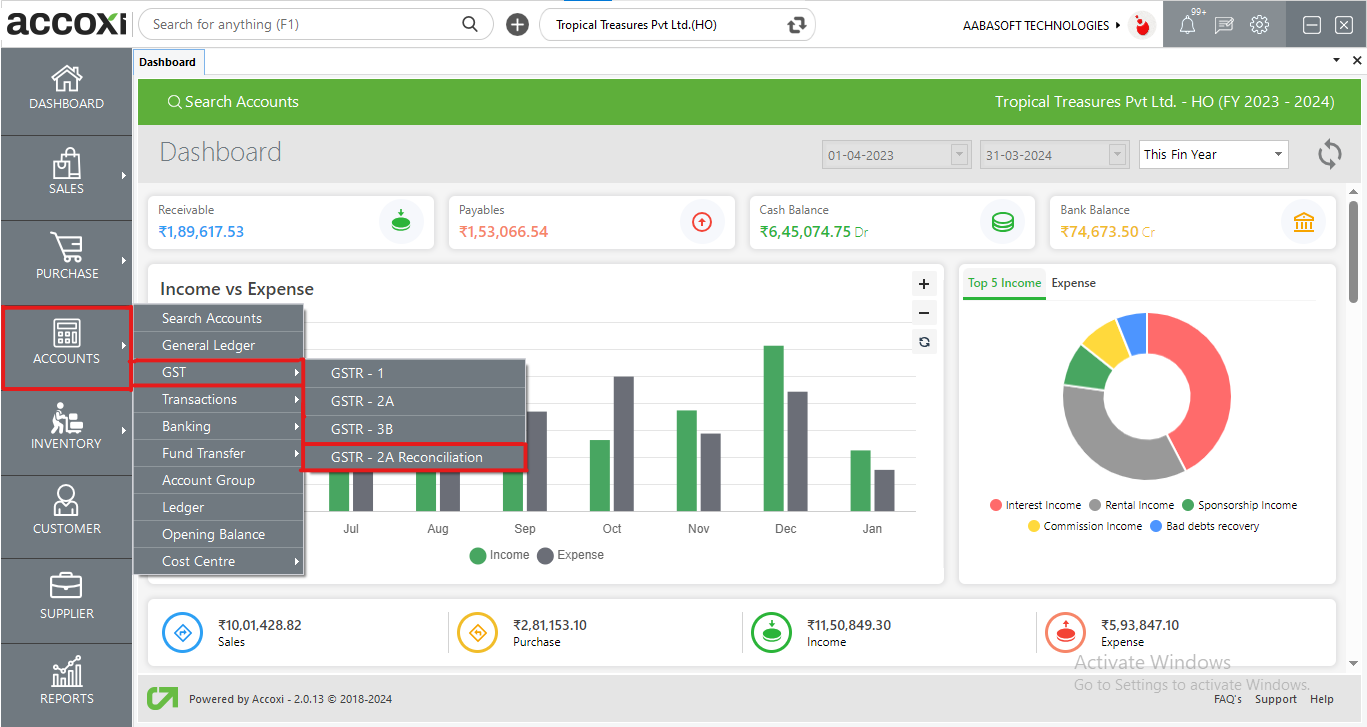

To access the GSTR 2A Reconciliation form:-

Click on ACCOUNTS Section => select GST => GSTR 2A RECONCILIATION

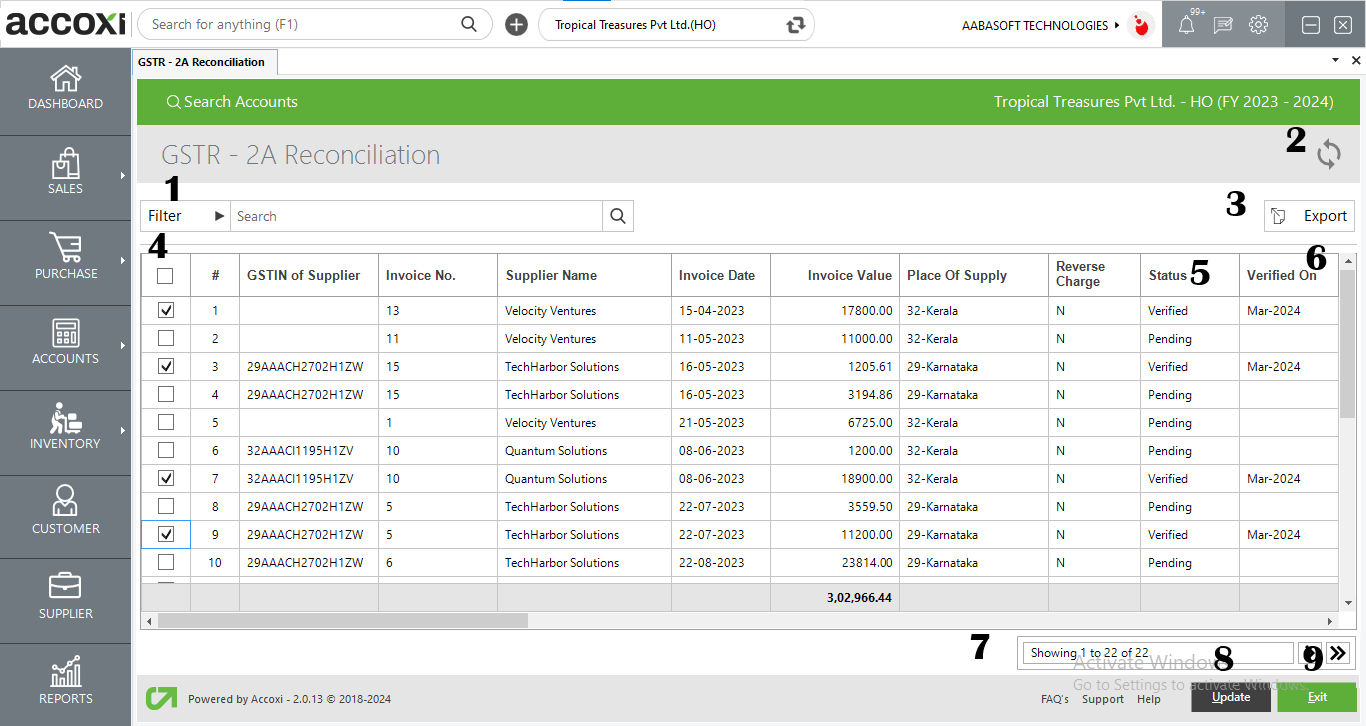

All the invoice details will be available in the GSTR 2A reconciliation form. Users can manually verify and reconcile the transaction details under this form. The user is allocated with an option to update the reconciliation status and date of each transaction.

|

Fields |

Description |

|

1. Filter |

The Filter Of GSTR 2A Reconciliation Form Can Be Used In Two Ways-Either You Can Directly Enter The GSTIN Or Supplier Name Into The Search Bar Near The Filter Option Or By Clicking The Filter Dropdown. Users Can Filter The Data By Supplier Name, GSTIN, Or Status. Users Can Filter The Data According To Reconciliation Status: Pending, Verified And Excluded. |

|

2. Refresh |

If The Latest Data Is Not Displayed, Click On The Refresh Icon On The Top Left Corner Of The Page To Fetch The New Data. |

|

3. Export |

The GSTR 2A Reconciliation Data Can Be Export To Excel Format. Click The Export Button At The Top Right Corner. Select The File Location And Click On Save. |

|

4. Check Box |

Ticking the check box will verify the reconciliation at the date of ticking |

|

5. Status |

User Can Update The Status Of GSTR 2A Reconciliation Data. Status Such As Pending, Verified, And Excluded. |

|

6. Verified On |

The user Is Also Able To Update The Reconciliation Date Of Each Transaction |

|

7. Pagination Control |

It Controls The Page Navigation by Clicking On Arrow Button. It Jumps To The Next Page/Last Page |

|

8. Update |

After Making The Necessary Changes User Can Save The Data Using The Update Option |

|

9. Exit |

To Close The Form Click On The Exit Button |